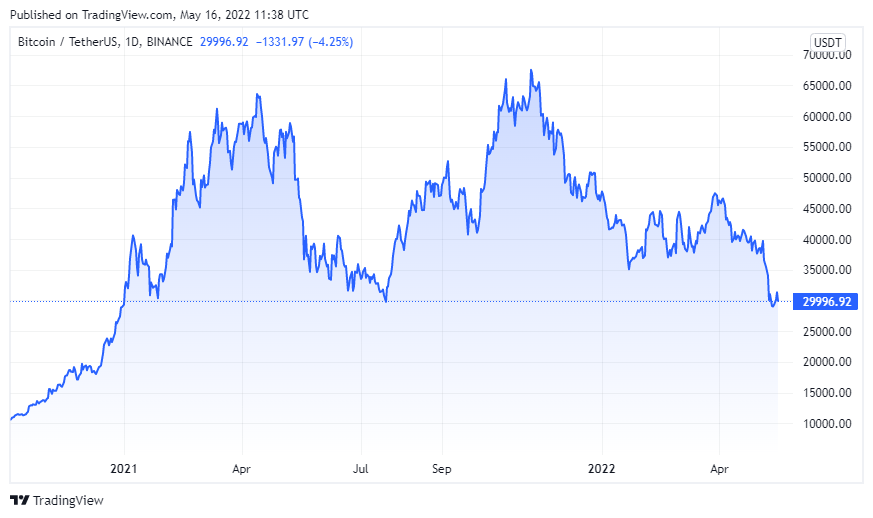

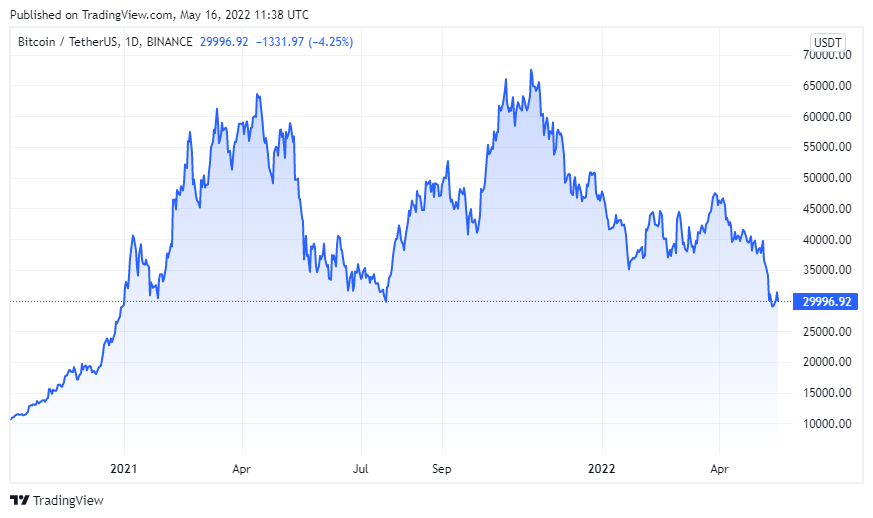

Bitcoin (BTC) price could trade between $20,000 and $40,000 over the next 6 months. Altcoin Sherpa on Twitter is talking about a second half that will put the BTC price under pressure and thus the entire altcoin market.

Bitcoin stuck below $30,000

The recent turmoil in the cryptocurrency market has largely blocked many altcoins seeking ATH levels, especially Bitcoin. However, the recent crash forced the price to stay limited below $30,000. Interestingly, the BTC price rally in the coming days is expected to remain confined within small brackets. In this case, the crypto market could see significant volatility that could boost altcoins.

Bitcoin price over the past six months has largely consolidated by a massive amount while an attempt to breakout has also failed. The trend is expected to continue in a similar fashion as the price reaches the same support levels. Therefore, as Sherpa predicts, BTC price may continue to trade between $20,000 and $40,000 for another 6 months.

$BTC: Welcome to the next 6 months. #Bitcoin pic.twitter.com/sCiJWtViU4

— Altcoin Sherpa (@AltcoinSherpa) May 16, 2022

However, the BTC price has changed more than once since the Asian stock market’s inception. It recorded a red candle, igniting a steady downtrend. Therefore, the price could stay below $30,000 within the consolidated zone for a longer period of time until it gets enough pressure to exit the current consolidation. “Altcoin Sherpa” summarizes the technical outlook in its current analysis under 3 headings:

- BTC price is trading inside a slightly ascending wedge, so the current drop could be the result of the formation.

- Therefore, the price may decline to $28,800 as it could offer strong support with a significant recovery here.

- Once the price recovers, it may attempt to reach the $30,000 levels initially and then rise above $34,000 very soon.

What’s left in Luna’s spare wallet?

Crypto investor Luna Foundation Guard is stuck on how much reserve it has left. As we quote Kriptokoin.com , LFG also shared its pledge to “compensate the remaining users of UST, the smallest investors first” with the remaining assets.

10/ The Foundation is looking to use its remaining assets to compensate remaining users of $UST, smallest holders first.

We are still debating through various distribution methods, updates to follow soon.

— LFG | Luna Foundation Guard (@LFG_org) May 16, 2022

In summary, 80.081 Bitcoin (BTC) or Bitcoin protected by LFG 99.61% of it came out of the fund. The Terra team confirmed the sale of “33,206 BTC for a total of 1,164,018,521 UST” in a tweet.

The remaining 47.188 BTC is not taken into account, while 313 BTC remains in reserve.