Traders and investors are grappling with uncertainty after Bitcoin slumped to $25,000. The prevailing sentiment, exacerbated by the prediction of a potential drop to $20,000 before a major uptrend reversal in BTC price, is a cautious one. All in all, Bitcoin continues to hover around $26,000 and attempts to reach $27,000 are challenging. In the ever-evolving world of cryptocurrencies, analysts closely monitor Bitcoin (BTC) price movements and market sentiment, providing valuable information for both traders and investors. Here are the details…

Analyst Bluntz forecasts market bottom

cryptocoin.com As we reported, the pseudonymous analyst Bluntz, who is known for accurately predicting that Bitcoin will bottom in the bear market in 2018, now shares his views on the current state of the crypto market. Bluntz takes a close look at the total market value (TOTAL) of cryptocurrencies. According to his analysis, Bluntz sees a potential drop of 15 percent on the TOTAL chart before a significant jump in crypto assets. His interest in the TOTAL chart, which Bluntz believes offers a clearer picture than analyzing individual assets like ETH or BTC, suggests that June lows may need to be reconsidered before they can be called a bottom.

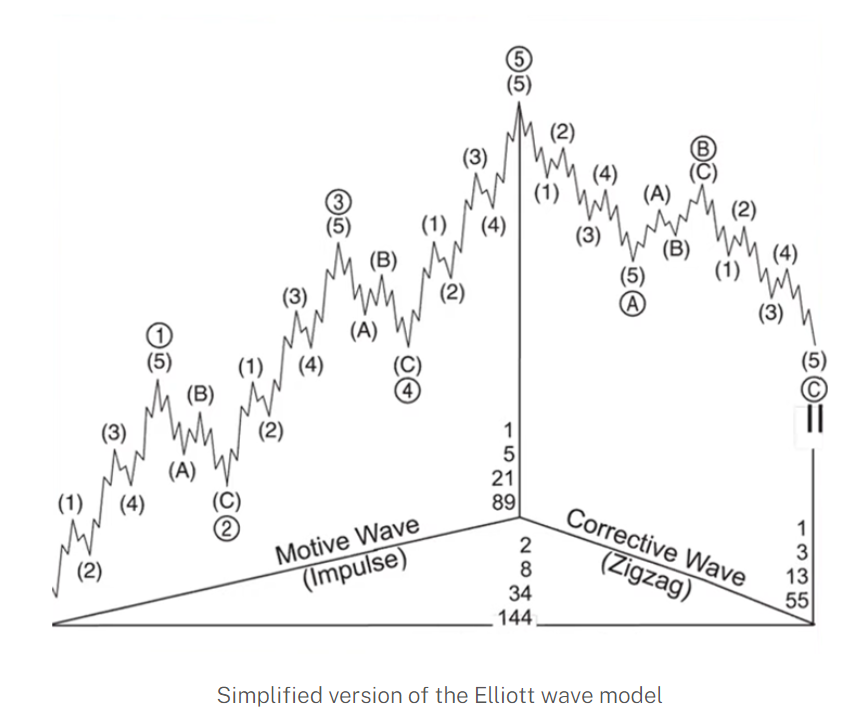

He predicts that this could be a significant buying opportunity for the next few years. Based on his analysis, Bluntz predicts that the total market cap of all cryptocurrencies will fall to $880 billion compared to the current value of $1,032 trillion. As a proponent of the Elliott Wave theory, Bluntz’s prediction is based on crowd psychology manifesting in waves. He talks about an ongoing correction wave after a steep rally and states that this correction is about 70-80% complete.

