Bitcoin (BTC) has lost an important bear market trendline as it fell almost 12% last week. But other charts show hope for the bulls on the downside. Delphi Digital analysts identify the bottoms that Bitcoin will suffer before the top.

Analyst: Bitcoin bulls may be about to ‘do better’

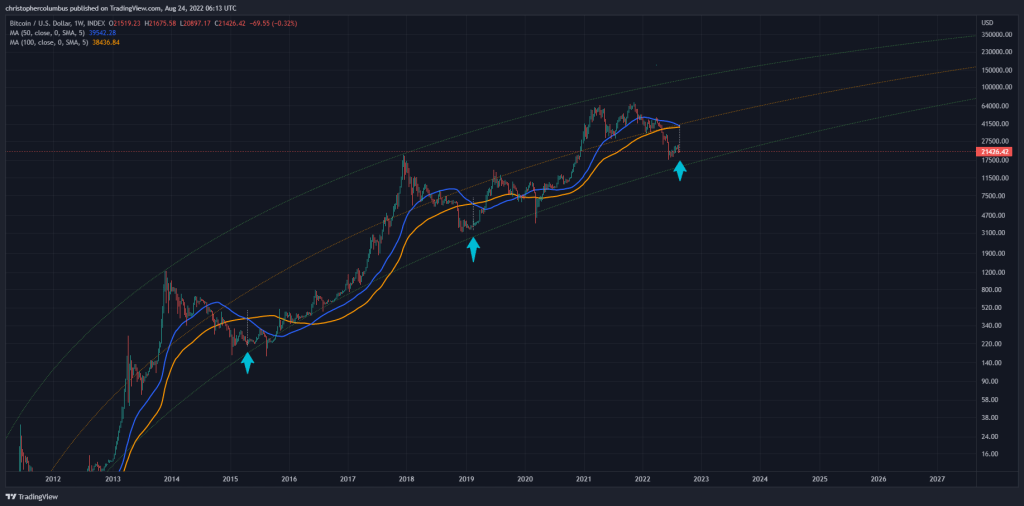

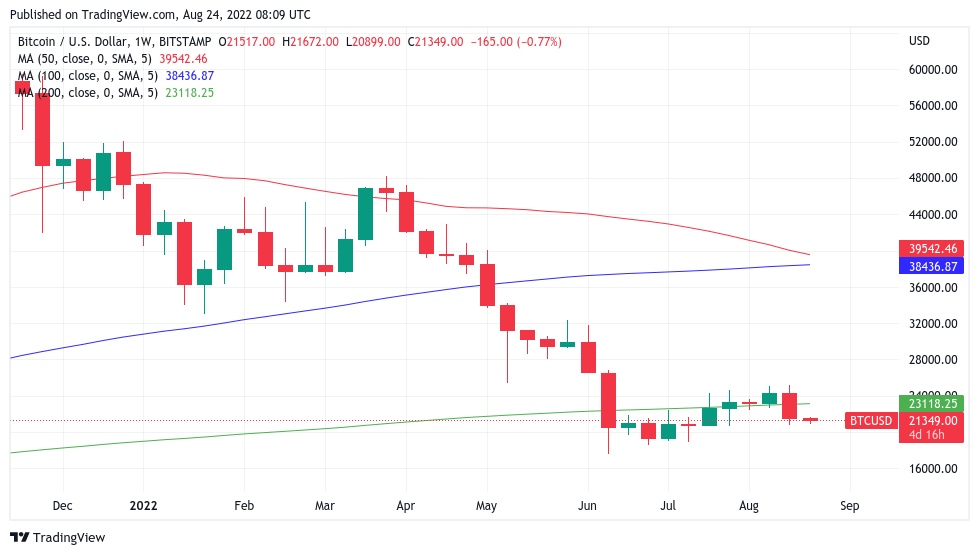

Bitcoin was frustrated over the weekend as it plunged to lows not seen since the end of July. Since then, $21,000 has offered only weak support. At the same time, fears abound that new lows are coming. The 200-week MA data from TradingView was one of the downsides of the downturn. The 200-week MA offers a verdict on the current lack of strength in Bitcoin. Analyst Venturefounder summarized the situation after the 200-week MA failed as support:

The amount of FOMO we’ve seen in CT over the past 2 weeks during the $25,000 rally is unprecedented. This trap almost has to play

However, observing the behavior of the 50-week and 100-week MAs suggests that all may not be lost.

