Gold prices fell more than 2.5% to a three-week low on Friday after stronger-than-expected US jobs data fueled fears that the Federal Reserve could continue to raise interest rates. Analysts interpret the market and share their forecasts.

US employment growth hits record, gold fell hard

Spot gold fell 2.51% to close at $1,864.66 on Friday. U.S. gold futures1 fell 2.8% to $1,876.6. Gold is down 2.5% so far this week and has lost nearly $100 in two sessions, its biggest weekly drop since early October.

US job growth accelerated sharply in January, adding 517,000 positions, almost double the increase in December. The unemployment rate fell to 3.4%, a 54-year low. This points to a consistently tight labor market. “These data will add support to the argument that the Fed may need to stay a little more aggressive going forward,” says Edward Moya, senior market analyst at OANDA.

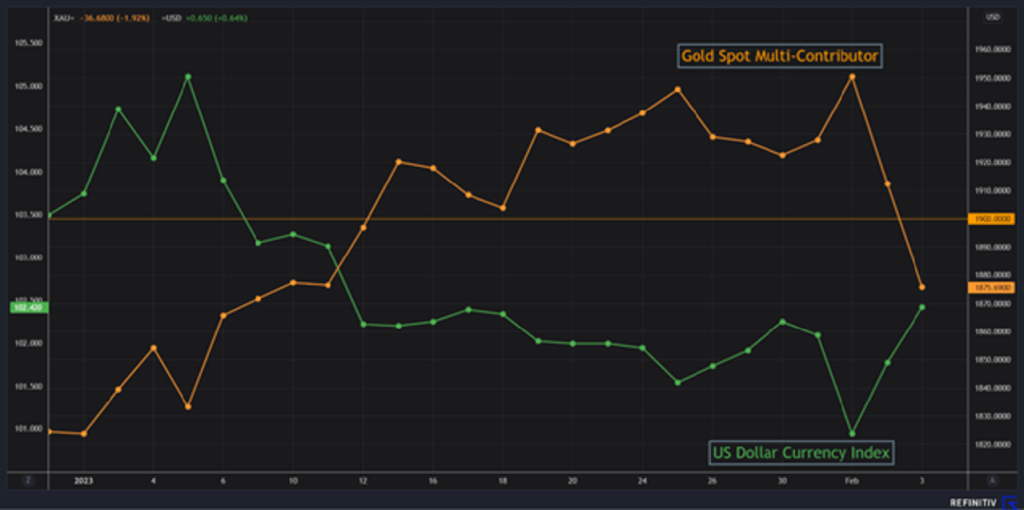

Gold price and DXY chart

Gold price and DXY chart“This is why gold is taking a break!”

Meanwhile, the dollar index (DXY) rose 1.1% to hit a three-week high. This made gold a less attractive bet. The yield on 10-year Treasury bonds also rose. cryptocoin.com Earlier this week, the Fed raised interest rates by a quarter point after a year of larger hikes. In addition, Fed Chairman Jerome Powell warned of further tightening of monetary policy. Bart Melek, head of commodity markets strategy at TD Securities, comments:

As long as US employment and other data remain solid, I think we should start expecting the US central bank to act cautiously.

Traders’ bets on a 25bps rate hike at the Fed’s March meeting rose after Friday’s data. Kinesis Money external analyst Carlo Alberto De Casa comments:

The recovering dollar pulls the bullion down. A new catalyst is needed for more rallies underneath. That’s why gold is taking a break.

“Breaking below this level is important for gold prices”

Russians bought a record number of gold bars in 2022, according to finance ministry data. Because tax cuts on precious metals encouraged people to stockpile a safe-haven asset. Yeap Jun Rong, a market analyst at IG, comments:

With gold prices showing a spectacular performance of more than 20% in the last three months, some positions may already be in place for softer rate hike bets. It may also have found much-needed validation from the last FOMC meeting. There is a high probability of taking some profit in the near term. However, for gold prices, a bigger belief for sellers could be a break below the $1,895 level that bottom buyers stepped in just before the meeting this week.

“The positive surprise in the labor force data has struck gold”

The number of new jobs created in January increased by 517,000, the biggest increase in six months. The increase was much stronger than the 187,000 estimate of economists surveyed by The Wall Street Journal. The government said on Friday that the unemployment rate fell from 3.5% to 3.4%, the lowest level in 54 years. Gold Newsletter editor Brien Lundin says gold took a hit on Friday as the positive surprise in job numbers is a strong indication that the Fed has multiple rate hikes left. In addition, the analyst makes the following statement:

The yellow metal has been hit harder than stocks as it has outperformed stocks in the past few months. Profits were taken by those who enjoyed that journey.

“Fed decision spurred profit-taking wave”

Jason Schenker, chairman of Prestige Economics, emphasizes that for now, the Fed’s Federal Open Market Committee has the authority to raise interest rates. Rising interest rates weigh on gold, while higher yields on bonds increase the opportunity cost of holding non-yielding assets like gold.

Three major decisions taken by central banks this week have caused the dollar to rise roughly 2% from the bottom to the top in the last two sessions. “The Fed decision, announced Wednesday, spurred a wave of profit-taking in gold as the yellow metal is in overbought territory ahead,” says Tyler Richey, associate editor of Sevens Report Research.