The threat of free fall if it breaks, has made a prominent analyst sound alarmed. Michaal van de Poppe, with 165,000 Youtube subscribers, draws attention to this level in Bitcoin price.

If Bitcoin breaks this level, it will drop a nuclear bomb

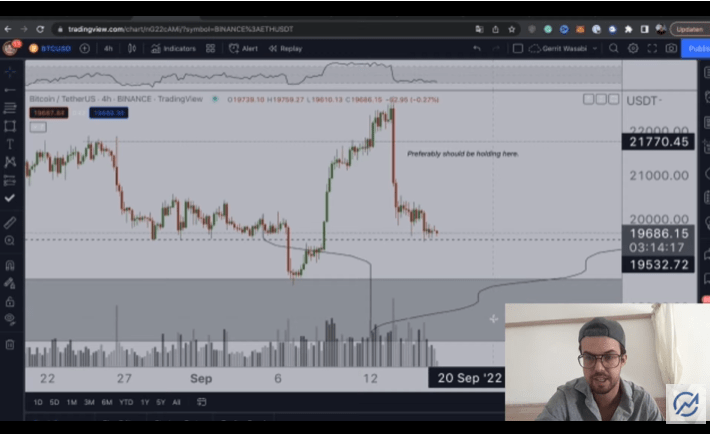

Michaal van de Poppe explained at what level Bitcoin (BTC) should stay in order to prevent further price drops. The analyst, who includes detailed technical analysis, says that Bitcoin should be around $ 19,300. In a new YouTube video, Poppe explained why this level is critical:

Because if we lose $19,300, there is a possibility that we will go below $18,500 for a short time and see new lows, which will be difficult for us especially after the last candle. This is final support, and if it doesn’t or does not provide any support, we’ll likely nuke it further down between $17,500 and $18,500… and then we’ll seek help there.

Van de Poppe thinks Bitcoin won’t make a major move until next week’s Federal Reserve meeting in the US, where investors will learn more about the direction of Bitcoin and risky assets like crypto. The analyst says he will not be surprised when he sees horizontal prices until the meeting date, September 21:

The Fed is meeting next week. I wouldn’t be surprised if we continue to slide or consolidate until we get an opinion from the Fed.

cryptocoin.com As you follow, Bitcoin is currently consolidating to reclaim $20,000. It remained stable throughout the day and managed to maintain the level that Poppe pointed out. However, the 6% depreciation since last week means the bulls are still on the court.

Bitcoin inflows to the stock markets are increasing, will investors sell their BTCs?

In the second week of September 2022, 1.69 million Bitcoins flowed to cryptocurrency exchanges. Bitcoin, worth $33.5 billion, flooded stock markets for the first time since October 2021. It is often associated with a drop in the asset’s price when stock markets are flooded with Bitcoin. Whales who want to sell their assets and individual investors who want to make a profit move their BTC to exchanges.

Interestingly, Bitcoin exchanges have seen an increase in trading volume as the price drops. Data from Glassnode shows that stock market entries have peaked since March 2020.

However, miners holding BTC during the “capitulation” period in August 2022 have started to snag their Bitcoins in recent weeks. Glassnode analysts note that Bitcoin specifically fell below its 60-day, 120-day, 200-day, 360-day and 720-day moving averages. Every time Bitcoin’s price drops below these moving average levels, it coincides with a “buying generation opportunity.”