According to crypto analyst John Isige, Polkadot (DOT) stands on the verge of a price rally. Also, the analyst says that Solana (SOL) is preparing for its 12% increase. We have compiled the analyst’s predictions and comments on two altcoin projects for our readers.

“DOT price is making a bullish move”

Polkadot price is approaching a breakout from the short-term falling wedge pattern. The support provided by the 50-day SMA on the four-hour chart has allowed buyers to worry less about sudden pullbacks. But he channeled his efforts to regain the ground for $6.50 and even $8.00.

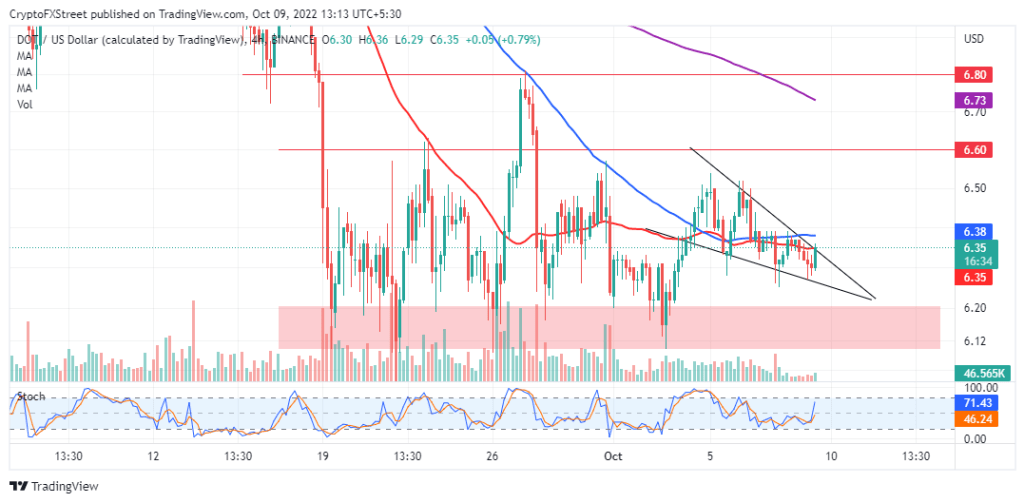

DOT four hour chart

DOT four hour chartAfter a significant downward move in price and a period of consolidation, a falling wedge is formed. The two trendlines connect a series of lower highs and lower lows. As the altcoin price slides towards the top, a breakout is usually expected. To get the most out of the wedge pattern while avoiding bull traps, traders need to confirm a break above the upper trendline. Potential take-profit targets stand at $6.50 and $8.00, respectively.

On the other hand, the Stochastic oscillator on the same chart shows that the altcoin price is almost overbought. In other words, it is possible for short-term trades to favor sellers. This is also likely to deter buyers from trying to push DOT up the ladder. In case of a trend correction, support areas that are likely to be tested are at $6.20 and $6.12, respectively.

“This altcoin is heading towards a major bull move”

cryptocoin.com As you follow, Solana has announced the launch of Mesh, a new program tailored for DAOs and institutions. This move will make it part of the Squads Multisig Program Library. Mesh allows organizations to develop hierarchies or several interconnected structures with multiple multi-signatures.

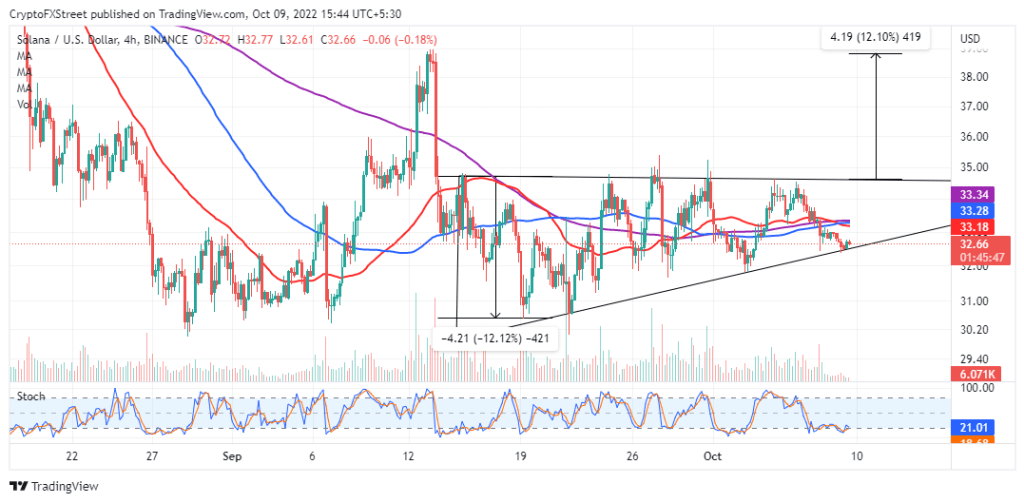

Buyers battle selling pressure at $33.00, while Solana is trading at $32.85 at press time. The 50-day SMA (Simple Moving Average), red and 100-day SMA, blue line up to prevent further upward movement at $33.20 and $33.31 respectively. However, the Stochastic oscillator confirms that SOL is in the hands of the bulls. Also, the index is making a positive divergence from the price. So, it has risen from the oversold zone and is heading towards the midline.

LEFT four hour chart

LEFT four hour chartThe ascending trendline reinforces the bulls’ presence in the market. But the x-axis represents the dominant selling pressure around $35.00. Traders need to wait for the SOL price to break this resistance before activating their long positions. Potential exit positions of $35.00, 37.00 and $39.00 for those who prefer to take profit early.