As the cryptocurrency market is going through a tough time, investors are raising bullish expectations for an altcoin that continues to make big changes to its ecosystem. As Kriptokoin.com, we are transferring the details.

Developments in this altcoin project raises anticipation

Polkadot (DOT) continues to make major changes to its platform. With the announcement of innovations in the Polkadot ecosystem, such as the ability to allow parachains to communicate with each other and transfer assets between chains, liquid staking, and issuing USD stablecoins, investors’ expectations for altcoin price bullish have increased. The development in the Polkadot (DOT) ecosystem has slowly emerged over the past year and a half, and the work done by the developers is finally starting to bear fruit as the parachain auctions finish and the first chains are launched on the mainnet. The next phase of interoperability within the ecosystem will begin now as cross-chain functionality is about to be released. In the next step, it will allow Polkadot-based parachains to communicate with each other and transfer assets between chains.

After passing community vote, v0.9.19 has been enacted on Polkadot. This upgrade included a batch call upgrading Polkadot’s runtime to enable parachain-to-parachain messaging over XCM and upgrading #Statemint to include minting assets (like NFTs) and teleports. pic.twitter.com/uqIB5di2Q1

— Polkadot (@Polkadot) May 4, 2022

Up to this point, DOT had limited uses and was basically very isolated on its own network without much functionality. Its main functions included staking, governance and contribution to parachain mass loans, which helped reduce circulating supply but did little to really fuel demand. The introduction of cross-chain communication enabled DOT transfers to various parachain networks and the number of use cases for altcoins on parachains such as Moonbeam and Astar Network.

How will the improvements affect the DOT price?

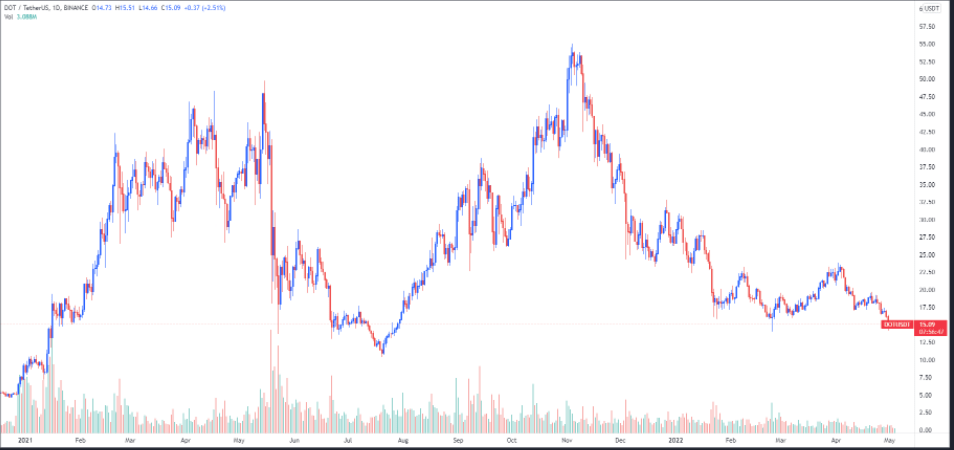

shows that the DOT price has been hit hard by the six-month downtrend in the crypto market, as it dropped nearly 73 percent from its all-time high of $55 on Nov. While the altcoin is currently trading at a significant support/resistance level, it is not yet clear whether the ability to transfer DOT between various parachains will lead to an increase in DOT demand.

A notable use of DOT, which has grown in popularity in recent months, is liquid staking and stablecoin issuance using crypto assets as collateral. DOT can now be transferred to the DeFi-focused Acala parachain and then deposited into a liquid staking contract in exchange for LDOT, which can be used as collateral for Polkadot and Kusama’s native decentralized stablecoin aUSD. DOT can also be used in various DeFi applications such as yield farming and borrowing. As the introduction of cross-chain communication spreads throughout the Polkadot ecosystem, it will create additional use cases for DOT, especially as parachains provide increased functionality. If what is expected is expected in the short and medium term, investors can get serious profit opportunities.