Ripple price tumbled as the bears repulsed another recovery attempt before surging higher. On-chain indicators provide insight into some of the barriers behind the pullback. Two critical factors could cause another pullback for the altcoin in the coming weeks, according to crypto analyst Ibrahim Ajibade.

Despite bear sentiment, altcoin network activity has not deteriorated

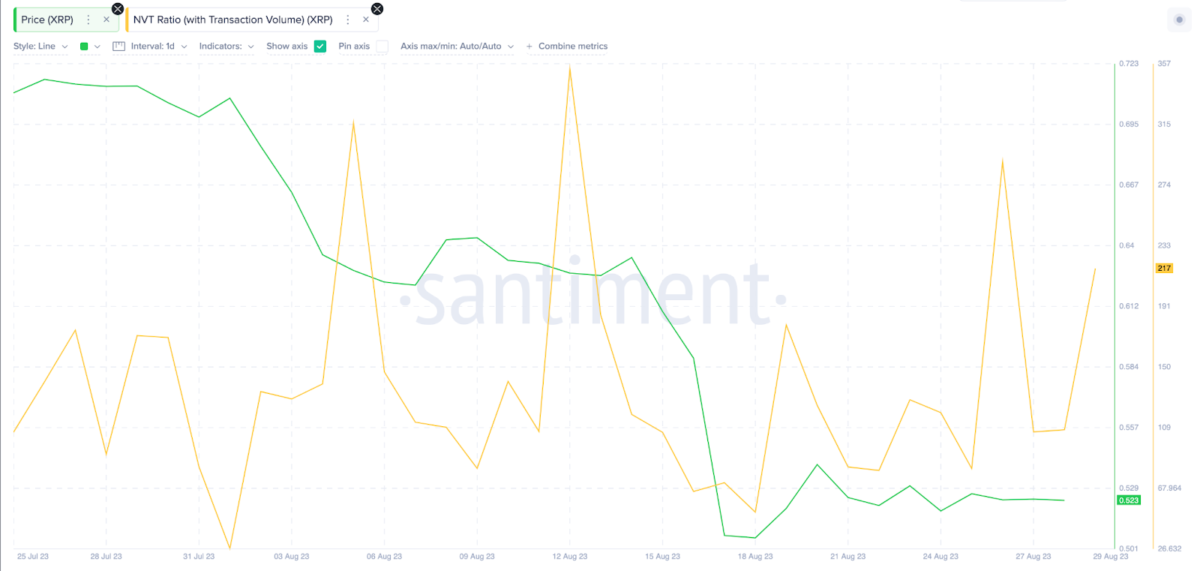

cryptocoin.com As you follow, XRP was badly hit by the altcoin market crash on August 17. It has continued to grapple with downwinds ever since. But despite the price downtrend, on-chain data shows that economic activity on the XRP Ledger Blockchain network has not deteriorated. As you can see below, the XRP Network Value to Transaction Volume (NVT) ratio has been on an upward trend since the beginning of August. As of August 29, it stands at 217, up 400% from 51.85 local bottom recorded on August 18.

Ripple NVT Rate. August 2023 | Source: Santiment

Ripple NVT Rate. August 2023 | Source: SantimentIn short, when the NVT ratio rises, it indicates steady growth in the underlying economic activity relative to price action, as you can see above. Typically, when trading volumes rise, so do price and network demand. Thus, XRP’s current undervalued state suggests that other factors other than network demand may be responsible for driving the price down.

