Today, Binance USD (BUSD), an altcoin issued by Paxos, briefly fell from its $1 peg. This came after reports emerged that the SEC was suing Paxos for claiming that BUSD is an unregistered security. Here are the details…

Altcoin price briefly loses $1 stable

cryptocoin.com As we reported, the SEC claimed that BUSD is an unregistered security. NYFDS ordered Paxos to stop issuing BUSD. The SEC’s enforcement staff issued a Wells notice to Paxos, which the agency uses to notify companies and individuals of possible enforcement action. The notice claims that Binance USD, a crypto-asset issued and listed by Paxos, is an unregistered security.

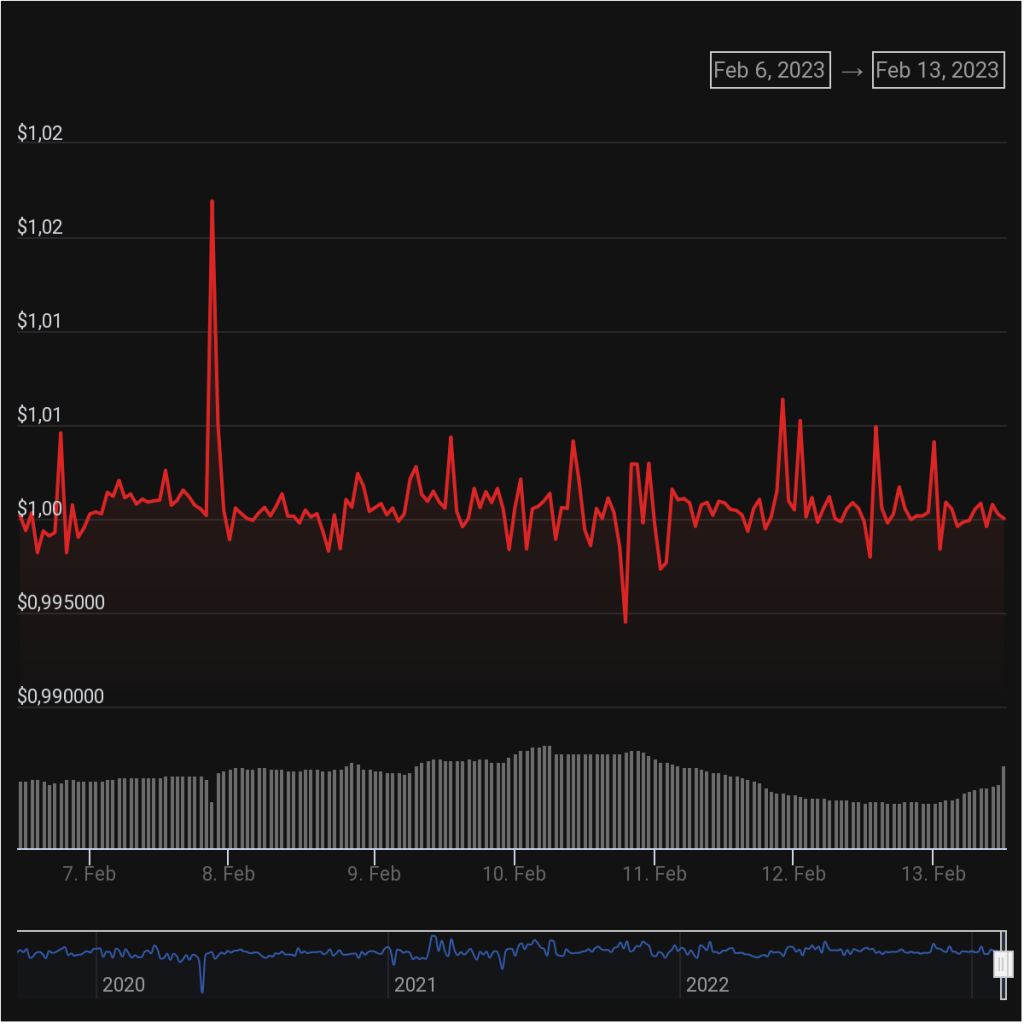

After the SEC news broke, the value of BUSD dropped rapidly and returned to $0.9999 after falling to $0.9996. Despite this temporary drop, BUSD’s market cap remains high at $160 million and its price quickly bounced back to $1. Trading volumes also increased as a result of the news.

Binance USD, a Binance-branded, dollar-pegged stablecoin, was launched in 2019 in partnership with Paxos. ItBit, the crypto-asset exchange operated by Paxos, also lists BUSD. “Paxos does not comment on any individual matter,” a Paxos company spokesperson said. Binance said BUSD is owned and owned by Paxos and only licenses its own brand.

SEC’s move will affect the cryptocurrency space

The SEC’s lawsuit against Paxos raises concerns about the future of stablecoins and the regulatory environment for cryptoassets. It highlights the importance of transparency and accountability in stablecoin issuance, along with the need for clear guidelines and standards in the industry. While the exact details of the investigation are not yet known, it is clear that the SEC is taking a closer look at stablecoins and their compliance with current securities laws. This is an important development for the industry as it could have important implications for the future of stablecoins and the wider regulation of crypto assets.

Meanwhile, BUSD continues to be traded and used as a stock market vehicle, indicating that stablecoins remain a major player in the crypto asset ecosystem despite regulatory challenges. It will be interesting to see how this case progresses and what impact it will have on the future of stablecoins and cryptoassets.

SEC’s crypto efforts are on the rise

Recently, we have been witnessing increased efforts by the SEC towards crypto enforcement. Last week, Kraken’s agreement to stop offering crypto staking services in the US and pay a $30 million penalty came into question. The SEC has not previously taken enforcement action against a major stablecoin issuer, but stablecoins were a focus area last year when the agency expanded its dedicated enforcement unit dedicated to the crypto market.