Altcoins, which the SEC declared securities in the first week of June, fell in double digits throughout the month. Despite the recent recovery, some analysts say that the altcoin market reckoning is not over yet.

Benjamin Cowen sees more bearish in altcoin market

The popular crypto analyst has included warnings about the altcoin market in his latest tweets. According to Cowen, deep losses await the altcoin industry. The analyst attributes this pessimistic expectation to influencers who continue to encourage large investments in altcoins (meme tokens), thereby prolonging the market downturn. Cowen suggests that unless this trend changes, the altcoin casino will remain open until all funds are gone.

As long as all these influencers keep publicly YOLOing large sums into altcoins, the altcoin reckoning will continue.

They will tell you to buy the dip all the way down.

The altcoin casino will remain open until all of the money is gone.

— Benjamin Cowen (@intocryptoverse) June 15, 2023

Many altcoins will never recover

Also, Cowen said that some altcoin projects will never regain their value. He warns that this could potentially lead to their extinction. While the overall altcoin market may eventually recover, he anticipates that old ones will be shelved as shiny new altcoins grab the attention of investors. Therefore, he recommends caution when choosing altcoin investments, emphasizing the potential for drastic changes in market preferences.

I dont see what is bad to dollar cost averaging all the way to the bottom

— Birsan Horatiu (@HoratiuBirsan) June 15, 2023

Nicholas Merten said that 2023 will pass with decline

Another crypto analyst, Merten, addressed the question on every crypto investor’s mind. The crypto analyst predicts that the altcoin market will remain under pressure throughout 2023. Merten’s theory is based on one fundamental principle: liquidity. According to the analyst, the key factor driving crypto prices up or down is liquidity in the market, specifically stablecoin liquidity.

He explained how prices in the crypto market tend to rise during periods of stablecoin liquidity. Conversely, when stablecoin liquidity begins to flatten or decline, the market enters a period of recession or decline.

“If we look at the past, and even beyond that, in previous bull markets … we see an increase in Tether, which has become a growing player and tool in the crypto space since 2015,” Merten said. Sharing detailed analysis on liquidity, Merten warns that as a result, the current outlook is not suitable for the crypto market.

Declining stablecoin liquidity, lack of developmental optimism, shaken investor sentiment, market makers exiting the field and imminent regulatory threats paint a rather bleak picture.

Short term technical outlook according to Nicholas Merten

The crypto analyst then shared his technical analysis for ADA, MATIC, and LINK. Merten has issued a warning about a possible 50% drop in the ADA/BTC chart. He suggests that at the moment ADA could drop by about 0.00001000 BTC (from $0.259 to 0.00000450 BTC ($0.12). He suggests considering whether ADA can sustain the higher bottom trend against Bitcoin. If not, % from current level. It predicts a drop to a range of 500 Satoshis to 450 Satoshis, which represents a drop above 50.

Polygon (MATIC)

Merten, who switched to Polygon (MATIC), expresses a more cautious view, stating that he may experience a decrease of up to 90% from the ATH level against Bitcoin. He highlights the importance of liquidity and suggests that its lack could result in a correction of around 70% to 78%, leading to around 1,450 Sats. It also mentions the possibility of MATIC falling to 1,000 Sats by entering a traditional corrective bearish zone ranging from 85% to 90%.

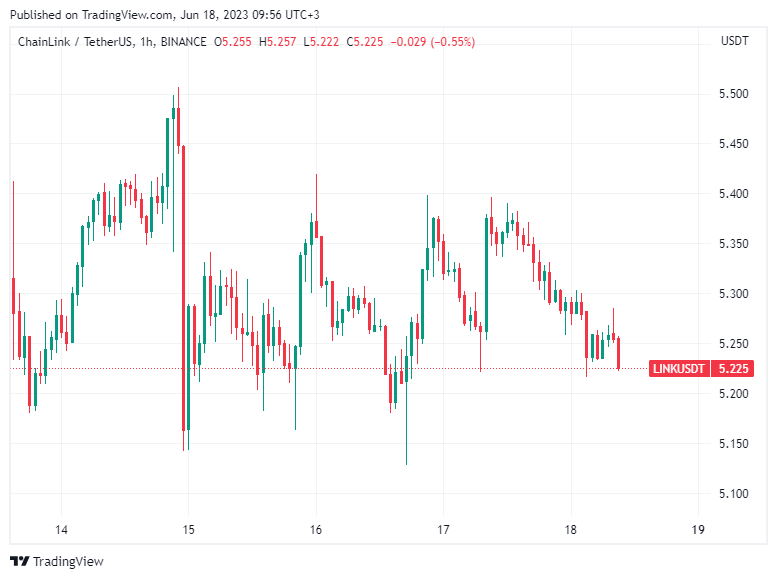

Chainlink (LINK)

Finally, Merten is turning to Chainlink, a decentralized orcle platform. He points out that Chainlink has been underperforming Bitcoin since August 2020. He also warns that if it continues its downward trend, it could drop 90% from its peak against Bitcoin. It specifically mentions the possibility of Chainlink dropping to 1,700 Sats, which represents a significant drop from its previous peak.

How about Bitcoin?

Bitcoin is locked in a falling wedge formation, creating a sense of anticipation among market participants. This pattern is characterized by downward sloping convergent trend lines. If Bitcoin successfully breaks out of this pattern, it will be a crucial turning point in its price trajectory.

$BTC.D x Bearish Divergence 🧐

If Bitcoin Successfully Breaks out of the Falling Wedge and Bearish Divergence in Bitcoin Dominance materializes, it could Potentially lead to a Significant Recovery of Altcoins with 25-30% gains.#Bitcoin #Crypto #Altcoins pic.twitter.com/QiJjY2xpoC

— Captain Faibik (@CryptoFaibik) June 17, 2023

Simultaneously, the bearish trend in Bitcoin dominance is drawing the attention of analysts. Bitcoin Dominance (BTC.D) is an indicator that measures Bitcoin’s market capitalization as a percentage of the total cryptocurrency market cap. The bearish trend points to a growing weakness in Bitcoin’s dominance. In terms of the next technical levels, cryptocoin.comYou can take a look at our current technical analysis.