Rekt Capital: There is a fierce sell-off for Bitcoin

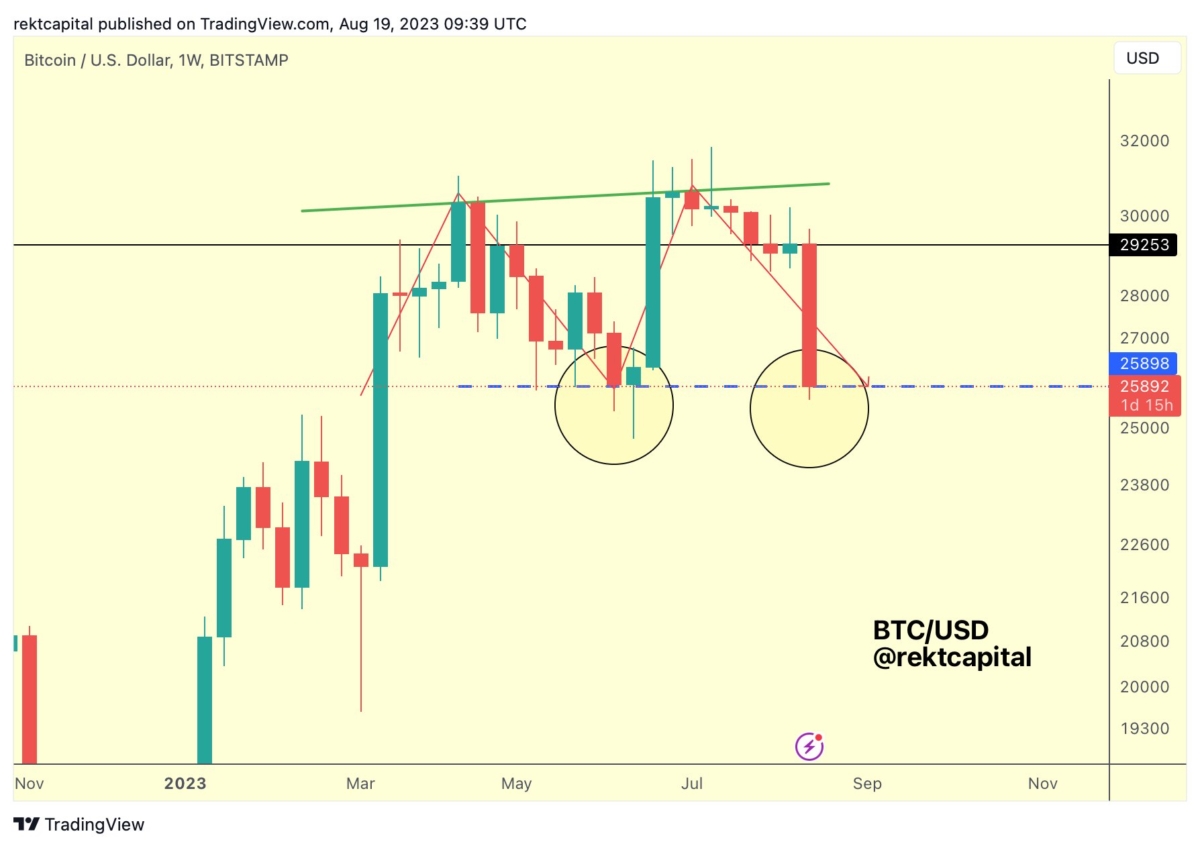

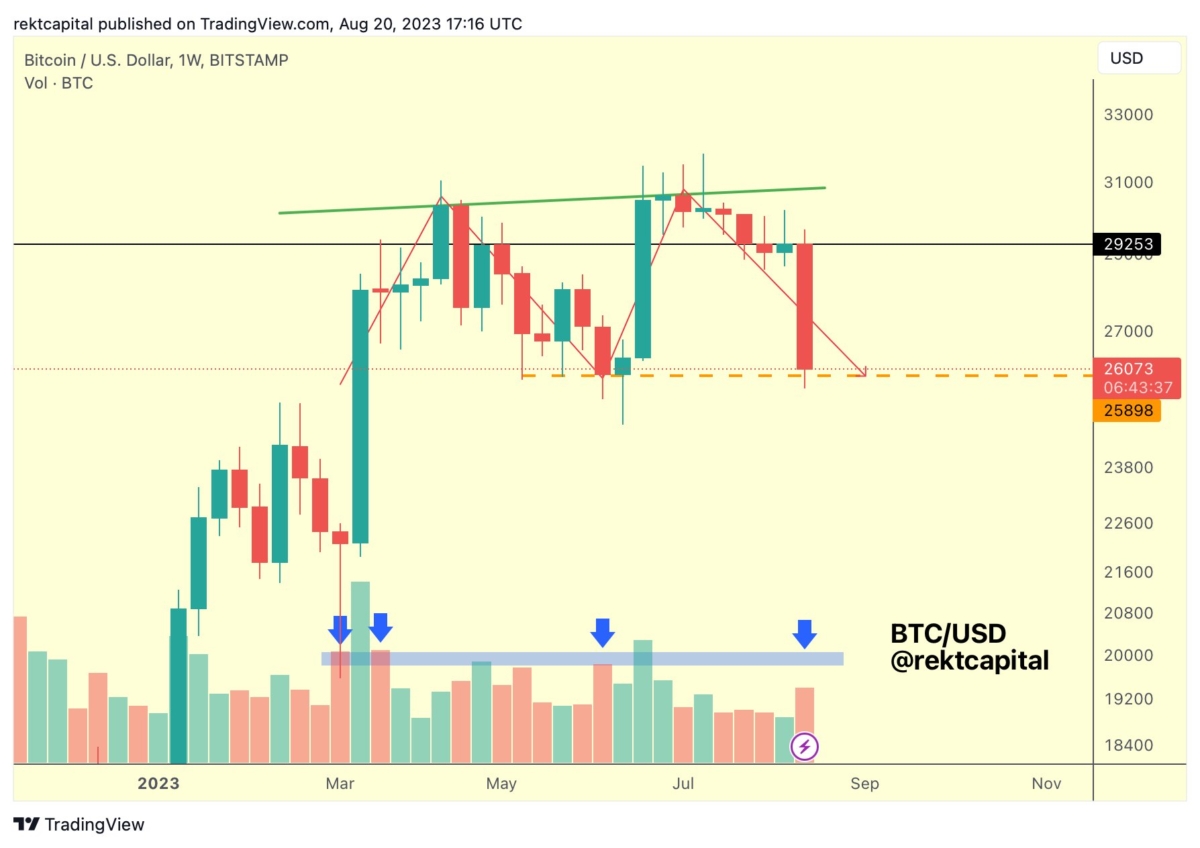

Rekt Capital, another prominent crypto analyst with 349,900 followers on X, is raising the alarm about Bitcoin’s potential for a serious sell-off. It highlights a completed double top formation and warns that Bitcoin is dangerously close to triggering a breakout from this bearish pattern. Rekt Capital emphasizes the importance of monitoring the trading volume of Bitcoin, which is especially close to the $26,000 support level, on a weekly chart.

He explains that confirmation of a crash would require a weekly close below this level, along with an increase in trading volume. Considering this analysis, Rekt Capital identifies $22,000 as a possible downside target if Bitcoin closes the week below $26,000, suggesting that a measured move to this double top break could lead to a drop in Bitcoin’s value.

How about market sentiment?

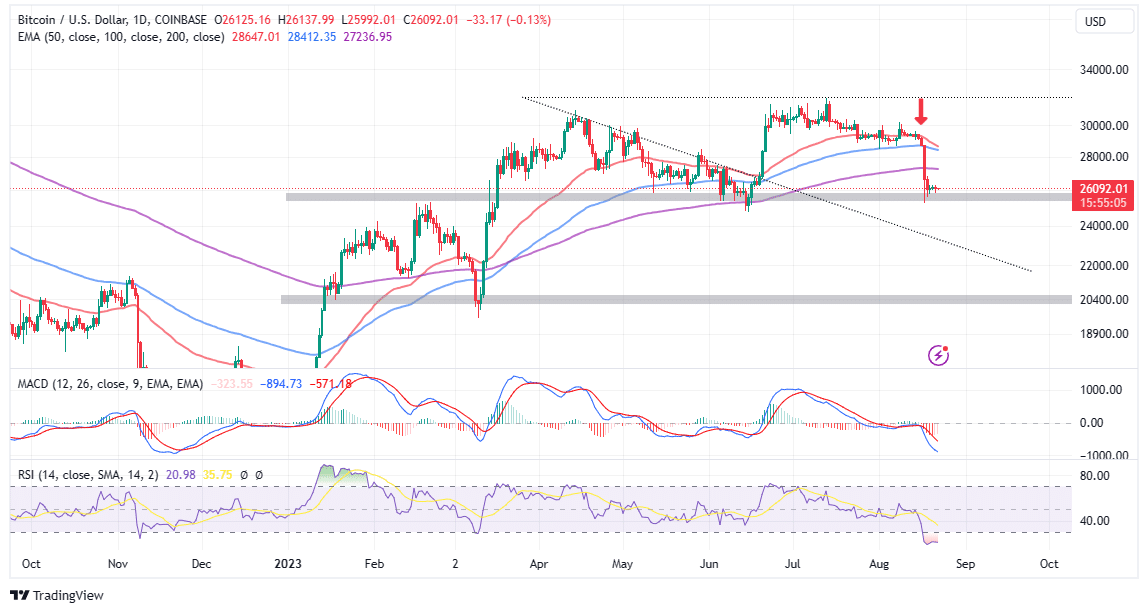

Experts point to historical patterns, stating that bull markets usually start with extreme fear, while bear markets tend to start with enthusiasm. Timing, especially buying during market downturns, is seen as an important strategy for creating value over time. However, many investors hesitate to buy during downturns, even when discounted deals are offered. In terms of Bitcoin’s near future, analysts are closely watching the $26,000 support level.

The Moving Average Convergence Divergence (MACD) signal signals a bearish divergence, suggesting the possibility of another breakout if the bears remain in control. Despite the weakening market structure, the oversold conditions shown by the Relative Strength Index (RSI) at 20 could potentially lead to significant price rebounds and prompt the need for cautious decision-making. All in all, while the crypto market remains dynamic and challenging, expert analysis sheds light on potential price movements and market sentiment. Investors and traders are advised to keep this information in mind when navigating the ever-changing landscape of cryptocurrency investments.