The pullback of the US dollar continues to support the struggle for gold. It’s also helped by stronger interest rates and recession fears. Meanwhile, US-China trade dialogue hopes to ease Trump-era tariffs on China bolster cautious optimism. On the other hand, what if US data and Fed Minutes look hawkish? According to market analyst Anil Panchal, in this case, talk of economic slowdown is likely to put downward pressure on gold prices.

“Gold prices reflect tarders indecision”

Gold prices lost their strength in the early Asian session. The yellow metal had a bad start to the week and fell below $1,800 again on Tuesday. In doing so, the Sino-US dialogue seems to have fostered an air of risk-taking. On the other hand, according to the analyst, gold prices reflect the indecision of the tarders.

However, comments by Chinese Vice Premier Liu He indicate an improvement in US-China trade relations, at least for the time being. This supports market sentiment. The macro update, which conveys the phone conversations between Liu He from China and US Treasury Secretary Janet Yellen, included the following statements:

The two agreed on the need to strengthen the communication and coordination of macroeconomic policies between China and the United States.

Gold investors will watch this data closely

Italy declared a state of emergency amid its worst drought in 70 years. Also, recession fears have recently taken cues from Europe. Also, after the Russia-Ukraine crisis, energy companies are struggling to pay gas prices. cryptocoin.comAs you can follow from , Germany also gave the signals of economic troubles.

Elsewhere, strong US Treasury yields point to market expectations for tighter monetary policy in the future. Hence, this also challenges the risk profile. The analyst evaluates the current situation’s impact on gold as follows:

To sum up, cautious optimism in the market is failing to impress gold buyers despite predicting modest gains. Therefore, today’s May US Factory Orders and Wednesday’s FOMC meeting minutes will be watched closely. Also, Friday’s June US jobs report is important for clear instructions.

Gold prices technical analysis

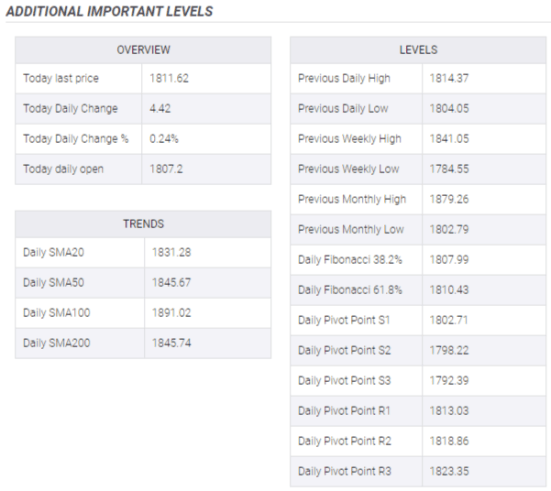

Market analyst Anil Panchal analyzes the technical outlook for the yellow metal as follows. The MACD’s bullish signals and continued trading beyond the two-day support lines keep buyers hopeful. Gold prices rose in this environment. However, retracements are repeating around $1,813 after the 50% Fibonacci retracement from June 27 to July 01. This is also testing the upside momentum.

Even if the price manages to break the $1,813 barrier, the convergence of the 200-HMA, one-week descending trendline and the 61.8% Fibonacci retracement level is challenging the gold bulls around $1,820. With gold above $1,820, a rise near $1,857 in mid-June is possible.

Alternatively, an immediate support line near $1,808 is likely to precede the $1,800 threshold to limit the short-term decline of the yellow metal. A break of this is likely to drag the gold down towards the recent decline near $1,785.