Ben GCrypto, one of the well-known crypto analysts, took the biggest DeFi altcoin projects in the market under the spotlight. Let’s list which altcoin projects are currently leading the DeFi market.

Here are the 10 biggest DeFi altcoin projects of February

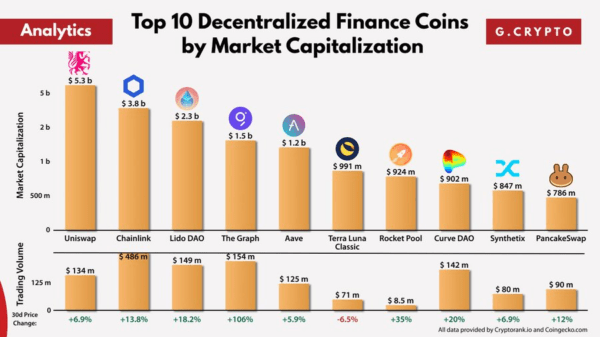

The CEO of Generation Crypto Media Channel named Ben GCrypto took to Twitter to share his pick of the top 10 DeFi altcoins by market cap. Dealing with the biggest DeFi projects of the market, the analyst shared a chart showing the last 24-hour trading volumes of the coins. Here’s an overview of the list before we get into the details:

- Uniswap (UNI)

- Chainlink (LINK)

- Lido (LDO)

- The Graph (GRT)

- AAVE (AAVE)

- Terra Luna Classic (LUNC)

- Rocket Protocol (RPL)

- Curve DAO (CRV)

- Synthetics (SNX)

- PancakeSwap (CAKE)

Uniswap (UNI) tops the list

The DeFi altcoin is currently trading at $6.88 after falling over 5% in price over the past day. UNI still increased by more than 5% compared to last week.

With a market cap of around $5.2 billion, UNI is currently ranked as the 17th largest crypto overall by market cap.

The second highest market cap DeFi altcoin was Chainlink (LINK). The altcoin is one of many cryptos in the red for today after a 6% drop in price in the last day and is currently trading at $7.45. With a market cap of approximately $0.8 billion, LINK is currently the 21st largest cryptocurrency.

Lido DAO (LDO) takes the third place in the list. Crypto was down more than 10% in price at one point yesterday. It is currently recovering slightly and trading around $2.85. However, LDO is still up more than 5% from last week. With a market cap of $2.2 billion, LDO is the 30th largest cryptocurrency by market cap.

Other cryptocurrencies on the top 10 list include The Graph (GRT), Aave (AAVE), Terra Luna Classic (LUNC), Rocket Protocol (RPL), Curve DAO (CRV), Synthetics (SNX), and PancakeSwap (CAKE). taking.

DeFi altcoin market regains FTX losses

cryptocoin.com As you follow, crypto prices have been rising since January. Total value (TVL) locked in DeFi exceeds $50 billion for the first time since the collapse of FTX. As of February, TVL in DeFi is $51.1 billion and liquid staking protocol Lido accounts for 17.18% of the total. The aforementioned price hikes put the DeFi locked total value (TVL) above $50 billion for the first time since November 8, 2022.