Bitcoin Faces Challenges After Four Consecutive Monday Losses

Investors in Bitcoin (BTC) are eager to overcome a streak of four consecutive losses on Mondays. Over the past few weekends, the leading cryptocurrency has endured notable price fluctuations, largely influenced by macroeconomic uncertainties, including geopolitical tensions, trade tariffs, and rising global bond yields. This weekend apprehension seems to have lingered into the subsequent Mondays.

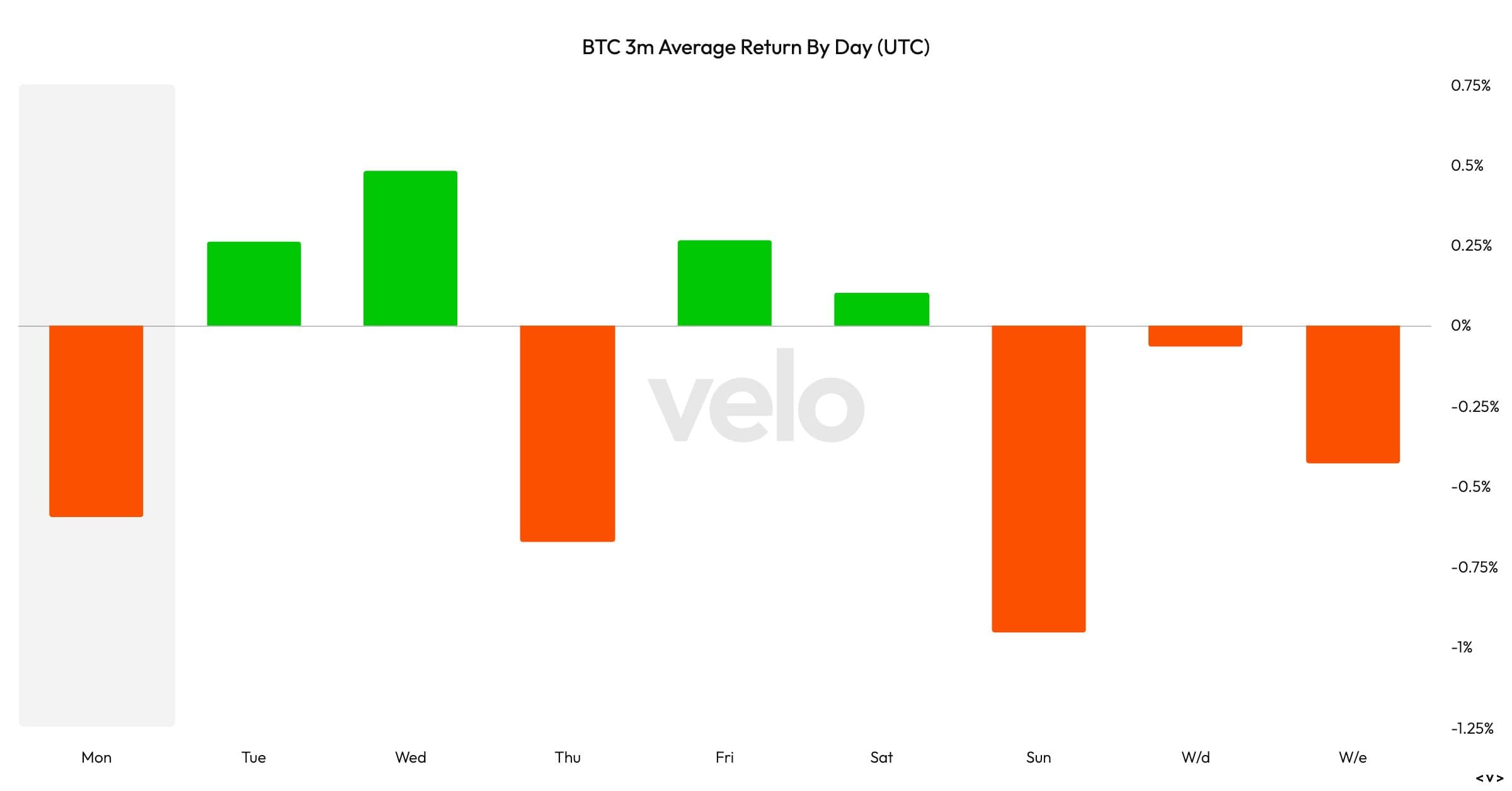

Data from Velo indicates that, over the last three months, Mondays and Thursdays have emerged as the most challenging days of the regular workweek for Bitcoin. Interestingly, Sunday has been recorded as the worst-performing day of the week overall, with an average price decline of 1%. In general, weekends tend to show slightly poorer performance compared to weekdays.

