According to the analyst, who believes a new sale is imminent, the price of Bitcoin (BTC) may see a new bottom with $ 24 thousand. As we reported on Kriptokoin.com, in May 2021, the same analyst had correctly predicted the collapse by analyzing the movements in cryptocurrency prices. Now they say they’re seeing signs of a new bottom on the horizon.

Bitcoin price could bottom out at $24,000

Dave the Wave is a prominent cryptocurrency analyst popular for correctly predicting the May 2021 crash in BTC price. The analyst foreshadowed the May 2021 crash, when the BTC price reached $25,400 and the double top pattern reached $69,000. The analyst, who is popular for his accurate predictions, explained his thoughts by saying that there are new clues that Bitcoin will form a new price floor in the near future.

I think this was my first mention of a double top [back when it was an anathema]. If a double top, why not a double bottom….? https://t.co/D2cDPgmttZ

— dave the wave🌊🐫 (@davthewave) May 13, 2022

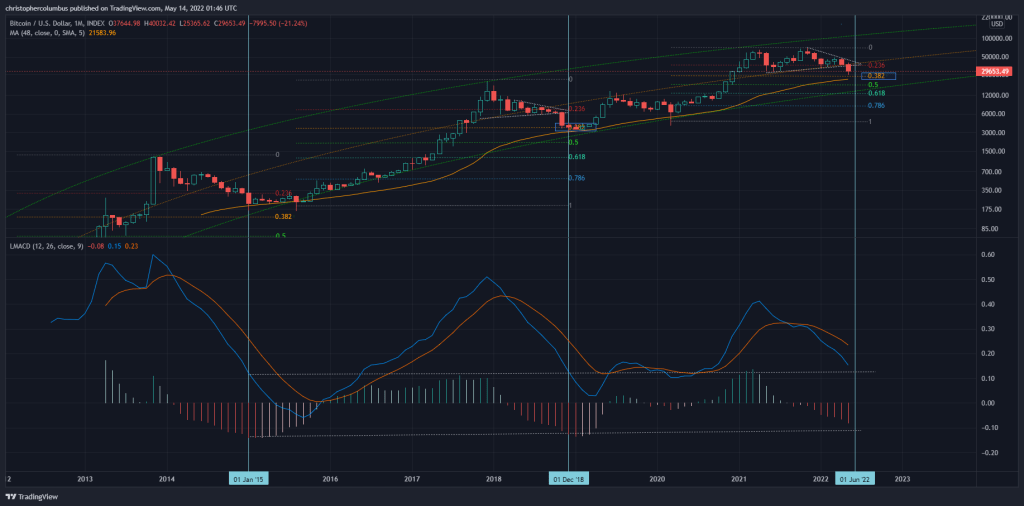

Analyst, Bitcoin price to May low believes it has reversed and will soon reverse itself and begin its decline. Dave told his 1.11 million Twitter followers that he predicts Bitcoin trading will be close to its 48-month moving average. He explained to the analyst that this is the point where Bitcoin has historically tended to bottom out, adding:

Probably, [based on this metric] another month… what you would expect if BTC price retests lows during this month. that’s the thing.

Indicators pointing to lows in BTC price

Dave, Bitcoin’s Logarithmic Growth Curve channel, Moving Average Convergence/Divergence (MACD) and He believes the Relative Strength Index (RSI) is pointing to bottoming out in the next few months. These technical indicators are used to identify strong buy-sell signals and identify an overbought or oversold zone in a cryptocurrency. At current levels, the analyst believes these indicators suggest that the Bitcoin price could bottom out ($24,000) this month as early as June 2022. The analyst shared his views with the following words:

Comparison of Bitcoin weekly MACD structure looks promising for the lower part of BTC price…

Dave tells the narrative of descending Bitcoin price cycles supports. He argues that BTC price cycles are getting shorter and “decreasing” with the increase in maturity in the cryptocurrency market. Dave’s conclusion is similar to that of Benjamin Cowen, a prominent crypto analyst who believes that BTC extension cycles are over. The bear market has been here for months and will likely come to the fore. Cowen practices Macro trading, an investment approach that takes into account factors such as inflation, the interest rate, and the impact of fiscal policy on the price of Bitcoin. He believes the bear market could continue and the long crypto winter could be a macro “bottom” signal for Bitcoin price.