Bitcoin price touched $18,872.32 today with sellers coming in at $20,357.00. Meanwhile, Ethereum and XRP are at risk of double-digit declines. Analysts identify critical levels for the third quarter, which started with a decline.

Bitcoin bulls have to hold these levels to avoid being wiped out

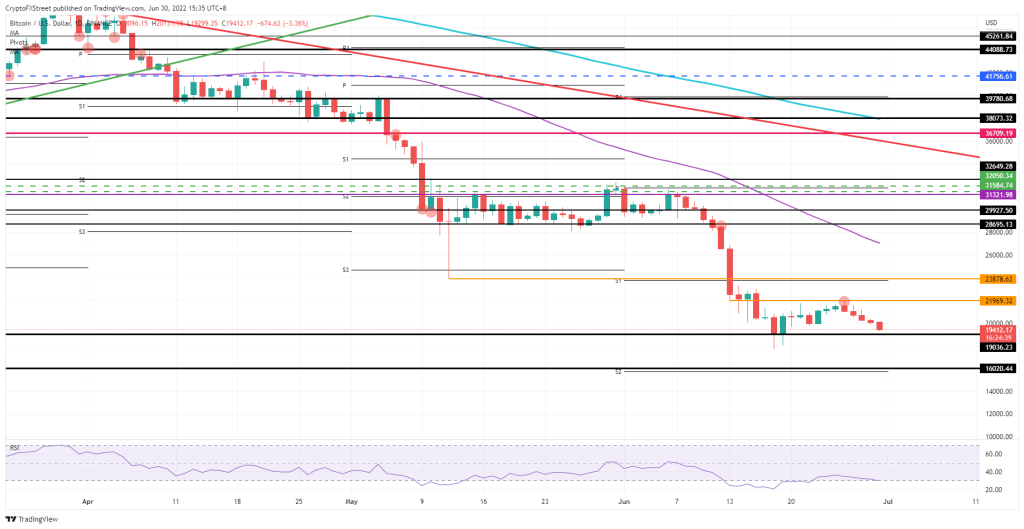

Bitcoin (BTC) price is approaching the end of the decline. Price action broke a historic level marked $19,036 today. Powell’s comments triggered another leg of strength in the dollar, which strengthened the bulls who tried to continue last week’s recovery but whose attempts were rejected as they bounced off the short-term level of $21,969. Now that this level is broken, analyst Filip says he expects Bitcoin to have a tough weekend technically.

On the other hand, if the price drops below this level, BTC could go into free fall. A lot of bulls will have taken positions at this level and have placed their stops just below $19,000. BTC price suggests a repeat of the pattern seen on June 18 and June 19, when the bulls’ stops were triggered, pushing them away from their positions and forcing them to retake action to support the price action to avoid falling further. Potentially, in addition to Bitcoin’s free fall, it could be possible to see another 16% loss and a $16,000 bottom.

At best, a simple technical bounce from $19,036 indicates a bull trap. Also, we could see the price bounce back to $21,969. A test above this will open room to try the short term key level of $23,878. We see that this is a somewhat unstable region. Therefore, it is possible to expect some profits here and a short decline to the downside in search of support.

What does on-chain data say for Bitcoin?

Additionally, IntoTheblock on-chain data provided by Ali Martinez points to 2 critical support levels. Initial key support for Bitcoin is $19,100, where 330,000 addresses previously bought 277,000 BTC. After that, the next important support remains near $16,000.

#Bitcoin | Transaction history shows that the most important support level sits at $19,100 where 330,000 addresses had previously purchased over 277,000 $BTC.

If #BTC can't hold above this demand zone, expect a downswing toward $16,000. pic.twitter.com/xvQ1hbxTLW

