We have news for an altcoin in the basket of Turks. The early days of the blockchain industry were defined by maximalists. Fans of every new project, be it Ethereum, Bitcoin or Cardano, have a philosophy. Accordingly, they would defeat the rivals of their chains. Or he was determined to convince others that it was the chain that would make their blockchain mainstream.

fall out of fashion

In recent years, this absolutist mentality has largely fallen out of fashion, with new blockchains being released every day alongside the “bridge” infrastructure to help them communicate with each other. At the forefront of this change has been the “chain of application,” shared security, and the blockchain ecosystem Cosmos, which helped pioneer the Proof of Stake consensus mechanism that currently powers Ethereum and most new blockchains.

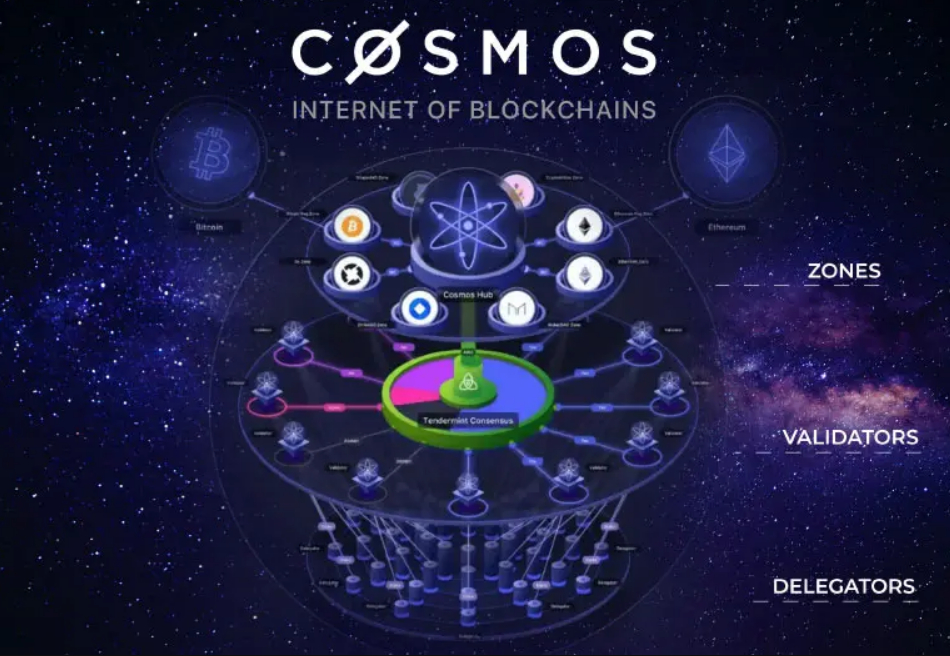

Cosmos is not a single blockchain. He set out to create a family of blockchains, each designed for its own use case, but built to easily communicate and exchange assets back and forth. Once considered a technical marvel in the world of blockchain infrastructure, the Cosmos SDK was at some point the toolbox for any developer looking to build a network. Cosmos SDK is a software development kit that allows anyone to build a Cosmos-based blockchain.

An altcoin affected by the crashes

However, among the blockchain ecosystems most affected by the collapse in the crypto market, altcoin Cosmos is at the top of the list. The spectacular collapse of Terra, one of the largest blockchains based on the altcoin Cosmos at one point, left a liquidity gap in the decentralized finance (DeFi) ecosystem of Cosmos that it has yet to recover. Politics and internal conflicts, both a feature and a fault of Cosmos’ open source development model, have been accused of slowing development. Now, newer-in-the-box blockchain projects have proliferated, particularly in the Ethereum ecosystem, putting Cosmos at risk of becoming obsolete in a category it once monopolized.

According to Zaki Manian, a prominent figure in the Cosmos community and creator of the Sommelier, the coming year for Cosmos may be “existential”. Manian emphasized important points in his statement this week. Accordingly, “I would say Cosmos has had eight to nine months, maybe a year at the most, to find a way to create something unique and distinctive that differentiates itself and feels like something coherent, separate from Ethereum or the rest of the blockchain space. . I think we have the raw materials to take our chances.” said.

Multichain focused altcoin

Every blockchain has its limitations. Bitcoin, the first blockchain, can’t do much beyond moving bitcoins from one address to another. It’s this limitation that maximalists say is deliberate. It also makes the unpretentious bitcoin asset a better candidate to become “digital gold.” However, for investors who are now accustomed to the flashy NFTs and DeFi practices of other chains, simple Bitcoin may leave them wanting more.

Ethereum introduced the world to smart contracts, which are blockchain-based computer programs that anyone can create to power these new lending applications and NFT exchanges. However, the network’s high fees (more than $14 for a simple token exchange) and relative slowness (over 1,600 transactions per second vs. 27 transactions per second on the Visa card system) have made room for newer blockchains to serve particularly demanding use cases such as gaming. left.

