Analysts are hopeful of the popular meme coin project Dogecoin (DOGE). According to analysts, despite the current crypto bear market, DOGE is poised to expand its recovery. We have prepared the analysts’ DOGE whitepaper and comments for our readers.

DOGE has a good chance of extending its recovery move!

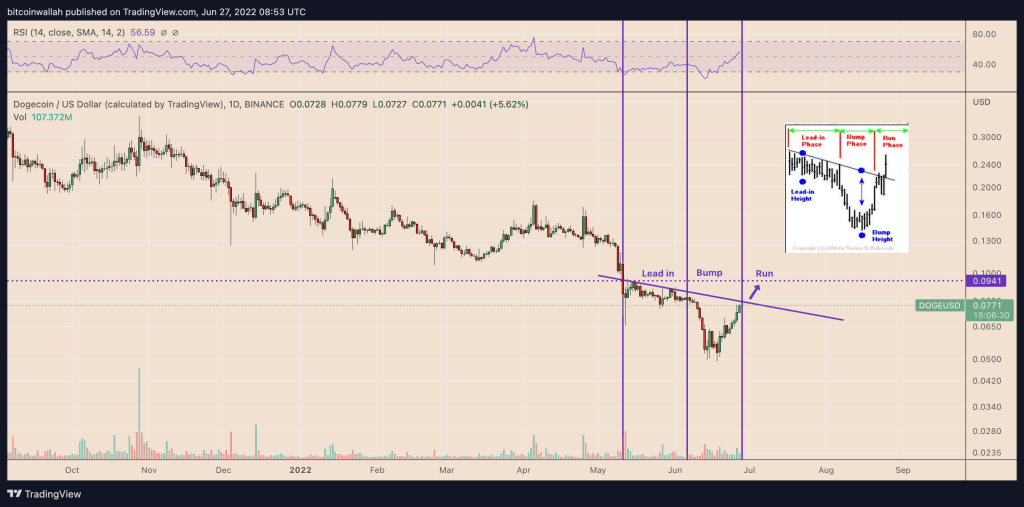

A technical pattern, a ‘bump-and-run-reversal (BARR) bottom’, indicates long-term trend reversals in a bear market. The price of DOGE has been moving according to this mpdele since May 11th. This model consists of three successful phases: Lead-In, Bump, and Run. Namely, Entry, Multiplication, and Running.

The ‘entry phase’ indicates that the price is consolidating in a narrow, horizontal range. It also indicates a temporary conflict of bias among investors. This follows the ‘Collision’ phase where the price drops sharply and recovers, leading to a price breakout described as a ‘Run’.

DOGE daily price chart with ‘BARR bottom’ pattern / Source: TradingView

DOGE daily price chart with ‘BARR bottom’ pattern / Source: TradingViewDogecoin is observing a breakout above the falling trendline resistance of the BARR bottom. That’s why it appears to be in the Multiplication phase. Suppose DOGE exceeds that price ceiling. Then, as a rule of thumb of technical analysis, it will initiate a rise of BARR towards the initial level.

This attack pushes the price of DOGE to $0.0941, an increase of over 20% from today’s price. Specifically, the upside target coincides with the token’s 50-week exponential moving average (50-week EMA; blue line in the chart below).

