According to veteran analyst Justin Bennett, a new wave of selling is approaching in both the stock and cryptocurrency markets, including Bitcoin.

Justin Bennett: Stocks, Bitcoin and crypto market on the verge of collapse

Bennett is alarming his 101,000 followers as the total value of the cryptocurrency market (TOTAL) is poised to breach cross support. The analyst said on Twitter yesterday:

Everything seems to be breaking either support. A small fake boost puts TOTAL up to $940 billion. Now adding pressure to channel support. I think it probably won’t take long.

“Cryptocurrency market is dormant”

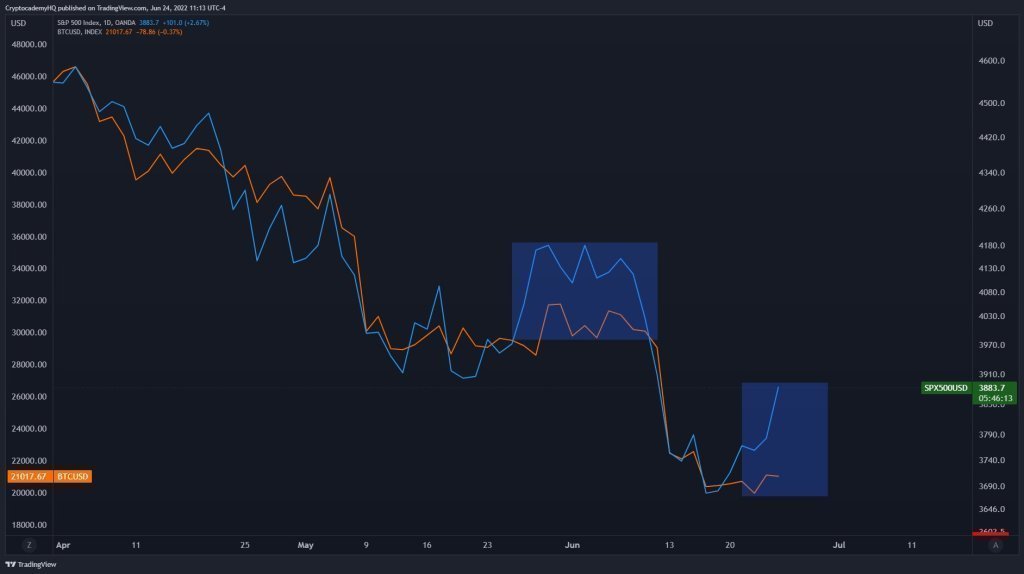

The S&P 500 made a solid close on Friday. But the expert warns that the decline continues. Bennett shared a chart showing how the stock market and Bitcoin rose in late May and early June before quickly losing all of their gains. The analyst interprets this chart as follows:

While the S&P 500 had a nice bounce today, the cryptocurrency market was dormant. The last time this happened, things got worse. A blue S&P 500 with an orange BTC.

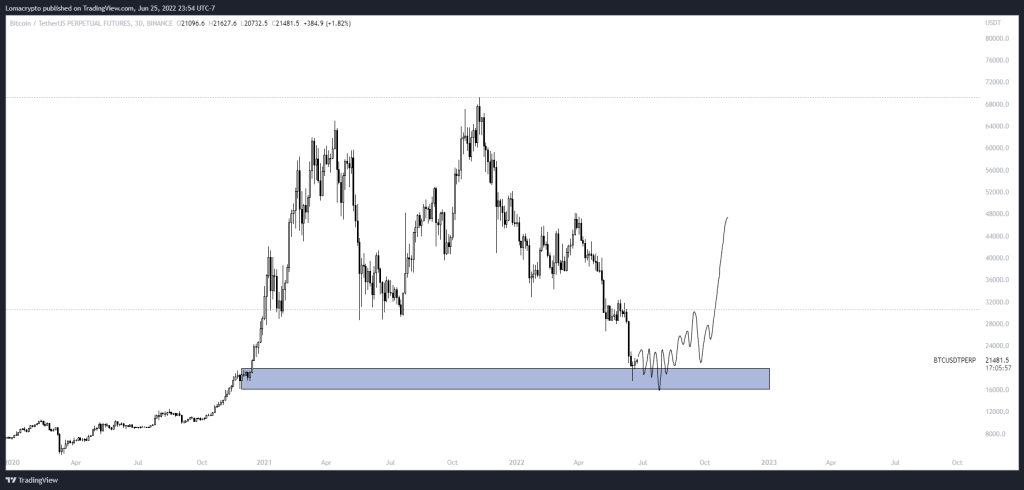

Bennett predicts that the cryptocurrency market will continue to decline and reach new lows. However, other experts in the field say that Bitcoin is about to reach the bottom. A Twitter analyst nicknamed Loma expects Bitcoin to enter a period of accumulation before rebounding faster than others. “Loma” quoted in a recent tweet:

Assuming the price has bottomed out; We’ll probably have an accumulation phase that will go much faster than usual. I’m more or less focused on catching volatility early in an uptrend and begging Satoshi not to sell too soon.

