According to

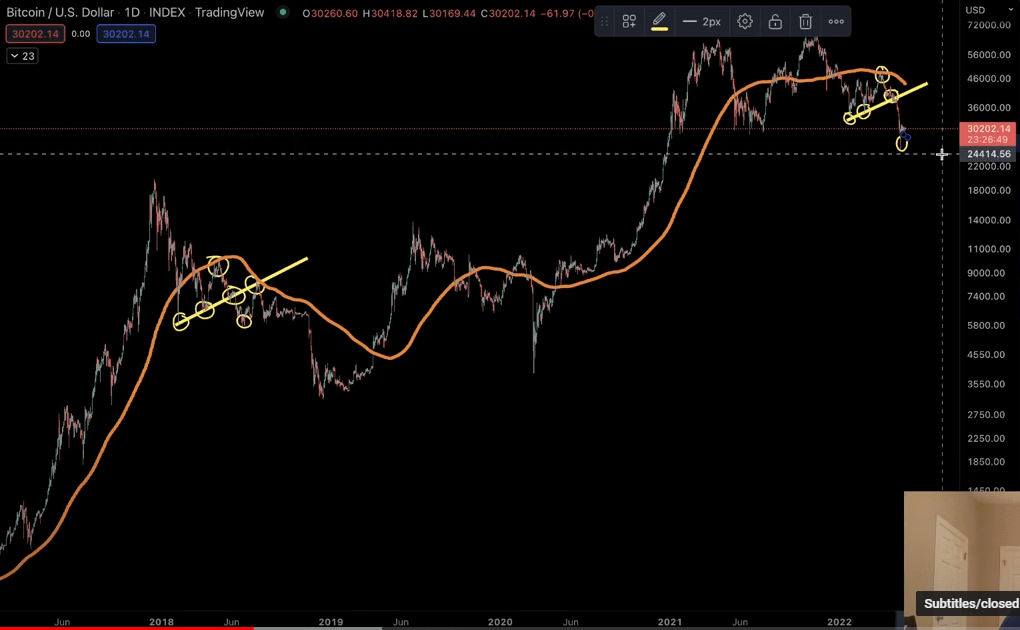

cryptocurrency analyst Benjamin Cowen, the largest cryptocurrency by market capitalization Bitcoin (BTC) follows a specific market structure as of 2018. Cowen said that in January of 2018, Bitcoin exhibited higher lows between $9,000 and $11,000.

Cowen conveyed important levels for Bitcoin

As we have reported as Kriptokoin.com, a well-known analyst Cowen said that Bitcoin eventually formed a crater and was around $5,800 at that time. indicates that it has reached a new low. “As you can see in 2018, we’ve had a dip, we’ve had a drop higher and we’ve had this, which is a pathetic attempt at a higher low. Ultimately we are back to a lower bearish and trendline. It was also the rejection of the 200-day simple moving average (SMA) in between,” he said.

According to Cowen, Bitcoin has been reflecting the 2018 market structure for the past few months. He highlighted that BTC made several high lows between $30,000 and $39,000 from January to May and eventually corrected up to $26,000. The cryptocurrency trader adds that if BTC truly follows the fractal, Bitcoin could be in a strong rally. Cowen adds the following to his analysis:

What happened in 2018 is we’re back to the trendline that is showing resistance because in bear markets trendlines tend to show resistance. We’re also back to the 200-day moving average, so there’s some confluence between the trendline where we put higher lows and the 200-day SMA.

Cowen: $40,000 re-visible

Cowen, if the current 200-day moving average is hypothetically extended to mid-June, possibly $40,000 He thinks he can get anywhere from $42,000 to $42,000. The analyst states that the level between $40,000 and $42,000 carries a lot of weight for BTC. Because he states that 2021 is the place where the first rejection was defeated in January. He states that once this level is broken, BTC was rejected in the summer of 2021. He states that if the fractal materializes, in the next few weeks, there may be a pump and a return to $ 40,000.