Gold prices rose on Monday after falling more than 1% in the previous session. Because a pause in the dollar rally has eased some of the pressure from the dollar-priced bullion. However, US rate hikes limited further gains.

“A move to $1,600 for gold is only a matter of time!”

Spot gold was trading at $1,657.3, up 0.87% as of writing. However, the yellow metal posted its biggest weekly drop since July last week. U.S. gold futures rose 0.84% to $1,662. The dollar index (DXY) is flat for now. The benchmark US 10-year Treasury yields, on the other hand, faded away from the 14-year high touched last week. City Index analyst Matt Simpson comments:

Gold rose slightly from Friday’s low. However, buyers were not convinced. So it’s more like technical repositioning. The US dollar and its yields will be a major driver for gold. If they continue to rise, then a $1,600 move and test is probably just a matter of time.

SPDR Gold Trust Holdings see decline

A survey from the University of Michigan on Friday showed that consumer sentiment improved further in October. However, inflation expectations deteriorated slightly, keeping expectations for a 75 basis point rate hike. Meanwhile, US retail sales were unexpectedly flat in September.

cryptocoin.com Louis Fed President James Bullard noted on Friday that the latest CPI data continues to warrant “front loading” through larger 75 basis points rate hikes. But that doesn’t mean rates should be raised above the Fed’s estimates, he said.

Gold is highly sensitive to US interest rates. Because it increases the opportunity cost of holding gold that has no return. Meanwhile, SPDR Gold Trust Holdings, the world’s largest gold-backed exchange-traded fund, posted its biggest one-day outflow since Sept. 26, down 3.18 tons on Friday.

“Extra weakness for gold should not be overlooked”

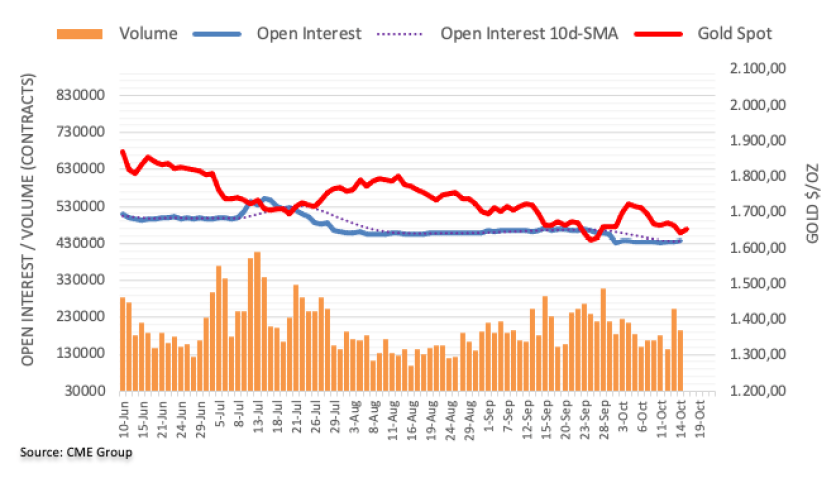

Open interest in gold futures markets rose for the third consecutive session on Friday. This time around 1.4 thousand contracts increased, according to preliminary data from CME Group. Instead, the volume kept the erratic performance in place. Thus, it narrowed to more than 56 thousand contracts.

Gold prices declined for the second consecutive session on Friday amid rising open interest rates. However, further declines cannot be ruled out in the very near term, according to market analyst Pablo Piovano. Also, it is possible for the precious metal to revisit the YTD low near $1,615.