Azcoinnews’ technical analysts are sending warning messages to AVAX and ARB investors. Prices falling below critical supports are preparing altcoin investors for a difficult September.

AVAX price lost long-term support line

cryptokoin.com As we reported, the altcoin market started the week of September 11 under dire conditions, with Bitcoin (BTC) falling to $25,000. Meanwhile, AVAX price has turned its previous long-term support into resistance.

The price of Avalanche (AVAX) fell below long-term support at $10.7 during the week of August 21-28. The following week confirmed this as resistance (red arrows). This setup is an extremely bearish signal as it invalidates a potential double bottom pattern. The weekly RSI also broke below a key bullish divergence line. It is currently showing a bearish trend, supporting the continuation of the downtrend.

Therefore, AVAX price is likely to continue its decline towards the next important support level at $4.7, which is 50% lower than the current price, according to analyst Davis.

AVAX short term price analysis

The daily chart also presents a rather pessimistic outlook for AVAX. This is because AVAX price broke below the minor support at $9.7. It is also invalidating the bullish trend on the daily RSI. This event triggered stop-loss orders. Analysts predict a long squeeze will occur as a result.

In summary, the most likely scenario shows that the AVAX price will continue to decline in the near future, and the potential target of this movement will be the $4.7 level.

Arbitrum (ARB) price decline once again showed bears’ superiority

Like AVAX, ARB price has also been moving downwards lately. The closely followed altcoin has experienced a significant decline of more than 20% in the last three days. Whale sales that occurred in the meantime also attract the attention of market players.

The eye-catching address 0xe97, owned by a crypto whale, made headlines on September 11 by selling 3.8 million ARBs worth approximately $3.26 million via Binance. This sale resulted in a significant loss of approximately $1.3 million.

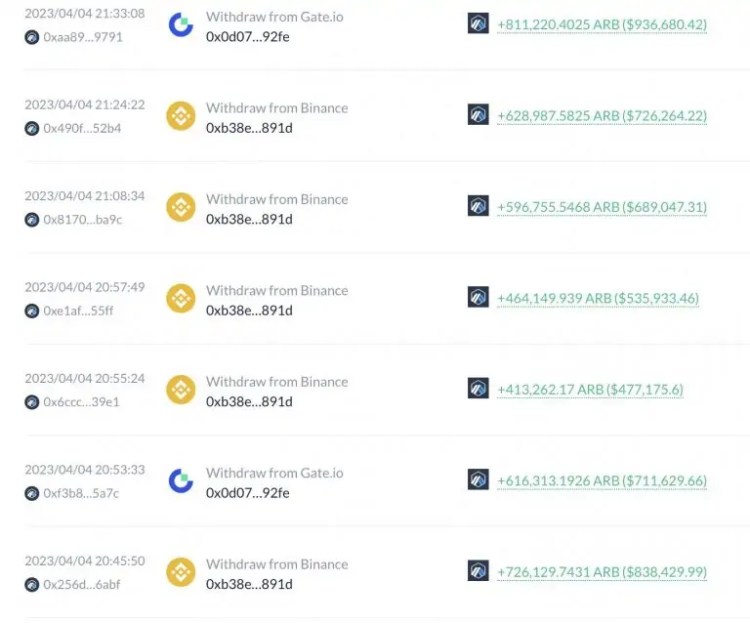

Adding to the intrigue, the same whale had previously withdrawn approximately 17.62 million ARB worth $21 million from both Binance and Gate.io in April. They sold these tokens at an average price of $1.19. As of now, this whale still has 13.78 million ARBs in his investment portfolio, worth $10.78 million.

Whales prefer to close ARB positions at a loss

Another interesting case involves the address 0xDce, also known as vladilena2.eth. This address exchanged 2,000 ETH (3.27 million) for 3.64 million ARB at an average price of $0.9. These transactions took place through DEXs such as ParaSwap and 1inch from September 3 to September 8. On September 11, the whale transferred the entire 3.64 million ARB (approximately $2.87 million USD) to Binance. Judging by the price of the ARB token at the time of transfer, this whale appears to have suffered an estimated loss of approximately $300,000.

Interestingly, this address does not have a very positive experience with ARB. In a previous transaction in August, they used 800 ETH ($1.47 million) for 1.27 million ARB. But they later sold it for a loss of about $36,000 after holding it for only three days.

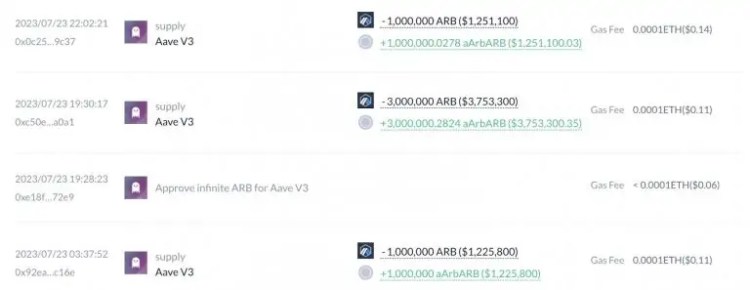

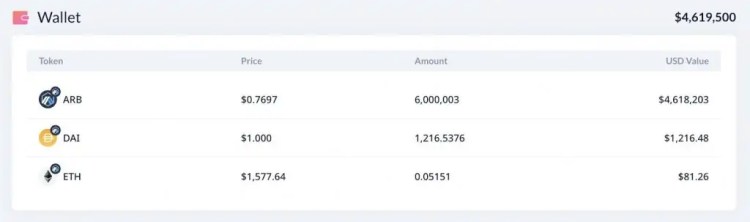

Address 0x695 made significant moves in July 2023 by withdrawing its ARB tokens from Binance and depositing approximately 7 million ARB into Aave to borrow USDC. Due to ARB price fluctuations, this whale withdrew 5 million ARB tokens ($3.85 million) from Aave to pay off his debt. He sold 4.5 million of these tokens (worth $3.47 million) on Binance.

Currently this whale holds a total of 6 million ARB worth $4.62 million. As for Aave loans, they are still collateralizing 2 million ARB tokens to borrow 263,667 USDC.

Famous companies follow the trend

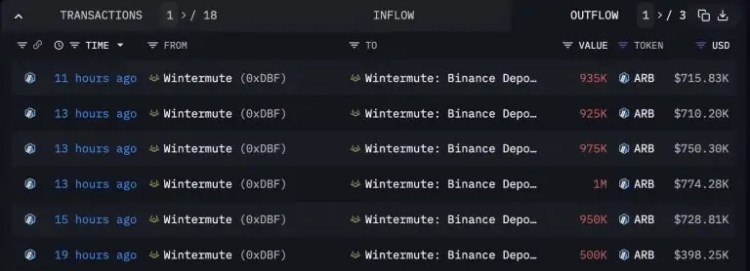

Unlike the addresses mentioned above, Wintermute also transferred 5.29 million ARB ($4.08 million) to Binance.

In addition, seven other whale addresses sold ARBs on the morning of September 12. According to Lookonchain, a total of 20.41 million ARBs were released, with a total value of $16.05 million. In general, most of these whales were sold at a loss. In summary, there was a total loss of approximately $8.15 million.

As a result, ARB has been in a sharp downward trend lately. It once again reveals the inherent risks in the altcoin market.