Is there a positive signal for Bitcoin?

BTC is currently trading around $21,400 without any significant change in the past day. However, it showed a bullish curve with a 16.4% jump in the past week after the last ‘crypto winter’. There are some interesting developments observed in the BTC data that suggest a mixed forecast for its near future.

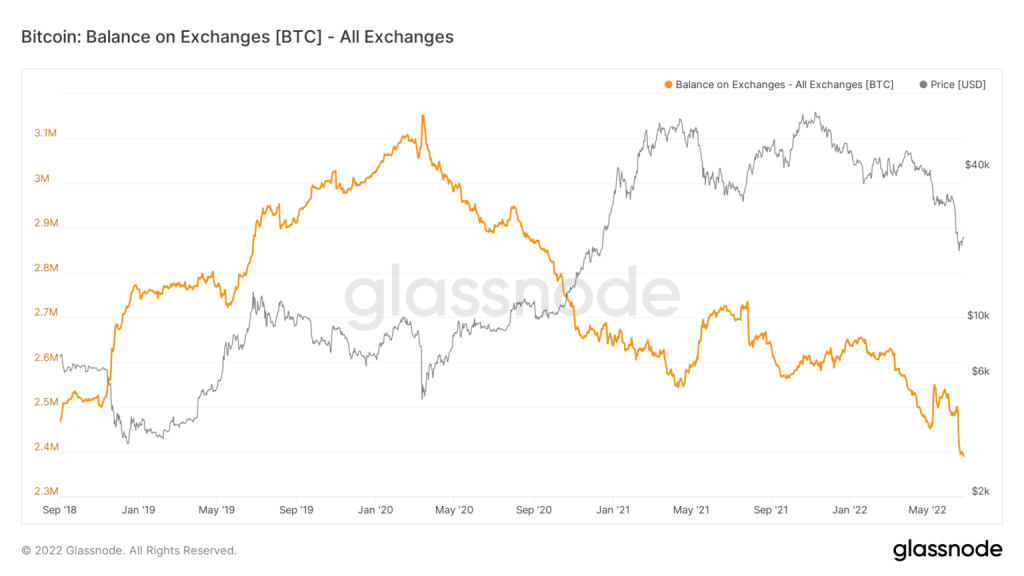

First, the supply of Bitcoin on exchanges has dropped to 2018 levels. According to data from Glassnode, BTC supply on centralized exchanges exceeded 2.4 million in March 2018. It also never fell below that. However, there has been a sharp increase in foreign exchange outflows since the Celsius and Babel statements on 13 June. These exchanges also decided to freeze withdrawals in user accounts in their respective announcements. Historically, stock market breakouts and low supply on exchanges have been bullish signs for Bitcoin.

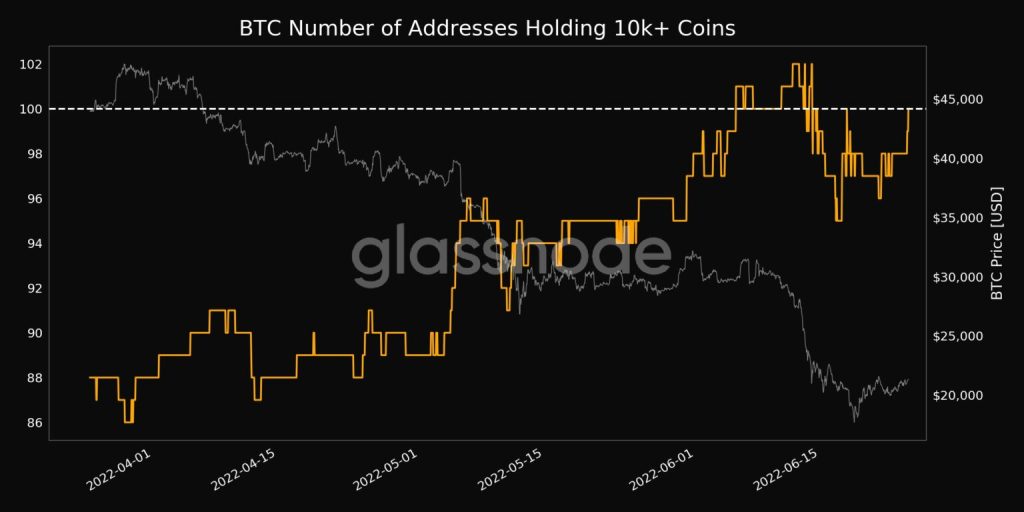

A Glassnode tweet contains more data on the topic. The number of addresses holding more than 10,000 BTC has just reached 100, according to the tweet. This is another bullish signal suggesting widespread accumulation.

However, the market has mixed signals for investors. BTC’s trading volume dropped to 27% in the past day. It can be said that it is a development that will potentially affect the BTC price. Another worrying issue is that miners sell their assets. cryptocoin.comWe have prepared a detailed article on this topic.