Last week, Chainlink (LINK) experienced a significant 15% increase in its price. Accordingly, it stood out as the best performing cryptocurrency. This impressive rise has put LINK ahead of Bitcoin (BTC) and Ethereum (ETH), the two largest cryptocurrencies in terms of market cap, which have experienced relatively stagnant price movements during the same period.

Rising demand and increasing activity for Chainlink

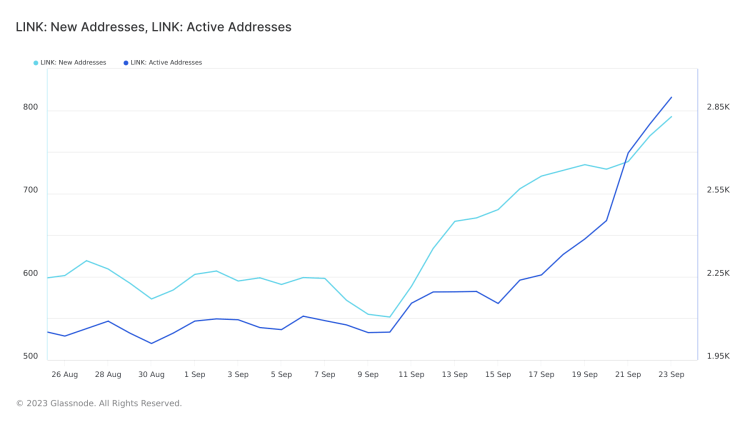

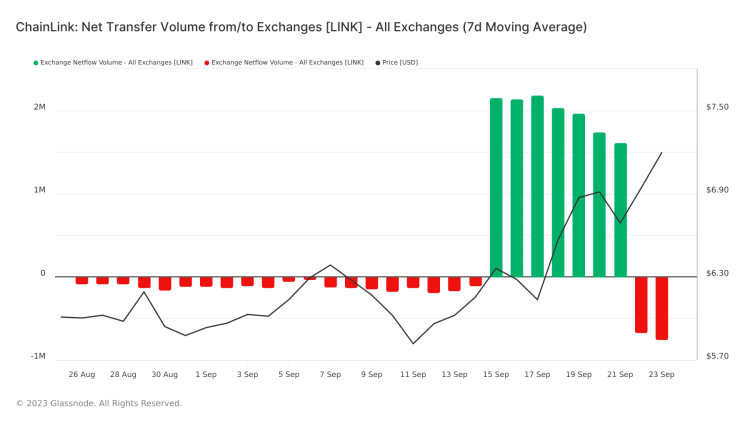

The increase in the price of Chainlink LINK is attributed to the increasing demand for the altcoin. There is also a significant increase in network activity. On-chain data from Glassnode highlights new addresses and active addresses participating in LINK transactions. This shows that their daily numbers have increased since September 10.

📊 As #Bitcoin remains in its $26K to $27K range, more #altcoins are spiking following whale accumulation and network growth. $LINK has notably climbed to $7.08, and $EXRD surged up to $0.067. Less social volume in #crypto means more and more projects are moving under the radar. pic.twitter.com/CPipEc0fsX

— Santiment (@santimentfeed) September 23, 2023

As of September 23, a total of 792 new addresses have been created for Chainlink trading. Accordingly, this indicates a significant increase of 44% compared to the 551 new addresses recorded on September 10. Additionally, the daily number of unique addresses actively participating in the LINK network as senders or receivers has increased by 41% in the last two weeks.

Bullish momentum confirmed

A closer look at the daily price chart of Chainlink LINK reveals an interesting situation. Accordingly, the bullish momentum prevailing in the altcoin market is confirmed. Key momentum indicators such as the Relative Strength Index (RSI), Money Flow Index (MFI), and Chaikin Money Flow (CMF) all reflect strong accumulation pressure in favor of LINK.

For example, Chainlink LINK’s RSI value is 64.88. Accordingly, this indicates strong bullish sentiment. In fact, the MFI at 81.55 indicates that the token may have been overbought due to heavy accumulation. Additionally, CMF, which tracks buying and selling pressure over time, continues to be positioned above the zero line at 0.23. Accordingly, it indicates more buying pressure than selling pressure.

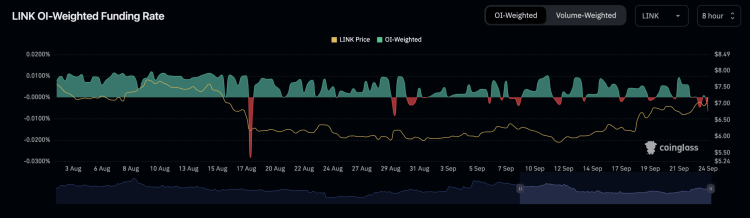

Optimism in Chainlink LINK’s futures market

An upward trend prevails in the futures market of Chainlink LINK. Open Interest in LINK futures has increased by 69% since September 17th. At the time of writing this article, it reached $181 million. In addition, LINK’s funding rates on various exchanges heavily favored positive positions. This also shows that most investors are expecting a price increase in the altcoin.

When we look at Kriptokoin.com, Chainlink LINK’s extraordinary performance last week draws attention. Not only is it solidifying its position as the best-performing cryptocurrency. It also fuels optimism among traders and investors. With strong demand and increasing activity, LINK continues to be the cryptocurrency gaining traction in the market.