Gold prices rose on Tuesday as the dollar pulled back amid expectations for a less aggressive rate-raising strategy from the US Federal Reserve. Gold price renews a nine-month high, while it remains comfortably above the $1,917 support intersection. Analysts interpret the market and evaluate the technical outlook of gold.

“Policy signals from FOMC will be decisive for gold”

Spot gold was up 0.3% at $1,936.32 at the time of writing. U.S. Gold Futures were up 0.5% to $1,937.70. The dollar index fell 0.2%, making bullion cheaper for many buyers. Gold has gained nearly $120 since the start of 2023, supported by expectations that the Fed, which cut its pace by 50 bps in December 2022, could increase it by just 25 bps at its first two meetings this year. Exinity chief market analyst Han Tan comments:

Policy signals from the upcoming FOMC meeting could either confirm gold’s recent gains or greatly disappoint bullion bulls. However, if the Fed signals that markets will persist with more rate hikes than they currently anticipate, that could loosen some of the precious metal’s progress since the start of the year and bring it back closer to the psychological $1,900 mark.

“This situation may support the gold price”

Some analysts also point out that an expected recession could force the Fed to loosen monetary policy tightening. US fourth-quarter GDP growth forecasts to be released on Thursday may determine the decision at the January 31-February 1 Fed meeting. Matt Simpson, senior market analyst at City Index, comments:

Any sign of a weaker US economy will be taken as a reason for the Fed to tighten less aggressively. Also, this can support gold, which will include safe-haven streams.

“Gold prices must break this barrier for a new uptrend”

cryptocoin.com As you can follow, gold price consolidates its recent rise near nine-month highs. Gold is targeting $1,942 and global PMIs for further upside, according to market analyst Dhwani Mehta. The analyst makes the following statement:

The focus is now shifting again from the Eurozone and the US to the preliminary S&P Global Manufacturing and Services Procurement Manager Index. If PMI reports across the eurozone and from the US hint that a global recession is likely to rise, investors could rush to the safe-haven dollar, triggering a sharp reversal from higher levels in gold.

Gold bulls continue to gain acceptance above the upper boundary of an ascending wedge formation currently aligned at $1,942. The analyst says that a fresh rise towards the $1,950 psychological level cannot be ruled out in a daily candle closing above the latter. In this direction, the analyst draws attention to the following levels:

The bottom of the wedge, currently at $1,923, holds the key for gold optimists. A sustained downside break could trigger a fresh decline towards the January 18 low of $1,897. However, the previous day’s low of $1,911 and the rounded figure of $1,900 could provide some relief to gold buyers for a short while.

Gold bulls hold the reins above $1,917

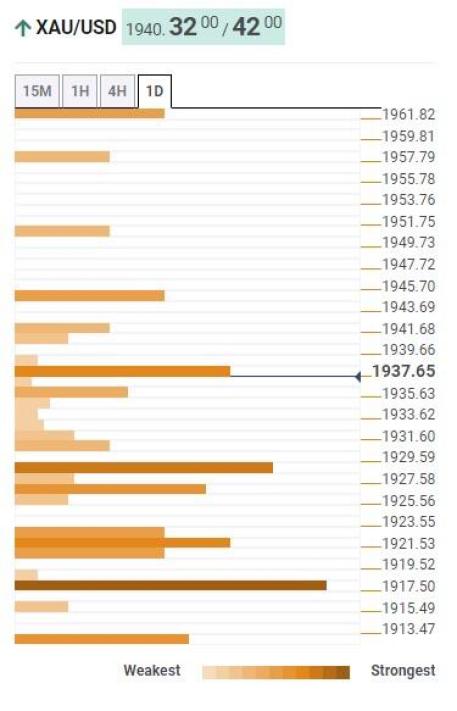

Gold rose to $1,940 in the first hour of Tuesday’s European session, renewing a nine-month high. In doing so, the bright metal supports general weakness in the US dollar ahead of monthly activity data and hopes for more demand from China. According to market analyst Anil Panchal, the cautious mood ahead of key preliminary activity data from the US, Eurozone and the UK seems to have made a bottom for the price of gold at around $1,917. The analyst points to the following technical levels via Confluence Detector:

It should be noted that the downside break of the $1,917 support opened the door for gold to move south towards the $1,900 threshold. Alternatively, Pivot Point R1 one-week close to $1,945 looks like the imminent hurdle that gold bulls could target. Following this, there is a clear path for buyers to move forward before the April 2022 peak surrounding $1,966.

Confluence Detector

Confluence DetectorAre gold prices targeting $2,000?

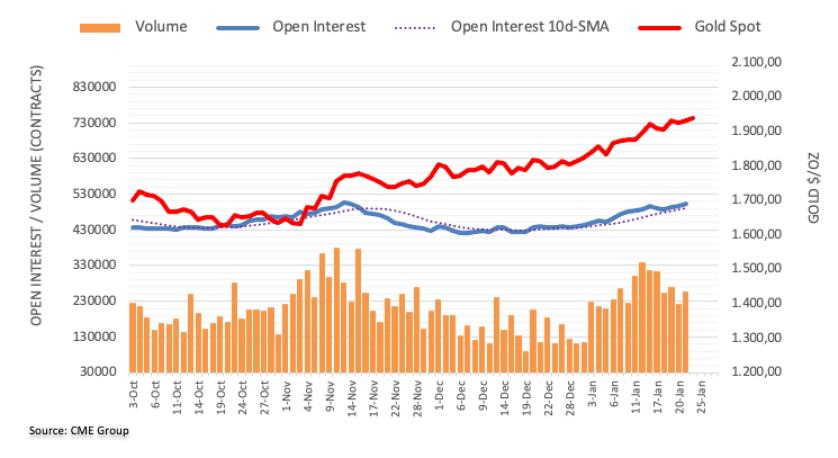

Open interest rose by nearly 6.2k contracts for the third consecutive session on Monday, this time, given CME Group’s advanced data for gold futures markets. Volume followed suit, increasing by around 34.2K contracts, keeping erratic activity in place for another session.

Market analyst Pablo Piovano states that gold started the week on a positive note with rising open interest and volume. On the other hand, the possibility of further gains is in place and the next target level is at the key limit of $2,000.