Grayscale Investments LLC has achieved a significant legal victory. It is now possible for the company to launch the first Bitcoin exchange-traded fund (ETF) in the United States. This points to a potential influx of investment from the general public. After this announcement, the Bitcoin price witnessed a strong rise. However, an inveterate crypto bear thinks it’s a trap. Elsewhere, the “Black Swan” author labels Bitcoin a ‘fad’.

Analyst predicts Bitcoin price will rise before falling

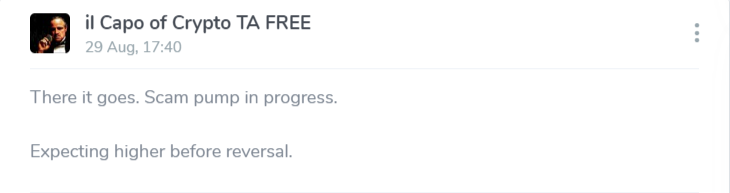

cryptocoin.com As you follow, Bitcoin started a vertical rise after the Grayscale victory. In this move, it reached over $28,000 with an increase of over 7%. However, there are doubts about the continuation of the rise of the leading cryptocurrency. One day before the rise began, the analyst nicknamed Crypto Capo, who is known in the market as an inveterate crypto bear, said, “Potential deception pump before the decline continues. BTC could touch $27,000-$28k.” he shared. After that, the analyst added the following statement a day later:

Prepare for the fake pump. As I mentioned yesterday, BTC could touch $27,000 – $28,000. Also, altcoins can jump 10-20%. Then the decline continues.

With Grayscale’s SEC victory, Bitcoin tested the $28,000 that the analyst stated today. After this move, Crypto Capo said, “Here it goes. The fraud pump continues.” He described the rise as a trap. Besides, the analyst noted that there could be more bullishness before the reversal.

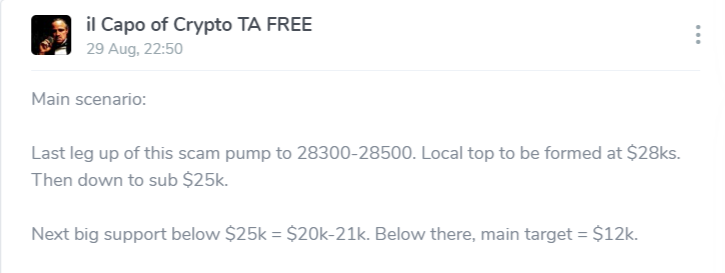

Crypto Capo’s main script for BTC has $12,000!

The popular analyst then explains his main scenario for Bitcoin. In this context, Crypto Capo points to the following levels:

The last leg of this scam pump is up to $28,300-28,500. The local top will be at $28,000. Then it will drop below $25,000. The next major support below $25,000 is at $20,000 and $21,000. Below that, my main goal is $12,000.

“Black Swan” author sees Bitcoin as a fad

Nassim Nicholas Taleb, author of the seminal risk analysis book “Black Swan,” briefly warned of an impending death for Bitcoin. Taleb writes in X that once the popularity of a fashion like Bitcoin wanes, its most ardent supporters often argue that its collapse is predictable. Bitcoin trading volume on all exchanges collapsed at the end of August, according to data from CryptoQuant. It also recorded a staggering 94% drop from March. Taleb also argues that Bitcoin’s eventual decline will not result from a market crash but from “relentless decay.” “It’s their enthusiasm that threatens more indifference than disgust,” Taleb says.

The academic’s comments come at a strange time for Bitcoin, which has risen more than 6% today after Grayscale’s victory over the US Securities and Exchange Commission. Despite the recent one-day sell-off on August 17, the biggest sell-off since November’s FTX crash, long-term investors seem relatively unscathed. However, Taleb claims that the risk of market manipulation increases as the trading volume decreases. He likens this to the “explosion of Open Ponzi”. Taleb previously emphasized that Bitcoin’s trading volume has dropped over 85% from its peak.