Cryptocurrency analyst nicknamed Cred says that only a miracle can change the trajectory of market giants Bitcoin and Ethereum. Let’s look at the analyst’s expectations, keeping in mind that estimates are not certain.

Analyst says Bitcoin and Ethereum need a “miracle rally”

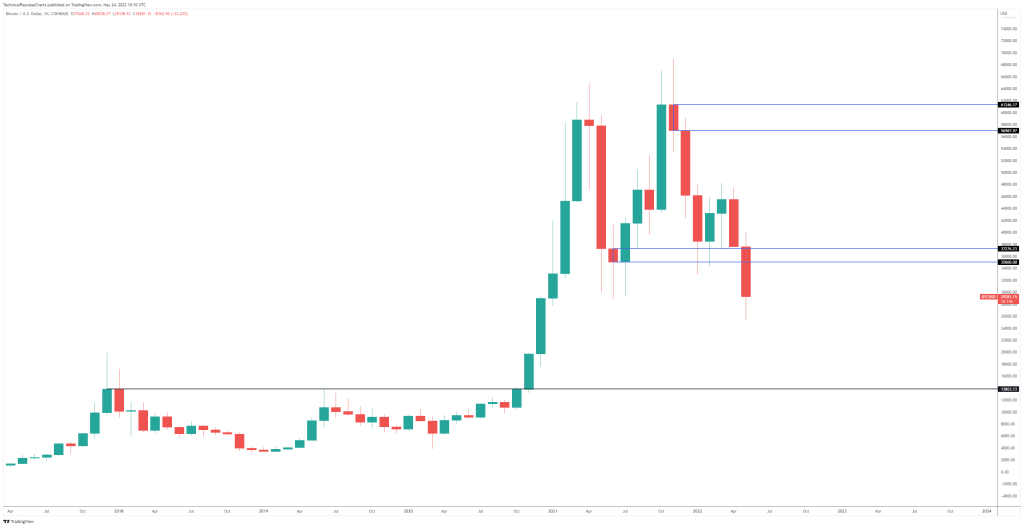

In their current analysis, Cred points out that Bitcoin (BTC) has held support zone since June 2021. He said he needed a “close and strong rally” to protect it. The analyst says that if the rally fails, the probability of further declines will increase:

Only one week before the monthly close, May will close as a macro range break with no close and strong rally. Even if the market rebounds after the monthly close, this rally should be considered a retest of the drop that turned the resistance from $35,000 to $37,000.

In conclusion, the analyst shares a scenario where Bitcoin will hit $30,000:

The market needs to form a miraculous rally this week to fix what appears to be monthly and weekly range breakouts. If that doesn’t happen, subsequent rallies to the low-mid $30,000 are much more likely to rebound and continue the decline. According to

Cred, if the range is broken, Bitcoin could drop more than 50% from the current level in the worst-case scenario. In the second round, the analyst lists supports below $20,000:

If the market continues to trade lower, our downside targets are around $20,000 in the medium term (200-week moving average, all-time high of the previous cycle) and monthly timeframe. reasonably $14,000.

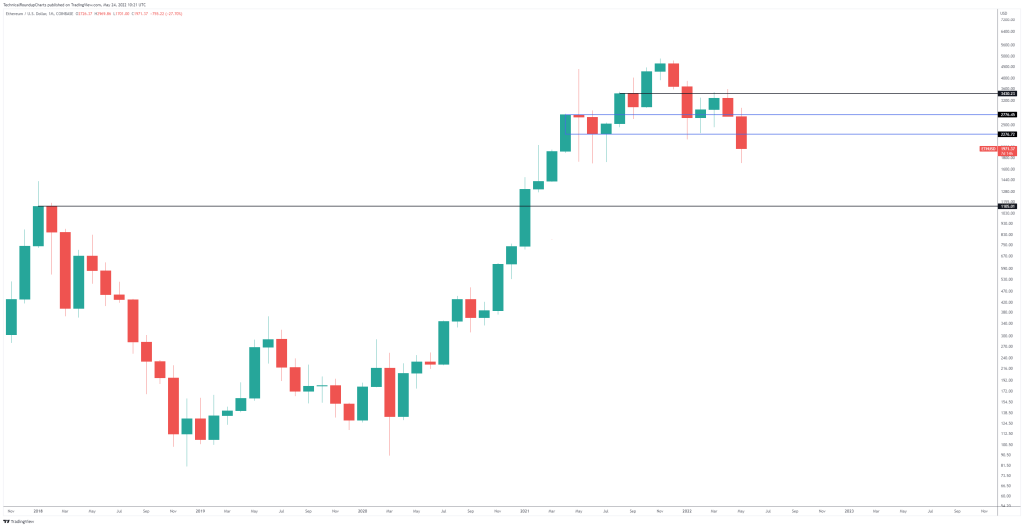

Ethereum needs to break critical resistance

Returning to Ethereum (ETH), Cred says the leading altcoin also needs a strong rally before the end of May. According to Cred, Ethereum needs to close above $2,300 to avoid collapsing the support zone it has consistently closed above since April 2021. Cred, whose analysis we share as

Kriptokoin.com , says that if Ethereum’s price sees an additional decrease, it aims to drop more than 40% from current levels:

As for the downside targets, there is a lot of confluence around $1000 (200-week moving average, monthly support) if there is no return to the above-mentioned range.