Terra’s LUNA price, one of the most talked about altcoin projects of recent times, has withdrawn from $ 2.60. He then deals with extreme market indecision on Sunday. This downward pressure it faces will likely continue into the new week. Technical analysis points to $2.00, down 15.50 percent. There is indecision and uncertainty in the price of Ethereum (ETH). Analyst John Isige examined and shared the analysis of these two altcoin projects.

LUNA price feeds downtrend

Terra, a cryptocurrency ecosystem powered by LUNA, announced the successful completion of the Terra Phoenix airdrop. According to the airdrop statistics, Terra & Thorchain took the top 50.50 percent of the tokens. Polygon came in second with 85,674, representing 20.8 percent of the network’s allocated tokens. Ethereum closed the top four, taking 6.90 percent of the 4,877,832 assigned tokens. The Terra Phoenix airdrop is designed to redistribute 19,504,909 LUNA tokens from the Community Pool to users who did not receive the correct allocation during Genesis. Terra’s development team is working to restore its image. However, the LUNA price will benefit from increased liquidity. And so there is the possibility of declaring a rally.

LUNA price is in the red despite the 100-day SMA. At the 50-day SMA (Simple Moving Average), the immediate upward blue border is holding the action. A break above the downtrend line could see LUNA price avoid the predicted pullback. However, the low trading volume is compounded by the bear market conditions. Thus, it points to a downtrend extending below the falling triangle pattern. Falling triangles have a bearish bias. However, traders should wait for a break below the x-axis support before entering short positions.

Leading altcoin price wipes out weekly gains

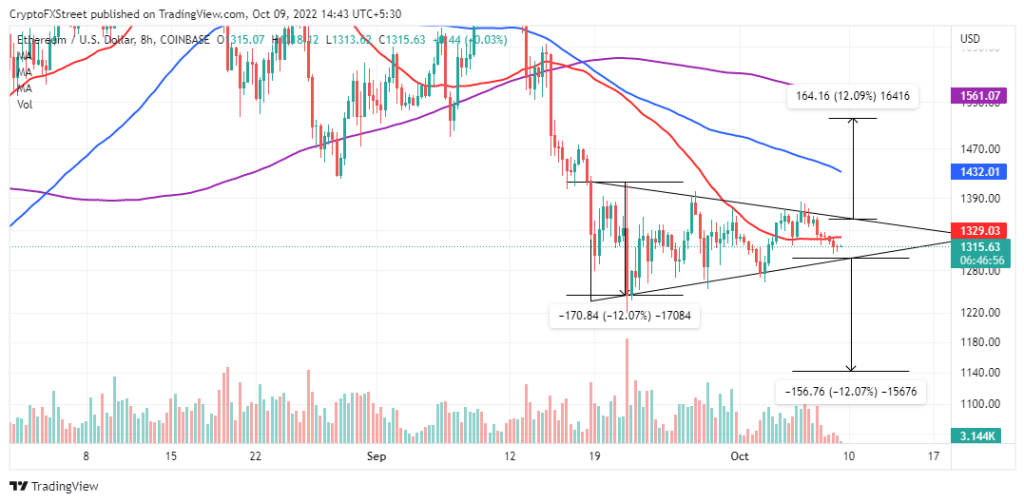

Ethereum price has been consolidating for almost three weeks. As a series of lower and higher lows reached, a symmetrical pattern emerged. This technical pattern predicts a 12 percent move up or down. With the 50-day SMA on the upside, Ethereum price will most likely break below the triangle. Therefore, it is recommended to wait for the ETH price to break the uptrend before activating sell orders. If there is an upside break, ETH will reach $1,521. There is no bullish or bearish trend in symmetrical triangles. This means that recovery cannot be ignored.

On-chain data from Glassnode reveals that addresses with 1,000 and more ETH continue to maintain its downtrend after Ethereum’s Merge. Now, investors in this cohort have roughly 6,316 addresses, and the pressure is far from diminishing. This means that as long as the whales empty their bags, their chances of recovery will continue to decline. It also shows that investors prefer their money not in Ethereum but elsewhere.

Ethereum price these levels are critical

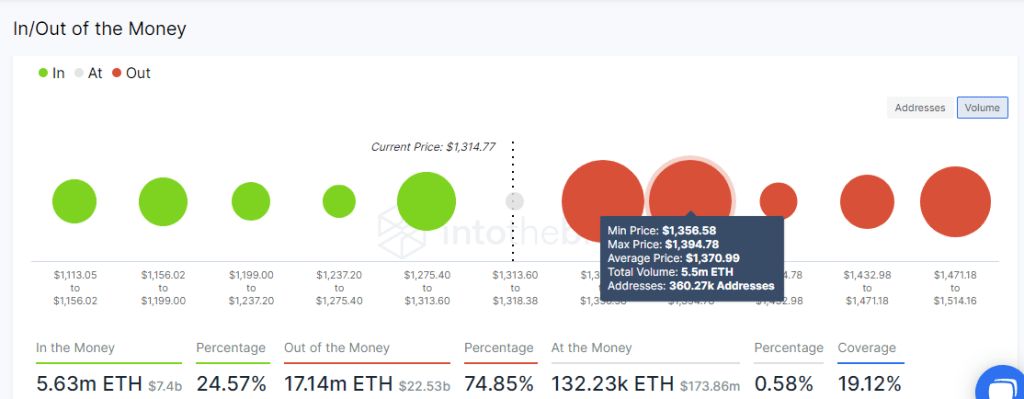

IntoTheBlock’s IOMAP sheds light on a few strong resistance areas that are likely to continue holding the sabotaging move up. The first $1,334 represents 1.65 million addresses that bought 5.6 million altcoins, while the second $1,370 hosts roughly 360,000 addresses with 5.5 million ETH. Trading above these two supply areas will be intimidating for the bulls. Therefore, the price of the leading altcoin could complete the 12 percent triangle breakout to $1,140 before entering another uptrend. However, the mobility of Ethereum whales is also on the rise, as we have reported as Cryptokoin.com.