XRP long-term holders sell their coins

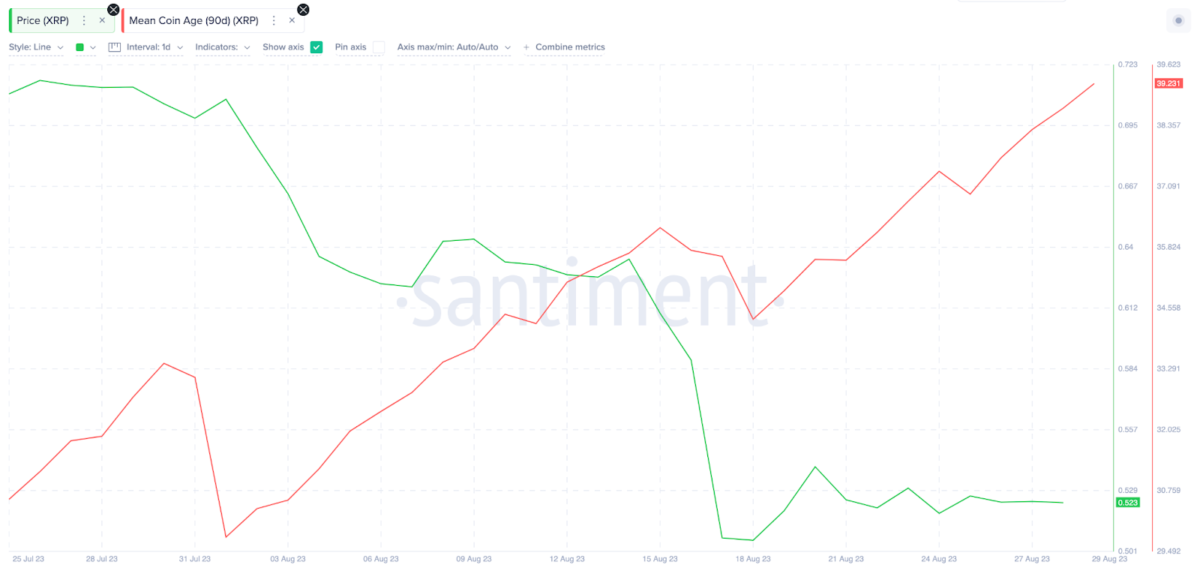

XRP network demand remains healthy. However, on-chain data reveals an alarming bearish trend among long-term holders. As an indication of this, the altcoin witnessed several notable drops in the Average Crypto Age over the month of August. Although to varying degrees, the chart below shows a significant drop in Average Crypto Age prior to each of the most prominent XRP price corrections on August 1, August 16, and August 25.

Ripple Average Coin Age. August 2023 | Source: Santiment

Ripple Average Coin Age. August 2023 | Source: SantimentAverage Coin Age data measures overall trading sentiment among long-term investors. It is obtained by estimating the average number of days that coins in circulation are not moved from existing wallet addresses. Typically, a downtrend in the Average Age of Cryptocurrency indicates that many long-term investors were selling their coins during that period. The chart above reveals a significant correlation between Average Crypto Age drops and recent altcoin price corrections. So this suggests that if long-term holders continue to close their positions, they could cause further pullbacks in the coming weeks.

Altcoin price prediction: Possible reversal below $0.50

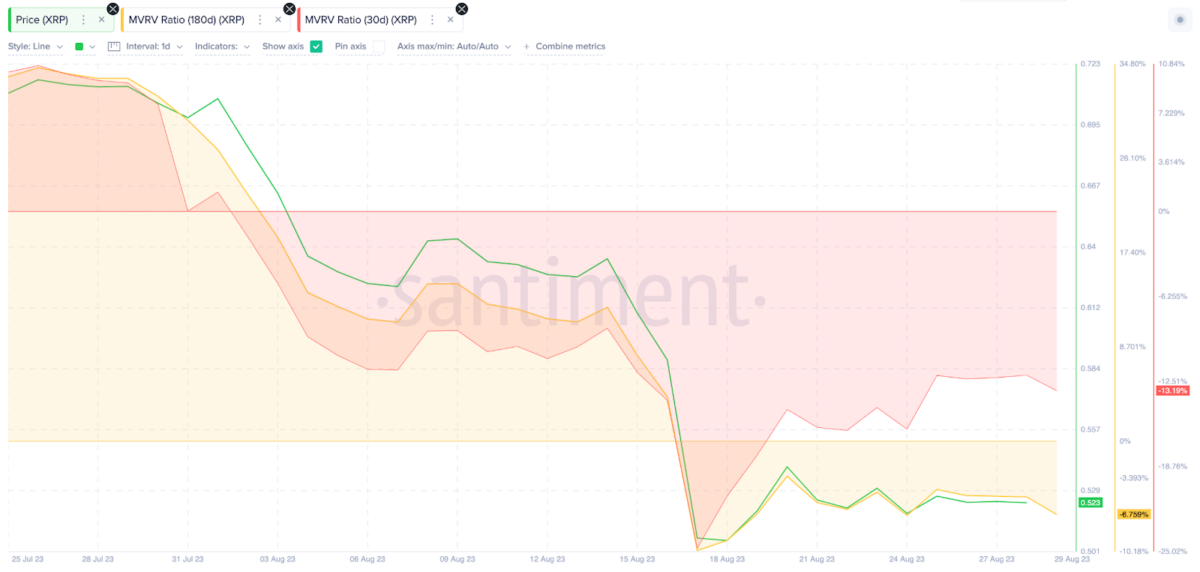

Current prices may be unfavorable for new investors. However, it is possible that those who bought XRP during the turbulence of the SEC lawsuit months ago may be more willing to sell. The Market Value – Realized Value (MVRV) ratio, which measures the net financial position of current holders, also confirms this prediction. Investors who bought XRP in the past month will lose 13.2% if they sell today. Meanwhile, those who bought 180 days ago will lose 6.7%, almost half that. Recent trading patterns show that 180-day holders stopped selling in the 10% loss range during the August 17 crash. If they repeat the same trend, they could continue to sell until the altcoin price reaches $0.49. And if this support level doesn’t hold, a drop to $0.45 is possible for XRP.

Ripple (XRP) Price Forecast – MVRV Ratio. August 2023. Source: Santiment

Ripple (XRP) Price Forecast – MVRV Ratio. August 2023. Source: SantimentIn contrast, long-term XRP investors have the opportunity to earn around 5%. However, if they close their positions at par, they are likely to face significant resistance above XRP $0.54. However, if the market momentum turns bullish, the altcoin price could sustain the rising wave of network activity and immediately retrace $0.60.