Different blockchains and problems

The contradictions of different blockchain designs with each other are becoming more apparent. Accordingly, the blockchain industry – and the Ethereum ecosystem in particular – has gradually coalesced behind the idea of a “multi-chain” universe where different blockchains peacefully coexist to serve different use cases.

But the old multi-chain ecosystem was plagued with security issues. In particular, the cross-chain bridges used to move assets between different networks were a concern. Errors in these bridges – or the blockchains in which they move assets – have led to high-profile exploits such as the Ronin bridge hack, which transferred more than 600 million dollars to North Korean hackers.

Altcoin Cosmos solution

One of the first projects to bring a solution to the multi-chain security dilemma was Cosmos. Built by a firm called Tendermint (now Ignite) and now maintained by a larger consortium of developers and companies, Cosmos “chains of apps” were designed to work together from day one. It’s a technical separation that drastically reduces the surface area for potential bridge attacks. Key differentiators of Cosmos included the Inter-blockchain Communication Protocol (IBC), which allows assets to flow easily between chains, and Cross-Chain Security (ICS), which allows new blockchains to borrow the security devices of existing networks.

Even when IBC and ICS were still in development, Cosmos was one of the biggest beneficiaries of the DeFi boom in 2019 and the crypto craze that followed. As startups race to create new blockchains in the sparkling, low-interest financing environment of 2019-2021, they have often turned to Cosmos’ open-source developer toolkit, or SDK. This was among the few ways to quickly build a new blockchain network back then. At this point, Manian said, “There were two sets of tools in 2019: Substrate and one with the Cosmos SDK. As a practical matter, everyone has used the Cosmos SDK.” says.

Using Altcoin Cosmos

As a bonus to using Cosmos, teams can brag about environmental sustainability. The two largest blockchains, Bitcoin and Ethereum, used a power-hungry “Proof of Work” model to power their networks. Cosmos chains use “proof-of-stake,” a system that has abandoned the energy-intensive crypto mining practice and has since been adopted by an increasing number of different blockchains, including Ethereum.

Terra problem

Whatever its initial advantages, Cosmos has begun to lose its grip on developers in recent months. In the early days of the crypto market crash in 2022, the Cosmos ecosystem was already beset by disaster. In May 2022, the price of Do Kwon’s “decentralized” digital dollar Terra USD (TUSD) dropped from $1 to less than a penny in a matter of days. Terra tried to use algorithms instead of collateral to keep TUSD at the $1 price. Ultimately it failed. The project was built using Cosmos. It was therefore compatible with other Cosmos-based chains. The market caps of TUSD and its sister token LUNA initially exceeded $40 billion. Also, much of that money has flown into the budding suite of Cosmos-based DeFi apps.

When TUSD and LUNA collapsed, so did Cosmos’ DeFi ecosystem. Osmosis, the main decentralized exchange (DEX) chain of Cosmos, had approximately $1.7 billion worth of liquidity at its peak in February 2022. This amount represented the total value invested in the platform to trade Cosmos-based tokens. In June 2022, one month after Terra’s collapse, Osmosis liquidity dropped to $150 million. A year later, it’s even lower at $116 million. Less liquidity in Cosmos means less incentive for developers to embed apps into the ecosystem. “In many ways, what Terra meant to the Cosmos ecosystem has been erased from people’s minds,” Manian wrote in February, nearly a year after Terra’s collapse. I think the blow was too big.” says.

new competition

Terra doesn’t take all the blame for deterring developers. The core features of the Cosmos SDK – its maintainability, shared security, and interoperability – are no longer as rare as they once were. Cosmos pioneered the proof-of-stake consensus. It also continues to claim its low carbon footprint as a key advantage on its website. But the PoS system is no longer a differentiator. Ethereum, the most traded chain outside of Bitcoin, has made the switch to a Proof of Stake mechanism with the “Merge” in 2022, as well as laying the foundation for many of the new blockchains.

Shared security is also supposed to be a significant added value for Cosmos, enabling startup blockchains to borrow security devices from other networks. Cosmos introduced this functionality this year with a feature called Interchain Security (ICS). However, a new project on Ethereum called EigenLayer has been launched with similar capabilities. Cosmos’ dominance in the chaining space has also waned with the entry of new competitors. Ethereum’s community has sought to expand the ecosystem through third-party scaling networks called rollups, which allow users to transact faster and cheaper than the main chain, but without losing the underlying security guarantees of the underlying network.

Different blockchain presentations

Recently, nearly every major rollup project has chosen to make its technology open for other teams to pick up and use. The “blockchain” offerings from Optimism, Arbitrum, Polygon, and other rollup providers are similar to those of the Cosmos SDK, with key features like customizability, shared security, low fees, and interoperability. By far ahead of the blockchain toolkit race, Optimism has used the OP Stack toolkit to power – among other new networks – Coinbase’s new blockchain Base and Mantle, a new chain linked to the Bybit exchange.