The amount of FOMO we saw on CT in the past 2 weeks during the $25k rally is unprecedented. This bulltrap almost has to play out. https://t.co/NCYirCgL1B pic.twitter.com/hz0fYhu8XH

— venturef◎undΞr (@venturefounder) August 20, 2022

Historically bullish 50 and 100-week MA change

The Twitter analyst, nicknamed Dave the Wave, showed in his latest tweets that the 50-week MA is about to cross 100 weeks. Historically, this has been followed by continuous price increases. In some of his analysis, Dave writes:

Bitcoin (BTC) 1-year moving average is now past the 2-year moving average according to the correction phase after a speculative rise. Technically it looks good…. whatever the feeling. Those who bought these levels have done well before.

Dave also adds that five months ago, the same MA pair correctly assessed the incoming market downtrend, which saw Bitcoin hitting a macro bottom of $17,600 in June.

Bitcoin bulls need to break higher

According to experts, there are multiple moving average-based chart mechanisms that have signaled a bottom this summer. The classic Pi CycleTop indicator, which has captured macro bottoms throughout Bitcoin history, is already turning green in July. He was also weighing in on the idea that June’s $17,600 is truly a multi-year base. But in an update on Pi this week, commentator Miles Johal acknowledged that bulls need to break higher to keep the status quo positive. It was analyst Edward Moya who shared his predictions about when the crypto winter will end.

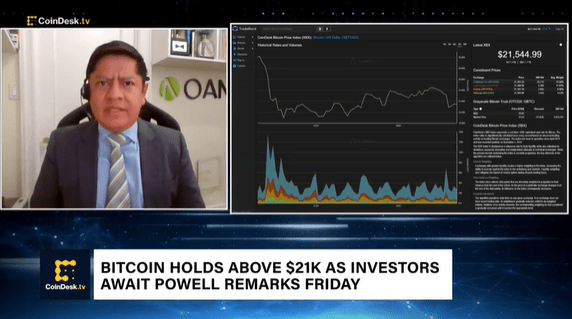

Crypto winter will end with the addition of new positions, according to Edward Moya

Edward Moya, senior market analyst at Oanda, says that crypto is “really getting the momentum going.” Edward Moya on Tuesday shared his predictions for how the crypto winter will end. Some crypto investors continue to buy more despite the recent bad market news. Edward Moya says this marks the end of the crypto winter:

I think you’re seeing hodl traders taking more space and starting to add to their positions. The crypto winter is likely to end.

Analysts at crypto research firm Delphi Digital wrote in a report Monday that if Bitcoin follows the pattern from previous historical price cycles, it could drop as low as $10,000 before eventually rising. Moya said the key point is whether Bitcoin will “continue to show” that it “will not reflect the stock market weakness over steroids when we have our risk-averse days.”

Moya adds that the crypto may not emerge from the “ripple” waters for the next few months:

But if risk appetite for Bitcoin continues to rise, we may see the momentum really materialize and push the crypto much higher.

Jackson Hole meeting, which is critical for Bitcoin and altcoins, will take place tomorrow

Moya’s comments came ahead of the economic symposium in Jackson Hole, Wyoming, where Fed Chairman Powell is expected to speak. “The majority of Wall Street, especially hedge funds, are expecting some pain in the stock market,” following Powell’s remarks that could provide a clue as to how high the next rate hike might be. This, too, could “aggravate crypto,” Moya said.