As the Bitcoin price approaches the $19,000 limit again, risky movements in the altcoin market are becoming evident. Most altcoins have so far found new buyers to be sold on. However, 2 popular altcoins from the Binance listing are on the verge of their drastic moves, according to analysts.

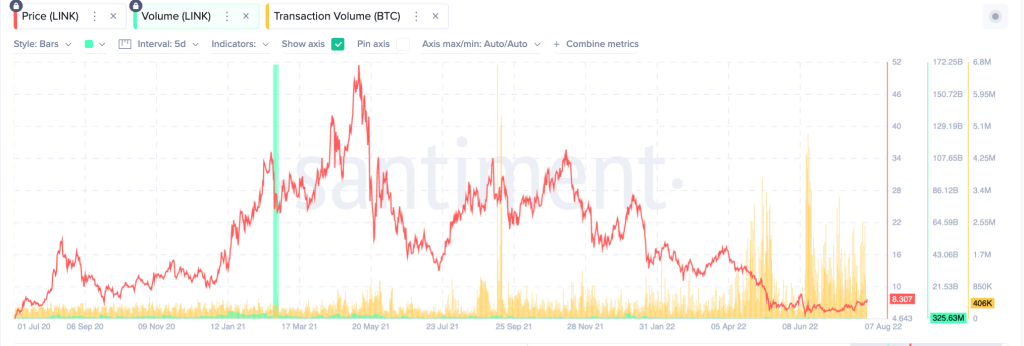

On-chain metrics showing chainlink price going down

Chainlink price is showing bearish signals that traders should be aware of. Since August 15, the price of the Ethereum-based oracle token has dropped 36%. In the last trading week of August, the bulls managed to recoup 6% of these losses. LINK is currently trading around $6.50. Santiment’s trading volume is showing a significant increase as the price moves through a critical support band. Historically, since its inception, large transaction spikes have resulted in disastrous sales.

Additionally, overall trading volume was relatively sparse across all exchanges. In theory, only individuals currently buy LINK, as volume data has no effect on institutional money. According to on-chain analysis, Chainlink price looks extremely risky. Investors may want to consider a reactionary reaction to the next big move rather than buying early. The invalidation of the bearish thesis will be confirmed once we exceed $10. Analyst Tony Montpeirous predicts that in this case, LINK price could make sharp moves up to $18 in the medium term.

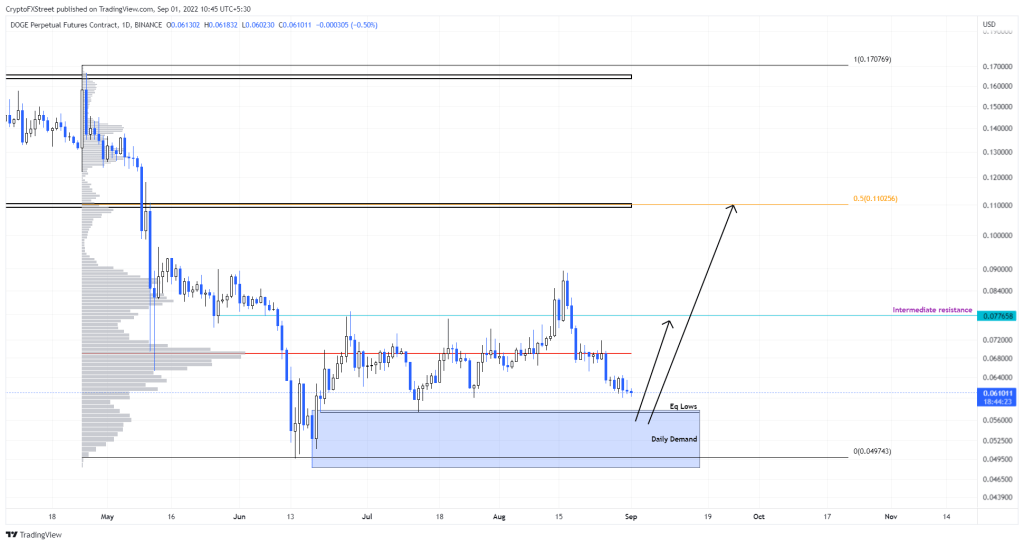

Dogecoin price drops as altcoin market seeks momentum

Dogecoin price broke below a key support level at the control volume point (POC) at $0.066. It has deepened roughly 12% to $0.060, where it is currently trading. This downtrend will likely continue until DOGE encounters the $0.048 to $0.057 demand zone. Interestingly, an even bottom formed at $0.057 coincides with this demand zone. This makes the region a strong support combination. Analyst Akash Girimath says the Dogecoin price could gain momentum in both directions in this environment.

However, if buyers step in at this point, we can expect a rally to $0.066 triggering a 20% rise. Turning this level is a tough job. but if it succeeds, we could see the upswing to $0.077, which is a 35% gain. However, from the perspective of the average reversal, there are chances of Dogecoin price retesting $0.110. Altogether, the move from $0.057 to $0.110 would represent a 95% rise. It will also likely limit upwards for DOGE.

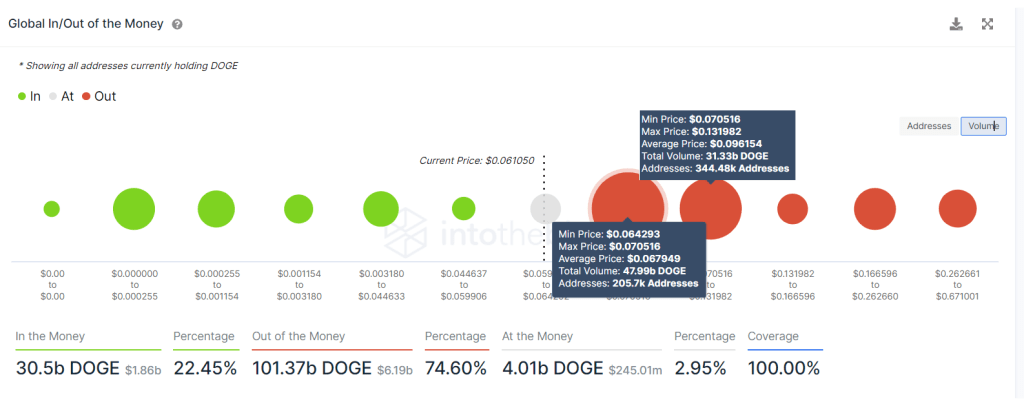

While the techs are potentially bullish, on-chain metrics disagree with this outlook. IntoTheBlock’s GIOM model shows that there are two large clusters of loss-making investors ranging from $0.064-$0.013.

Here, about 550,000 addresses are free of charge, purchasing about 80 billion DOGE. Therefore, if Dogecoin hits the breakeven price, these holders are likely to sell their shares and add further impetus to the downtrend. From a more conservative perspective, the Dogecoin price rise has been capped at $0.067, the average price at which the investor cluster bought about 48 billion DOGE on the first loss.

As a result, a daily candle close to below $0.048 will invalidate the bullish thesis for DOGE, according to analyst Girimath. In such a case, Dogecoin will likely crash lower in search of a stable support level at $0.040.