Bitcoin price faced its 190th worst day in terms of performance on August 17. Meanwhile, it experienced a serious decrease of 7.23%. The recent correction from $29,000 to $26,000 also leaves investors in uncertainty. Experts say further declines are possible.

Bitcoin is now more stable than before

Amidst the BTC price drop, an intriguing trend emerged. Bitcoin’s price volatility is now significantly reduced. This unexpected stability attracts the attention of both experts and investors. While the price drop seems alarming, a broader analysis of Bitcoin’s entire price history paints a picture of a slowly maturing market.

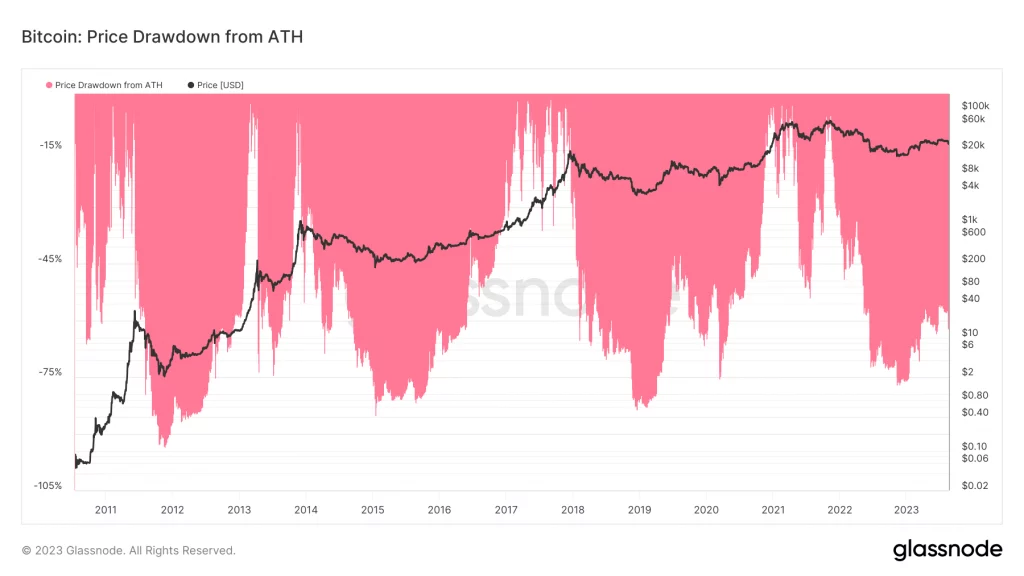

It should be noted that the last correction occurred against the background of a 62% drop from Bitcoin’s ATH level. This is a reminder of the inherent volatility of the leading crypto.

The sense of stability, although in its early stages, has important implications for the cryptocurrency market as a whole. A more stable Bitcoin leads to more predictable trading conditions. This, in turn, can affect the strategies of institutional investors. However, as Glassnode states in its current report, it is critical what kind of decision individual investors who are waiting to lose will make.

88% of Bitcoin investors are expecting a loss

In a recent report, Glassnode reported that 2.26 million BTC is currently inflicting losses on its investors. Analysts attribute these losses, coupled with the recent decline, to the ‘de-leverage’ catalyst:

Bitcoin bulls were caught off guard and the BTC price fell below $25,000 with the biggest sell-off in 2023. Leverage in the futures markets is a possible catalyst for the decline. But a bigger concern might be the 88.3% of the Short Term Holder supply currently held at an unrealized loss.

#Bitcoin bulls were caught off guard with the largest sell-off in 2023 sending $BTC below $25k

A deleveraging in futures markets is the likely catalyst, however a bigger concern may be the 88.3% of Short-Term Holder supply now held in an unrealized loss.https://t.co/Nhr6WkW0CY pic.twitter.com/YqOp4o9nRE

— glassnode (@glassnode) August 21, 2023

Experts say lower levels are possible

Bitcoin is currently struggling to hold onto the $26,000 region. Intraday decreased slightly and regressed below the region. Analysts told Barron’s that lower levels are still possible. This is because Bitcoin price is still spending time below the 200-day MA line. If this situation continues, investors should be more prepared for a decline, according to analysts.

$25,000 expected in the short term

Katie Stoctkon, senior director of Fairlead Strategies, says the leading crypto is still vulnerable to a potential drop. If Bitcoin breaks $26,000, the next closest support is at $25,000, according to Stoctkon. cryptocoin.comAs we covered in their analysis, most analysts expect the next levels to be in the $22,000 region.