Altcoins such as ADA, MATIC and SOL, which are among the top 10, are leading the decline in the market. In addition, Binance’s native token BNB dropped to a 6-month low. What’s going on in the market amid the SEC’s war on Binance?

BNB, ADA, MATIC and SOL led the decline!

cryptocoin.com As you follow, the US Securities and Exchange Commission has sued Binance and Coinbase. Major cryptocurrencies targeted as unregistered securities in these cases led altcoin sales Wednesday as traders sought the relative safety of Bitcoin (BTC). That’s why these altcoins fell sharply.

BNB, the native token of Binance Smart Chain, is down 8% in the last 24 hours. Thus, the altcoin fell to $252, its lowest price since the beginning of January. Cardano’s ADA, Polygon’s MATIC and Solana’s SOL, which are among the top 10 tokens by market capitalization, also lost between 6% and 8% during the day. Leading crypto BTC, on the other hand, dropped 0.9% to $26,500 in the same time frame. Thus, Bitcoin performed relatively better. The price of the leading altcoin Ethereum dropped 1.3% on the day to $1,850. ETH performed in line with the markets.

Focus for BNB and others: Unregistered securities

The SEC included 13 altcoins in its filings Monday and Tuesday. This put pressure on the prices of these tokens. Thus, the SEC potentially restricted US investors’ trading offers. Edward Moya, senior market analyst at broker platform Oanda, comments:

The SEC has made it clear that they will make it nearly impossible for major exchanges to offer them. That’s why these altcoins are under pressure. With the SEC label as a security, crypto investors are abandoning ship with BNB, ADA, MATIC and SOL. Some are moving these funds towards Bitcoin.

Institutional-focused digital asset brokerage Enigma Securities said in a market report that these tokens could prolong losing streaks, especially if the SEC tries to restrict staking. Enigma’s director of research, Joe Edwards, explains in the report:

ADA in particular will be the biggest victim as its growth over the last 4-5 years has been largely driven by consumer stakes.

$600 million exit from Binance and Coinbase

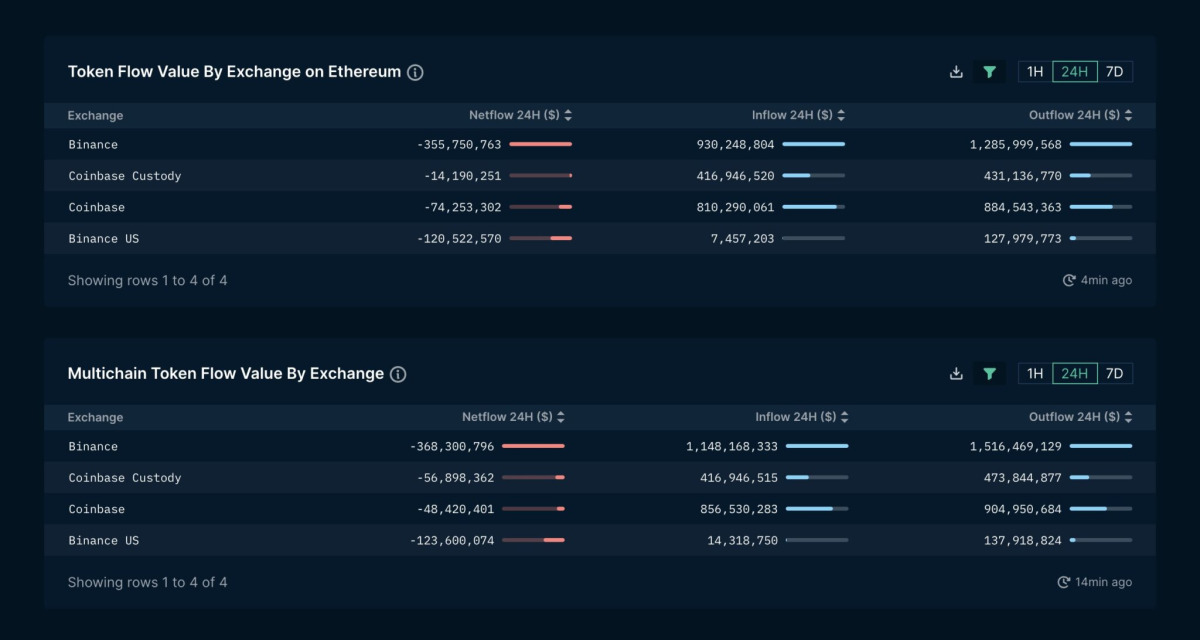

Blockchain analytics firm Nansen said the funds leaving Binance and Coinbase were much less than what he observed 24 hours after Binance was sued by the SEC. According to Nansen’s data, Binance and Coinbase have seen cumulative net outflows of $597.2 million across all protocols over the past 24 hours.

Source: Nansen

Source: NansenA breakdown of the data showed that Binance and its US subsidiary Binance US posted negative net flows of $491.9 million, while Coinbase saw $105.3 million. Net flow is the sum of deposits and withdrawals. If an exchange has negative net flow, it means that more assets are withdrawn than invested. And if an exchange has positive net flow, then more assets are being invested in the exchange.

Meanwhile, Binance US previously had a positive net flow of $78 million within 24 hours of the SEC lawsuit. However, net flow turned negative after the SEC took action to freeze the assets held by Binance.US. According to Nansen, withdrawals on Binance.US were $123.6 million as of 12:30 UTC. Nansen also noted that Coinbase and Coinbase custody had negative net flows of $1.28 billion over the same period.

Louis N, on-chain analyst at 52hz ALERTS VENTURES, noted that the data shows that the SEC-driven FUD has not had much of an impact on Binance compared to the past. Meanwhile, Binance and Coinbase said they will defend themselves against the SEC’s lawsuit in court. Numerous crypto stakeholders, including two US senators, have criticized the SEC’s approach to the industry.