Manian said, “We were making almost 100 hits for exchange chains. Every exchange was using the Cosmos SDK when it started shipping a blockchain. Now, two of the biggest exchanges have chosen different technology stacks.” he complained. Even Binance’s BNB Chain, built using the Cosmos SDK, has started testing a working version of its network using the OP Stack.

There are also advantages

Cosmos still has many advantages in terms of technical goodwill. dYdX, one of the largest decentralized cryptocurrency exchanges, decided to switch to a new Cosmos chain last year after finding Ethereum too expensive and slow to use. Other projects in the Cosmos community are hoping that dYdX’s upcoming Cosmos app, which is currently in testing, will replenish some of the users and liquidity Cosmos lost with Terra’s collapse. The switch has already been rewarding: Circle, the company behind USDC, the second-largest USD-pegged coin, has announced that it plans to issue its coin directly to Cosmos, in a move to coincide with the new implementation of one of the USDC’s biggest users, dYdX.

Supporters of Cosmos also claim that their toolkit – though it lags behind some newer tools in overall ease of use – still gives builders more flexibility. “There’s ‘interoperability’ and there’s ‘application chain’,” Manian explained. According to the founder of Sommelier, Ethereum’s layer 2 toolsets only allow for “interoperability.” It also allows people to code new chains that can easily talk to each other and send assets back and forth. According to Manian, these are not “app chains”. Because they still rely on Ethereum for their security and other core functions.

make the checks

By contrast, Manian notes that Cosmos allows developers to “integrate as vertically as possible.” So he says they can control every aspect of how blockchains are designed. Also, checks are possible, from how fast they execute transactions, to the rules they use to strengthen their security.

When it comes to Ethereum’s rollup toolkits, Manian argues that “its true capabilities in building an application chain are actually at a fairly early stage.” “They could never build what he built.” says.

Looking ahead for altcoin

Cosmos has other troubles beyond technical issues. Primarily, the SEC has put together ATOM with a list of crypto “securities” in its recent lawsuits against Binance and Coinbase. A security designation is rarely good news for a crypto project. But Cosmos wasn’t the only project targeted this time. Polygon (MATIC), Solana (SOL), and others were also on the list. Moreover, while ATOM is deeply rooted in Cosmos’ leading DeFi implementations, its core infrastructure does not rely on ATOM to operate.

altcoin

Perhaps a bigger problem than technical obsolescence or securities laws is Cosmos’ own community. Cosmos’ open source developer community is among the craziest even in the noisy world of crypto. Its history is filled with mass resignations, lawsuits, and allegations of decentralized voter fraud.

Controversial name in altcoin space

Jae Kwon, one of the founders of the ecosystem, remains one of the most controversial figures in the blockchain world. His return to Ignite, the development firm he founded last year to build Cosmos but left after a leadership dispute in 2020, has been accompanied by layoffs and strategic shifts that have largely left the development of Cosmos infrastructure to other priorities.

As a result, the ecosystem has a less clear organizational structure compared to similar projects. Nonprofits, development firms, and engineers all play a role in advancing technology.

disadvantages

Of course, Cosmos’ messy politics also have some downsides. Community governance disputes often lead to technical glitches, such as when a long-planned, strategically important “refresh” for the Cosmos Hub blockchain was set aside by a contentious community vote. Speaking at a panel Tuesday, Buchman said, “I used to think that events like the organizational drama we had in the Cosmos were a way of giving the universe a chance to catch up with everyone else. “Because we were too far ahead,” he said.

The policy has also resulted in some reputational damage. As dYdX prepares to transition to Cosmos, its CEO, Antonio Juliano, tweeted, “I don’t particularly want the dYdX brand to be associated with Cosmos too much.” According to Juliano, the rationale behind this explanation had nothing to do with the Cosmos drama. According to the dYdX founder in the same Twitter thread, “[a]pps must go beyond any technology they are built on. It also doesn’t mean we’re not big fans of the cosmos.” has an expression.

However, on Cosmos Twitter, some interpreted Juliano’s remarks as a veiled criticism of the community’s antics. On the other hand, part of the beauty of Cosmos comes from this chaos. If the Cosmos experiment is successful, its proponents say it will have a more realistic claim to “decentralization” than competing projects run by centralized companies or so-called decentralized foundations. While Cosmos has its own grant programs and informal hierarchy, its core infrastructure and many of its most popular projects are maintained bottom-up by a passionate base of builders.

Approved models

“This set of philosophy and values really shines through, you know, tuned into the hacker culture of openness and experimentation,” Buchman said. These values will be true in the long run, and despite all these short-term market disruptions, that’s what’s going to win out in the end.” He’s explaining.

As for what success really looks like, cryptocoin.com On the face of it, most of Cosmos’ key contributions to the blockchain space – early models for interoperability, Proof of Stake, and shared security – have already moved towards ubiquity. So they’ve been endorsed by the broader industry.