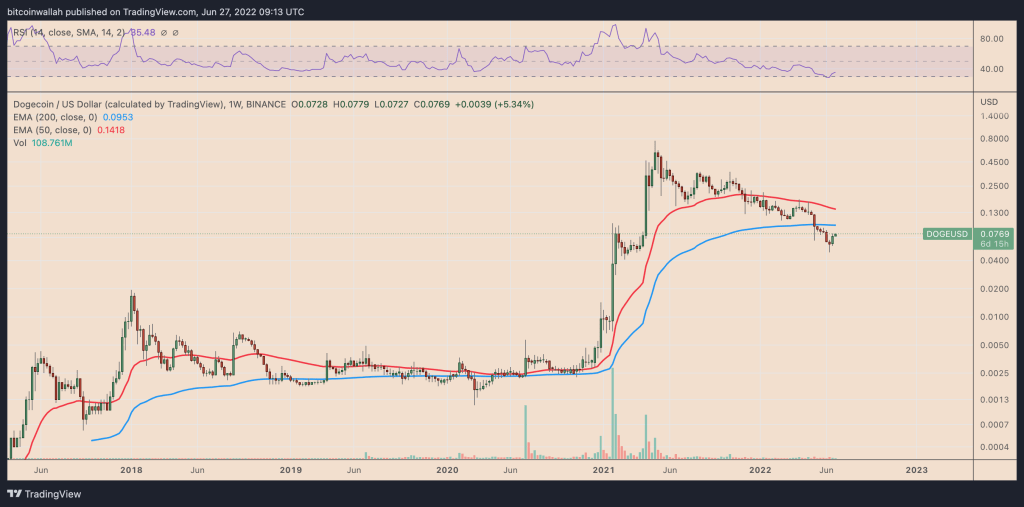

DOGE weekly price chart with 50-week EMA / Source: TradingView

DOGE weekly price chart with 50-week EMA / Source: TradingViewAccording to a report by senior investor Thomas Bulkowski, BARR hit its bottom profit target 79% of the time. Interestingly, the breakout phase of the pattern typically yields an average increase of 55%. This means that DOGE’s potential to reach $0.123 remains in the cards.

Will the meme coin price bottom out?

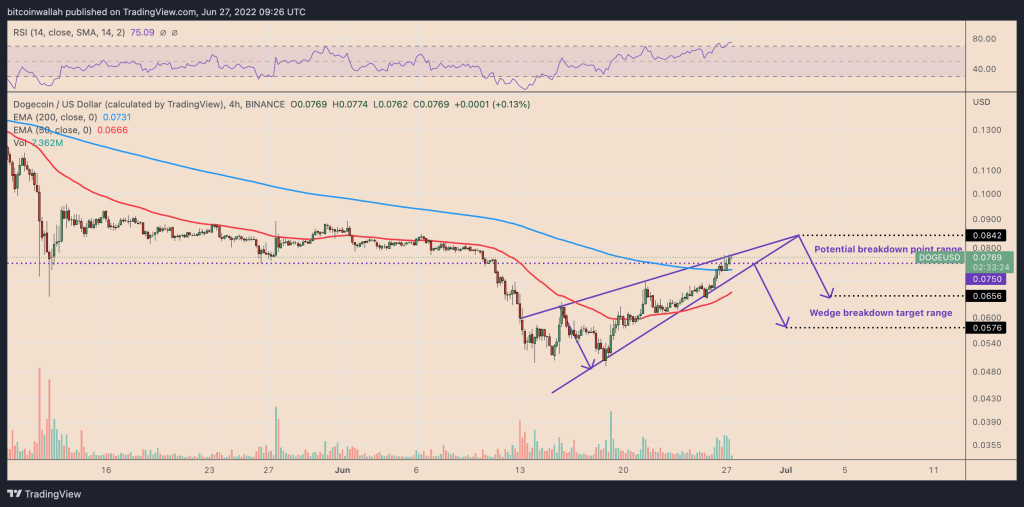

Dogecoin’s rally to $0.0941 may not be able to break out of the downtrend due to a combination of technical and fundamental factors. From a technical standpoint, DOGE’s price risks are bullish. It turns into a ‘bull trap’ for this. It has already rallied almost 60% in the last nine days. Notably, the altcoin’s bearish bias is manifested due to an ‘rising wedge’ pattern on the lower timeframe charts.

In detail, DOGE is in an uptrend within a range defined by two ascending, contracting trendlines. Thus, it creates a rising wedge. As a rule, this technical setup leads to a downside reversal, which is confirmed when the price drops below the trendline of the wedge. As it happens, it is possible for the price to fall by as much as the maximum distance between the upper and lower trendline of the wedge.

DOGE four-hour price chart with ‘rising wedge’ setup / Source: TradingView

DOGE four-hour price chart with ‘rising wedge’ setup / Source: TradingViewThe potential breakout points of DOGE’s ascending wedge are located in the $0.07-0.08 range. So it’s possible that a wedge break will occur as intended. In this case, the token is likely to drop to the $0.05-0.06 area, down 15-25% from current price levels.

Moreover cryptocoin.com As you can follow, the Fed’s interest rate hikes and shrinking its balance sheet of 9 trillion dollars are on the table. Fundamentals including these support the technical bearish outlook for the meme coin in the short to medium term.