A trader who bought the November low of Bitcoin at $16,000, then sold at the local top of $25,000 and then bought again at $23,000, has once again updated his Bitcoin and overall market outlook.

DonAlt says a pivotal moment has emerged for Bitcoin and the altcoin market

cryptocoin.com As we have mentioned, DonAlt became an analyst who came to the fore with his accurate predictions. He bought BTC at $16,000 in November when FTX went bankrupt and made his first profitable purchase at $25,000. The analyst, who is currently taking a position at $ 23,000, says that a very important moment for the markets has emerged as BTC’s monthly close is approaching.

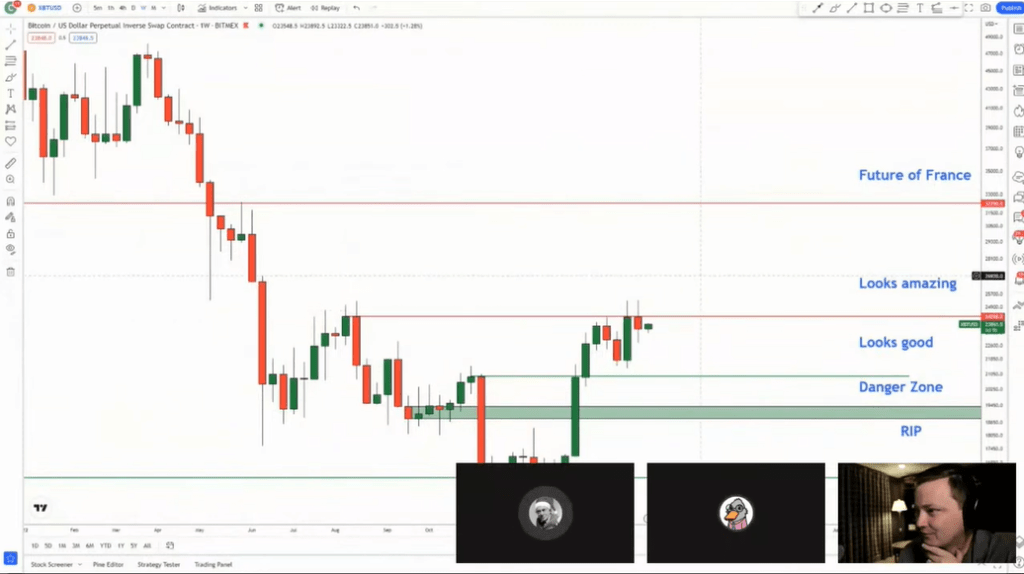

The crypto analyst said in his recent Youtube video that BTC is on the verge of closing above the $23,291 monthly resistance, which shows that BTC’s 2023 rally is not over yet.

DonAlt expects volatile price movements to continue above the monthly resistance at $23,291.

If we close above the monthly resistance, I will expect some decline next month. But overall, I expect BTC to rise again. So I will be quite satisfied with my position.

Watch out for bull traps

DonAlt says he re-entered the market due to an intense FOME sentiment and his bullish outlook for BTC remains intact despite BTC approaching $23,000. The crypto analyst says investors should be extremely cautious if Bitcoin breaks below $23,000 once again and approaches the key support area around $22,500:

I think we’ve pulled back a bit towards the best support in that area at around $23,000. If it starts to break out, I think it makes sense to be cautious because then we are entering an area where we are no longer making higher lows and returning to the old ranges below $22,500.

DonAlt wasn’t the only one, says hard moves for Bitcoin imminent on Alex Krüger

Another widely followed crypto analyst, Alex Krüger, says he expects the crypto market to enter its bullish phase. Krüger says he doesn’t think the S&P 500 will drop to $3,000, except for the black swan thing.

Instead, he says, stocks will likely trade within a range, giving Bitcoin (BTC) and crypto a chance to break the correlation from traditional markets and move upwards.

Krüger also warns that if inflation doesn’t fall further, the Fed could raise interest rates higher than expected, which could bring crypto to new lows. While the analyst generally thinks that an upward volatile movement may take shape, he recommends not to ignore the declines that may be caused by macro events.