— Ali (@ali_charts) June 30, 2022

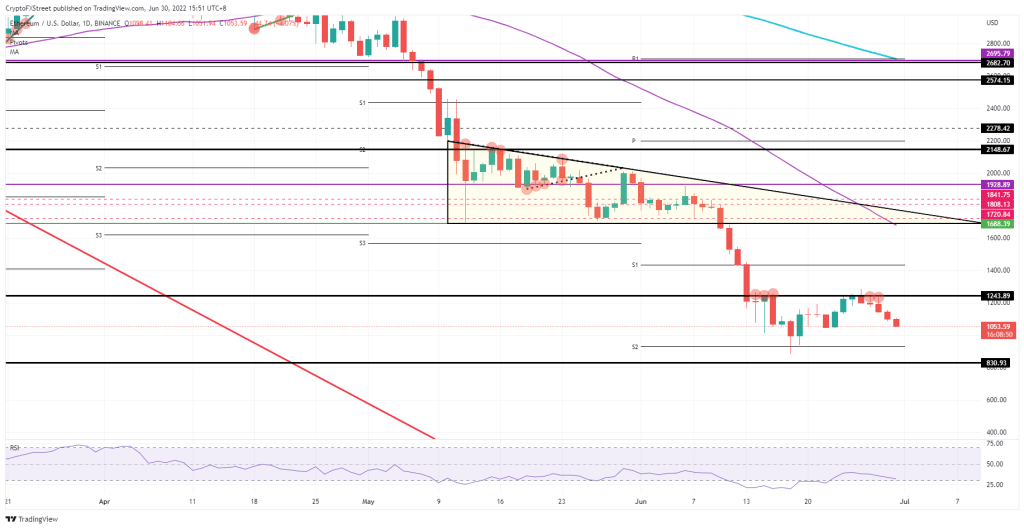

Ethereum price is quite vulnerable in this region

ETH price is trading on the monthly support of S2, which already provides support on June 18 and 19. Also, the Fed’s rate decision showed that ETH price action could exceed S2. It also means it could trigger a 20% drop by hitting $830 on the downside.

As a result, the analyst expects Ethereum to make a quick return to the triangle support base at $1,243, then $1,688. At this level, Ethereum will test the 55-day SMA.

Has Powell signed XRP’s death sentence?

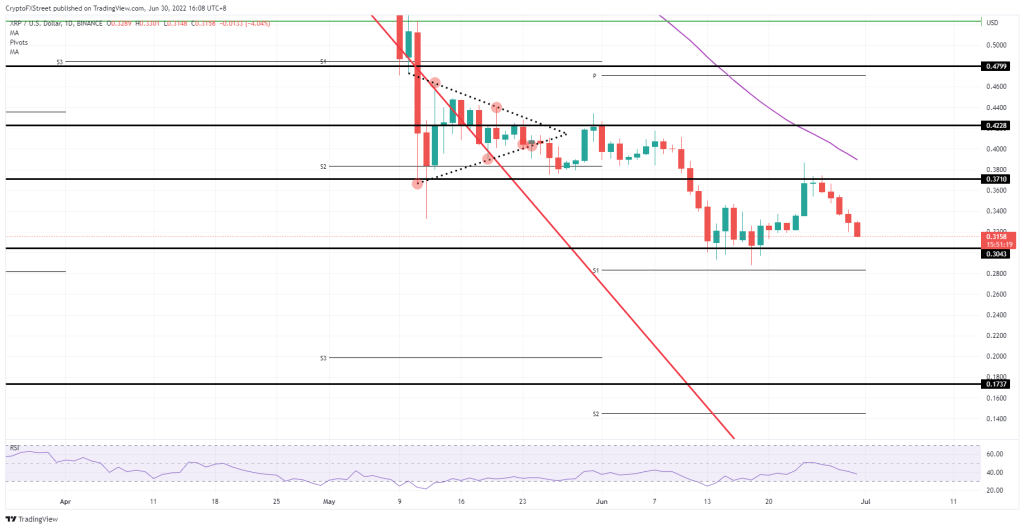

Ripple (XRP) reached a turning point level on June 18, which witnessed a trend change and is expected to trigger a bounce back to $0.3710 in the swing trade setup. However, cryptocoin.com The current mood and sensitivity in the global markets, which we have described as, shows the opposite. On the other hand, bearish pressure is increasing in significant numbers, posing a complete meltdown risk for XRP. Markets were hurt when Powell spoke of a controlled recession in Sintra on Wednesday. Which marks another cash drain just before summer, in case investors listen.

XRP price therefore does not have a good forecast for the summer. This is because price action is set to explode if it fails to hold $0.3043. According to the analyst, if the S1 support at around $0.2800 is broken, there is a risk that the XRP price will drop to $0.1737. Thus, it will open the doors of a big decrease of 40%.

The best-case scenario for XRP price is a return to $0.3710, which started with a bounce from $0.3043 triggering a reversal. If this happens, it will mean a 20% profit. Continuing the rally, $0.4228 is likely to be in place for a bull trend in the summer.