Two experts from Bloomberg and K33 Research are warning of a major correction for Bitcoin price. The sell-off will be effective across the market and may show a decline in Ethereum.

Veteran Bloomberg analyst issues warning for Bitcoin price

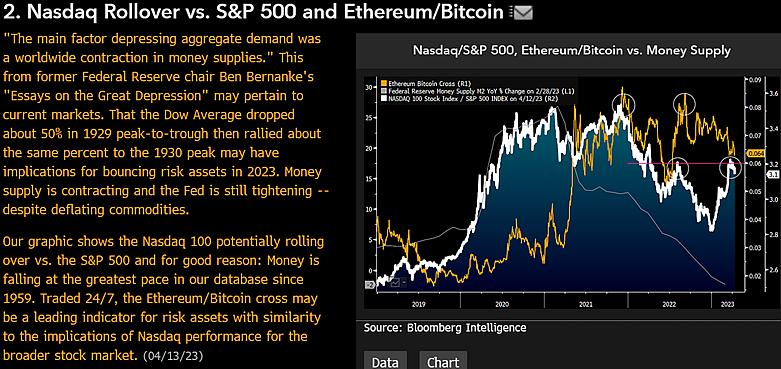

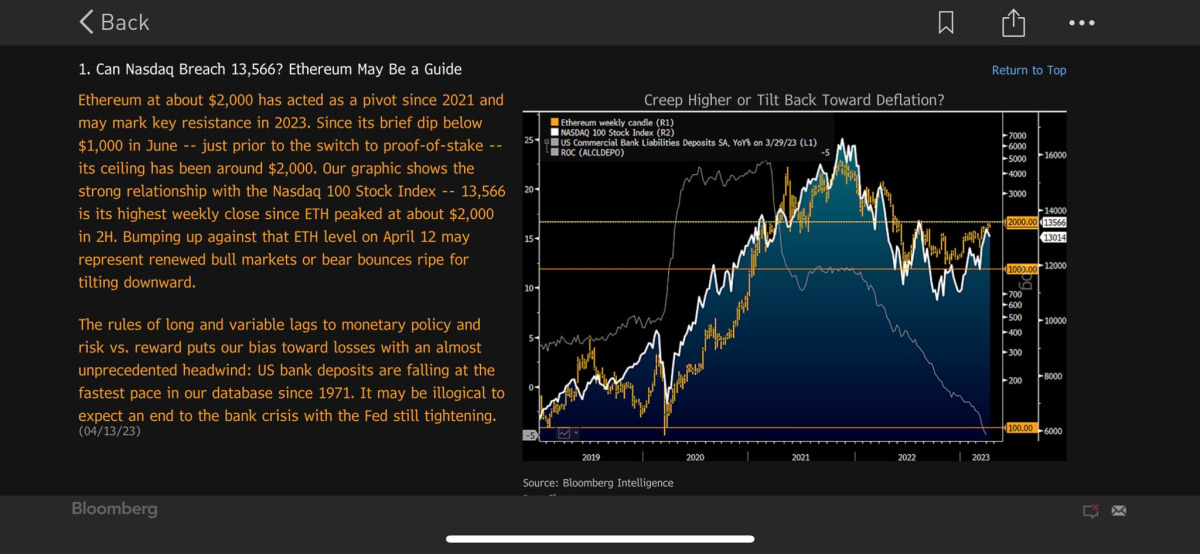

Bloomberg Intelligence senior macro strategist Mike McGlone warns Bitcoin (BTC) and Ethereum (ETH) bulls that crypto and risk assets could be in for a correction. McGlone shares a chart on his Twitter after comparing the money supply of ETH/BTC, NASDAQ and the Fed.

According to the analyst, the ETH/BTC pair may be acting as a leading indicator for risk assets, signaling an incoming correction in the stock market and perhaps crypto.

McGlone says markets may adjust to an emerging period of disinflation brought about by the Fed’s drastic reversal in monetary policy:

Don’t blame the $2,000 Ethereum, $30,000 Bitcoin. If risky assets peak, markets may be in the early days of adjusting to the disinflation that is normal in recessions, but the Fed may never relax as much as it has in the past.

Bitcoin price moves parallel to 2019 period

Vetle Lunde, a crypto market analyst at K33 Research, sees parallels between Bitcoin (BTC)’s tumultuous recent rise in 2022 and its price pattern from 2018 to 2019. In a new interview, Lunde said that “the current bearish and recovery phase is quite similar to 2019 in terms of both duration and price action.”

In a research note to clients last week, Lunde wrote that Bitcoin could reach $45,000. BTC was currently trading at around $29,440, down 2%, but up around 80% in 2023. This recovery follows a year of woe, with many large firms declaring bankruptcy, prompting risk-averse investors to flee the crypto market.

“In the second half of 2022, we saw a large number of forced sales, as well as sales from cautious investors. This resulted in insufficient opening of positions. It also convinced many people to get nervous, to sell crypto. “This creates this dynamic where Bitcoin feeds from short squeeze and goes higher.”

“Bitcoin is preparing for a big drop”

In another collapse scenario, technical analyst Akash Girimath talked about the bears pulling the BTC price down by 30%. Prior to this, Bitcoin price is trending bearish on the four-hour chart. As explained earlier, this setup includes two higher levels that create an illusion of bullishness and invite more bulls to join.

However, as the price drops and forms a lower low (LL) level, early investors are now trapped and looking for an exit. Bitcoin price is facing tremendous selling pressure as it pulls back and retests the last bearish candle between high highs (HH). This retest can be a good entry point for the bears.

‘Down breaker’ for Bitcoin price stretches from $30,539 to $30,244

A retest of the lower limit of $30,244 could be a good place to short BTC. However, traders can choose to short the $30,000 psychological level earlier. While things look bleak for bitcoin price, a quick move above the $30,000 psychological level will be the first sign of a bearish reversal.

If this move continues to push BTC higher and produces a daily candlestick above $30,540, it will invalidate the bearish thesis. Confirmation of the bullish outlook will come when Bitcoin price reaches a higher high and identifies the next critical resistance at $32,661.

Pay attention to these dates

In another development that may cause downward pressure, the large amount of BTC obtained by the US government in the Silk Road case will go on sale this year. cryptocoin.comWe have included the dates that investors should pay attention to in this article.