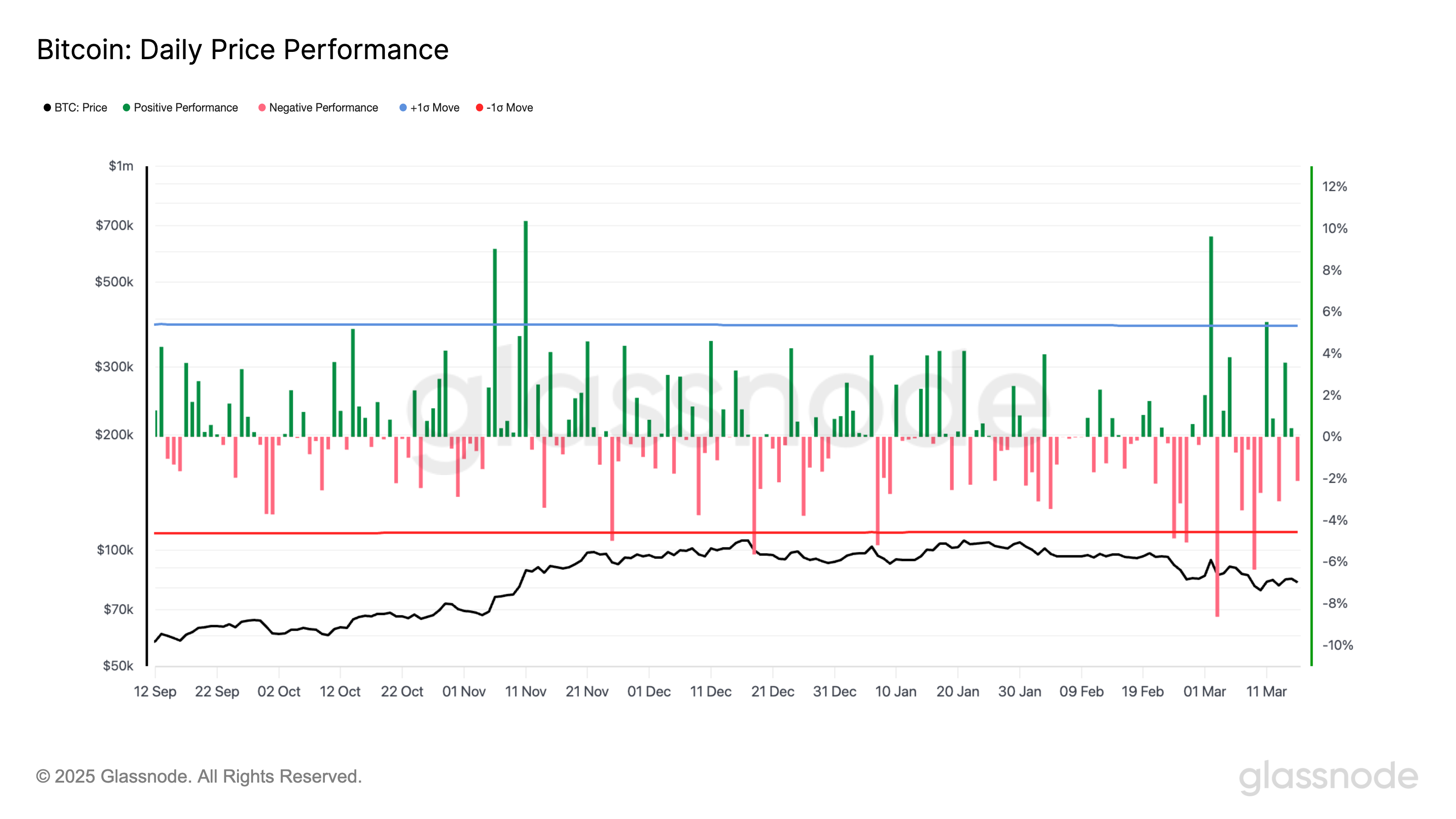

According to Bitcoin’s three-month return data provided by Velo, the cryptocurrency has faced declines on the last four Mondays, as reported by Coinglass. The losses were as follows: a 0.31% drop on February 17, a significant 4.6% decrease on February 24, an even steeper 8.5% decline on March 3, and a further 2.6% drop on March 10. Since reaching its all-time high in late January, Bitcoin has plummeted by 30%, a decline that coincides with a 10% drop in the S&P 500 index.

Notably, the S&P 500 has also faced three consecutive Mondays of losses. It’s worth mentioning that trading did not occur on February 17 due to a U.S. holiday. Currently, Bitcoin is trading approximately 1.4% higher over a 24-hour period, while S&P 500 futures have turned slightly negative. What the future holds for both Bitcoin and the broader market remains uncertain, leaving investors contemplating the next moves in this volatile landscape.