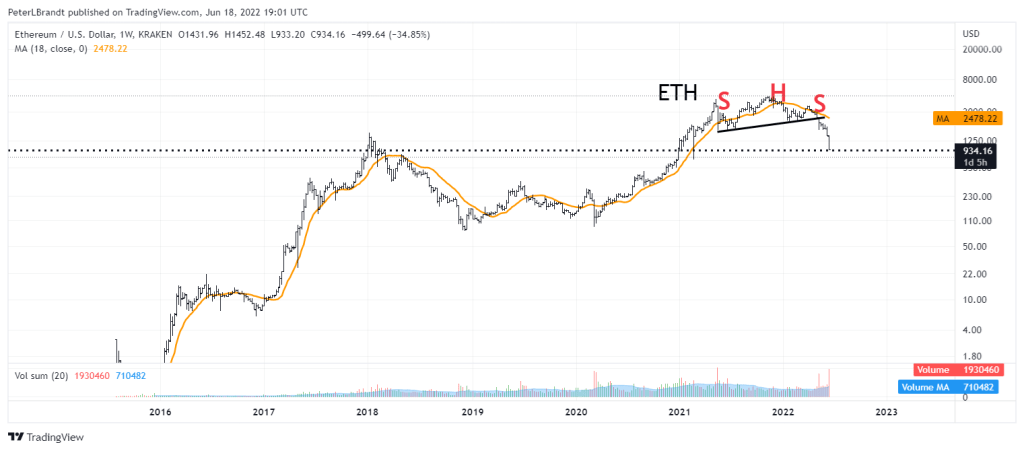

Crypto analyst Peter Brandt, known for his accurate predictions, predicts the risk of collapse for the leading altcoin. Correctly predicting that Ethereum price will continue to decline, the analyst marks a new low below $500.

Peter Brandt says “$300” for leading altcoin

In a recent tweet, Peter Brandt predicts that the price of Ethereum, the market’s largest altcoin project, could drop as low as $300.

To underline the extreme bearish trend, Brandt said that he would not buy the leading altcoin even with his enemy’s money. On Saturday, ETH hit $881 on Binance, its lowest level since December 2020. It is now trading above $1,000 on Binance after new traders coming in from the bottom. But overall sentiment continues to decline overwhelmingly.

Ethereum price plummets 80% from ATH price

The leading altcoin is now down nearly 80% from its record high of $4,878 reached in November. ETH price will need to drop another 69% from here to reach Brandt’s bearish price target. When it comes to Bitcoin, Brandt still claims that there is a 50% chance it will become “basically worthless”…

However, he does not rule out a scenario where the leading cryptocurrency eventually reaches $500,000. Brandt explained that in the long run, the price of Bitcoin continues to rise. However, he harshly criticized community members who chose to marry their investments instead of thinking rationally. “Crypto is a bad faith,” Brandt said in his recent tweets.

The seasoned analyst has been a long-time critic of excessive market enthusiasm, taking sides with laser-eyed Bitcoin advocates. The charter still sees Bitcoin as just a tool for speculation. Besides, he apparently rejects the idea that it has now become a legitimate investment. Earlier this month, Brandt correctly predicted that the Ethereum price would continue to decline.

What levels are altcoin investors looking at in Bitcoin?

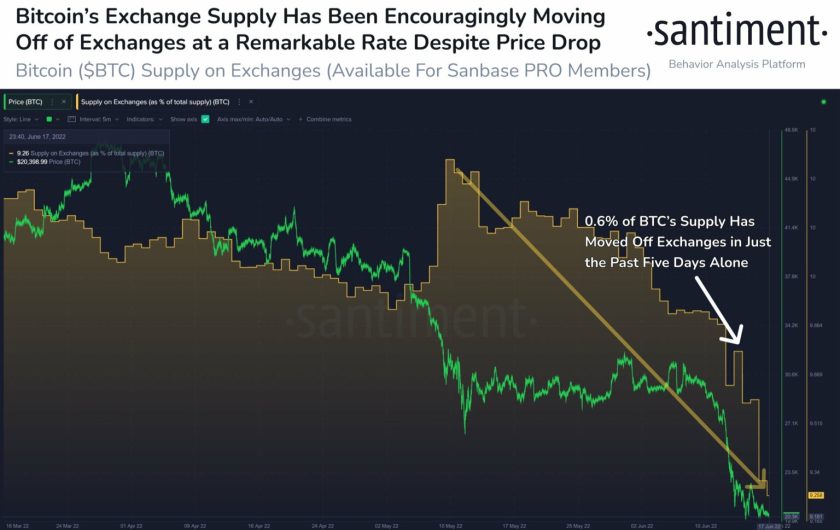

As we have also reported as Kriptokoin.com , Bitcoin fell below the ATH level in 2017 for the first time in its history after falling below $ 18,000. One of the main reasons for the recent rise is due to the multi-fold increase in the volume of the network. Volume projections, now up by a whopping 83%, point to potential rallies in the coming days.

However, according to Santiment, Bitcoin’s supply on exchanges has dropped drastically in recent days. As shown below, 0.6% have withdrawn from exchanges in the last five days alone. This means there is a growing consensus that the worst is over and there is a rally on the cards for Bitcoin.

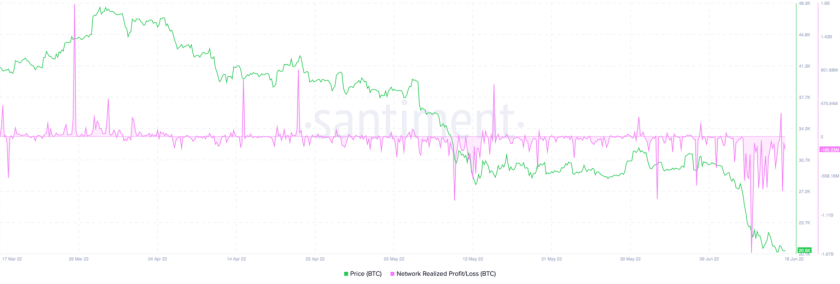

Even though exchanges are dumping BTC, here’s another metric that indicates more pain. According to Santiment’s analysis, Bitcoin has seen the biggest losses this week. The apparent loss was estimated using the network realized profit loss metric. It also shines a light on the pain of the investor during a week when it lost almost 33% of its value.