A crypto analyst who foretold Bitcoin bottoms warns that the market carries significant downside risks.

“There are fewer and fewer reasons to rise”

‘DonAlt’, which recently closed all Bitcoin, Ethereum and XRP positions and cashed in, is now waiting for a major correction. In his current analysis, he said that the markets that have witnessed the high-profile collapse of FTX in the past six months are under downward pressure.

The analyst draws on the rise of meme coins and the increased activity of scammers. He predicts that these factors will put the market under pressure. “We need to find a reason to use nuclear weapons,” adds DonAlt.

I'd say the opposite

If you just look at this move technically:>Nuke with 0 bounces from $69k to $16k

>Retrace some of that with the current move

>Not even back in the old rangeIgnoring my feelings and bullish underlying bias this is nothing more than a bear market rally https://t.co/ej9eBTNpkB

— DonAlt (@CryptoDonAlt) May 8, 2023

According to the tweet, “The downside risk is now much higher than it was six months ago. Now meme coins are on the rise and scammers are scamming everyone as much as they can. So there is less and less reason to rise.”

cryptocoin.comWe have mentioned that DonAlt has been giving warnings in this direction for a while.

Next goals for Bitcoin

According to DonAlt, Bitcoin’s 100% rise from its November 2022 lows was likely a bounce in a macro bear market.

The crypto analyst now says that the downside risk for the crypto market has increased. However, he noted that markets are “significantly higher risk” than six months ago. DonAlt says that from a technical point of view, Bitcoin went from $69,000 to $16,000, now we’re getting some of that back, but we’re still not even in the old range.

DonAlt says that sentiment ignores the underlying bullish bias. He claims that this move is nothing more than a bear market rally. The analyst believes that Bitcoin has not yet crossed the bull zone. But he is adamant that $16,000 is the bottom for this bear cycle.

As for his view on Bitcoin, DonAlt says that as long as BTC is stuck between $20,000 and $30,000, it will likely move sideways.

Will Bitcoin price reach $25,000 in the short term?

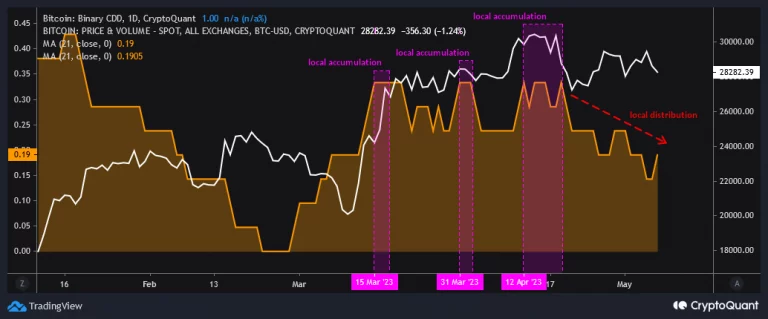

According to other analysts, the drop to the $25,000 region is clear as investors’ BTC accumulation slows. While Bitcoin’s weighted sentiment remains in negative territory, CryptoQuant analyst Baro Virtual stated in a new report that the leading crypto could drop below $25,000 as long as the market bearish sentiment continues.

Baro’s conclusion was based on the evaluation of Daily Destroyed Coin (CDD) against the 21-day MA. This metric tracks the number of coins that are inactive for a given period of time and then move.

According to Baro, BTC’s CDD metric shows that it experienced three local accumulation periods on March 15, March 31 and April 12, respectively, followed by a local distribution period on April 20. “Bitcoin is still moving within the local uptrend,” the analyst adds, although it remains at this stage. However, “the danger of a drop to $24,500-25,000 remains within the H&S bearish pattern.”

Metrics show Bitcoin seeking new support

Sharing the same opinion, another CryptoQuant analyst, Abramchart, stated that a new support area was identified after BTC fell from $30,000. According to Abramchart,

Following the recent drop in Bitcoin, we can identify the next areas of support through the Actual Price – UTXO Age Bands indicator, which helps us understand the holding behavior of each group by comparing a number of different realized prices. The closest support area is at 25619, which represents the average purchase price of wallets that have purchased Bitcoin in the last 3-6 months.