As Sam Bankman-Fried has fallen from grace to become crypto’s latest and greatest villain, crypto twitter and the conspiracy theory industrial complex is focusing on the presence of a token called TRUMPLOSE on the balance sheet the company he once ran.

For those looking for a shadowy tale that involves crypto in the halls of power in D.C., TRUMPLOSE is going to disappoint. It’s not a new world order talisman that shows FTX and Sam Bankman-Fried are complicit in laundering money to the Democrat party through Ukraine donations. Rather, it’s one part of FTX’s prediction market it ran during the 2020 U.S. election.

During the U.S. election, FTX ran a series of prediction markets where traders could purchase TRUMPWIN or TRUMPLOSE tokens that would resolve to $1 should Trump have won or lost, or, resolve to $0 if the opposite should occur.

Pollsters got the 2016 election dead wrong, and many thought that prediction markets would be a better source of alpha for the 2020 election.

“There are 25 or more years of data that show prediction markets do a better job predicting outcomes than polls,” Dr. Emile Servan-Schreiber, founder and CEO of Lumenogic and an expert in prediction markets, told Politico in 2014.

There was also a general TRUMP perpetual contract, which had the shape and feel of a crypto perpetual that FTX was famous for. Like the tokens, should Trump have won, it would have risen to $1, and when he lost, it fell to $0.

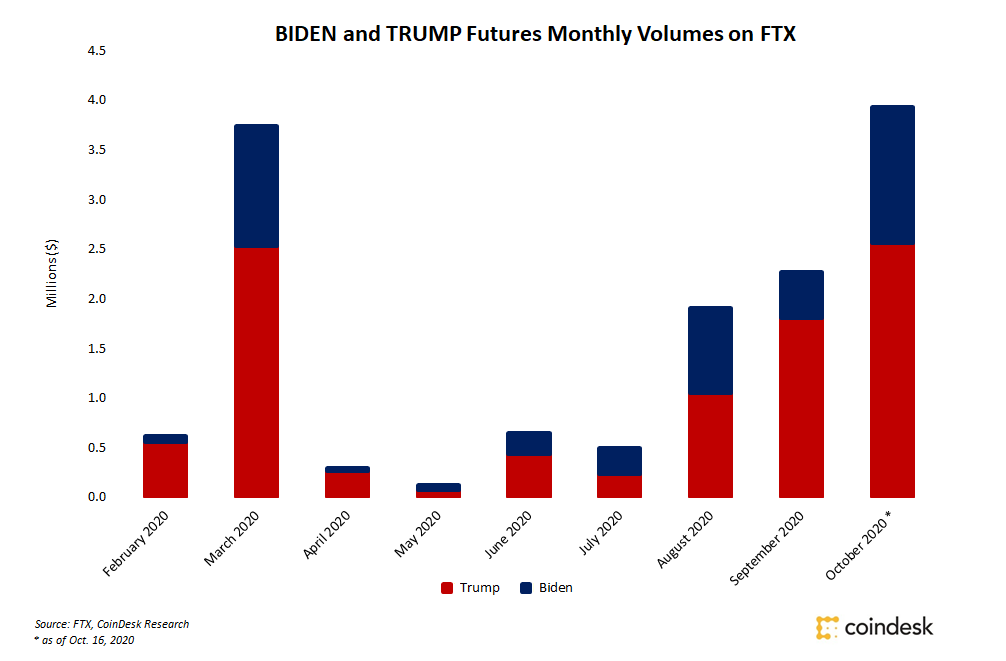

(CoinDesk Research)

With such a turbulent election, the token moved fast and hard. Performance at the debates moved its price in real-time, as did announcements like Trump’s Covid diagnosis.

At the time, FTX said that $2 million in total trading volume in its TRUMP contract followed the Covid announcement.

Trading in TRUMP futures on FTX crypto exchange. (CoinDesk Research)

Although some bought the WIN/LOSE token, or took a position in the contract out of partisan conviction, many treated the outcome of such a pivotal election as they would with any other cryptocurrency: degenerate positions with the extreme leverage one could only enjoy during the prelapsarian days of the 2020 bull market.

While it’s strange that this turned up on FTX’s balance sheet – especially now that it’s illiquid as the election is long over – to the disappointment of those wearing the tinfoil hats, the explanation for it is much for mundane: TRUMPLOSE is just a hangover from a prediction market the exchange ran in 2020. There’s not much more to it.