The decentralized finance (defi) developers at the Ethereum ecosystem think that the new version of UNISWAP V4 will give the sector a great momentum. Ethereum, who has been criticized for rapidly growing competitors and disagreements within the community in recent years, aims to start a new era in Defi with this new version.

Although Ethereum has a giant ecosystem of $ 75 billion, high trading fees, slow transactions and lack of features offered by central stock exchanges leave users in a difficult position. Uniswap V4, which was released last Friday, brought a series of innovations that could overcome these problems.

A new era in UNİSWAP V4 and Ethereum defi sector

According to Ari Rodriguez, CTO of Arrakis, the defi protocol, we are entering a new era in the decentralized financial world with Uniswap V4. “Defi Renaissance comes and Uniswap V4 will be at the center of it, Rod Rodriguez emphasizes the potential of the new version.

One of the biggest innovations of Uniswap V4 is the code particles called “hooks .. With this feature, developers will be able to add functions such as limit orders directly within the UNISWAP protocol, time -weighted token purchases and dynamic processing fees according to market fluctuations.

HOKS offers more return strategy for liquidity providers, while making new features such as integration with automatic limit orders and lending markets. However, these innovations can make liquidity in UNISWAP more complex than previous versions.

Productivity Increase in Defi with Uniswap V4

Another important feature that comes with the new version is the collection of all liquidity management codes in a single smart contract. Thanks to this “Singleton” design, token exchange transactions are less calculated and thus the transaction fees paid by users decrease.

This cost advantage of Uniswap V4 paves the way for new liquidity strategies that have not previously been implemented due to high trading fees. If these innovations attract great interest, there may be serious growth in the defi market. To remind you, at the beginning of the “defi articles ındaki in 2020, there was only 600 million dollars in the defi protocols on Ethereum. At the end of the year, this figure rose to $ 17 billion.

New protocols and solutions

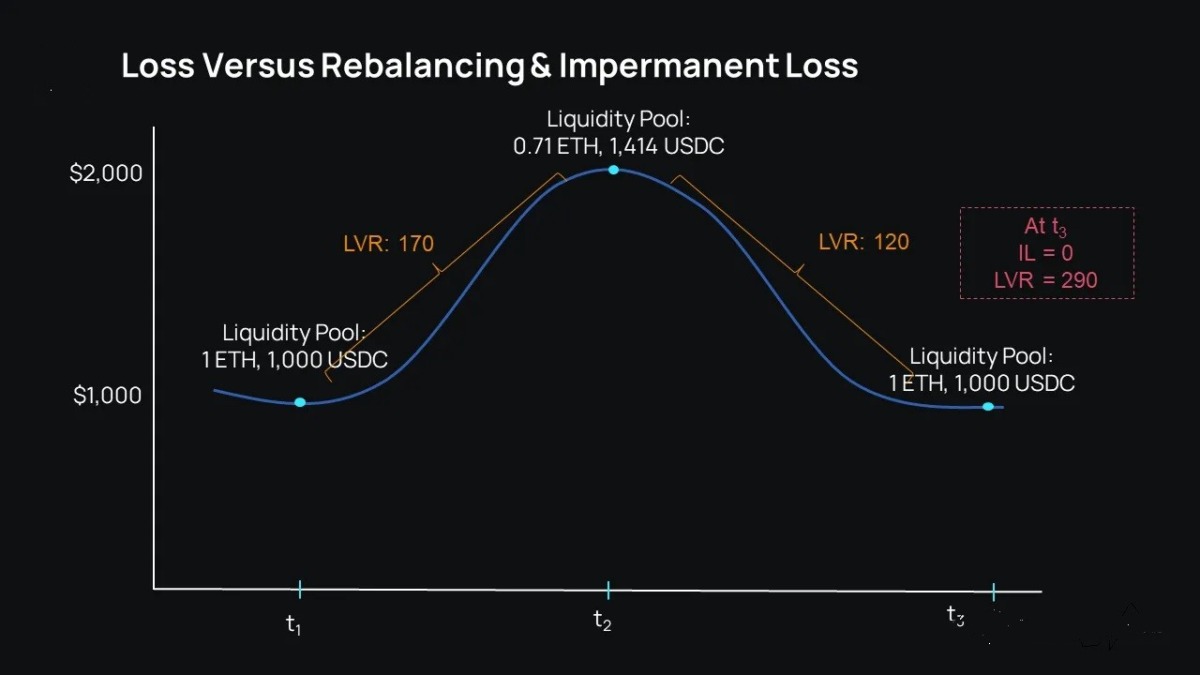

Uniswap V4 may not only develop existing defi applications, but also the emergence of new protocols. For example, the problem of “LVR (), which increases the losses of liquidity providers, one of the biggest problems of Uniswap, can be solved with new features.

LVR causes liquidity providers to damage by benefiting from the price differences in the liquidity pools of arbitrage boots. The Angstrom project, built on Uniswap V4, aims to produce solutions to this problem using HOKS feature.

In addition, other projects are developing new solutions using UNISWAP V4. A project called LIKEWID plans to establish a leverage protocol that does not need Oracle. Oracles are systems that transfer price data other than blockchain to smart contracts. However, in the past, in many major defi attacks, the price was manipulated and millions of dollars were stolen. LIKEWID aims to eliminate this risk.

Is it a new start at Ethereum Defi?

Ethereum Defi ecosystem had a great transformation at a time when competition increased and governance discussions within the community. Uniswap V4 can revitalize decentralized finance with lower trading costs, advanced liquidity management and innovative features.

However, it will take time to adopt new technologies. Rival Blockchain networks, especially high -speed alternatives such as Solana, continue to play Ethereum’s market share. Will Uniswap V4 really start a defi Renaissance, or will disputes and scalability problems within the Ethereum community continue to limit growth? Time will show that.