DeFi altcoin WAVES is gaining more than 30% for two consecutive days. The latest revival plan announced by the Waves team can explain such a rapid rise in price.

DeFi altcoin received massive support after USDN whales voted to close their accounts

As a result of the aggressive sale of USDN in the Curve Finance liquidity pool, the stablecoin ecosystem was launched at the beginning of April last year. left the US dollar. However, the problems did not end there. Vires Finance, a Waves-based lending protocol, soon ran into a liquidity problem when anxious lenders rushed to exit the protocol. Problems were exacerbated by the LUNA/UST crisis, followed by a second dollar divergence, with the stablecoin still selling at a disadvantage to the market at the time of writing. Withdrawals from

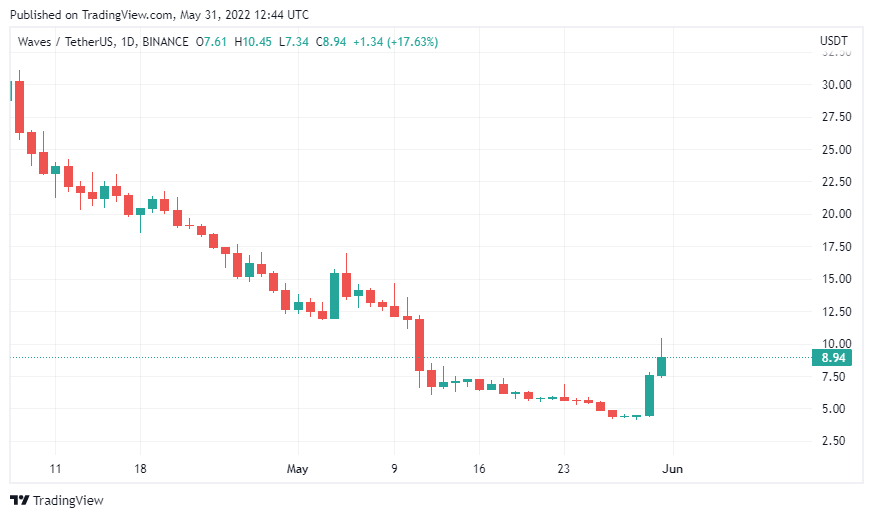

Vires are limited as most of the borrowed funds are still unpaid. As several extremely large borrowers stopped most lenders from withdrawing funds, lenders had to wait for payments to withdraw liquidity. Throughout this entire disaster, WAVES has lost value. At the start of the attack, its price was just over $60, but at the end of May it dropped to $4.17. As a result, WAVES has lost more than 90% of its value. Later, WAVES’ vote to close the accounts of USDN whales received huge support from investors. This follows a long downtrend with 48-hour gains of up to 130%.

What components are formed in the new strategy that raises the wave price?

The items in the official announcement, which we have transferred as Cryptokoin.com , with a rough translation are as follows:

- Return to the liquidity USDN pool using Curve and CRV can be done.

- Whales’ accounts will be liquidated and liquidity returned to Vires.

- USDN collateral will be sold slowly in two months.

- will be able to create a new cryptocurrency to recapitalize the Neutrino Protocol.

As of today, the unanimous decision is to undertake overextended USDN/USDt/USDC accounts, which will allow liquidation of large USDN positions without potential undesirable side effects such as USDN depeg. It seems that this vote worked and was effective in pushing the price up 60%.