Gold prices continue to struggle after $1,800 gold briefly tested. ANZ Bank economists predict that gold will find a base at current levels and move towards its $1,900 target. On the other hand, market analyst Pablo Piovano does not see any further rise as likely.

“Gold price will rise towards the $1,900 level”

Spot gold was trading at $1,806.06, down 0.27% daily at the time of writing. Gold futures, on the other hand, rose 0.034 percent to $1,807.6. The yellow metal was hit hard by the Fed’s rate hikes, which faltered to fight inflation. However, it receives support from inflation and geopolitical risks, which remain high. That’s why he has been range trading between $1,800 and $1,850 for a long time. However, last Friday, it slumped as low as $1,780.

The market is currently expecting a 75 basis point increase from the Fed in July, similar to June. cryptocoin.com As you can follow on , Fed Chairman Jerome Powell said in his latest speech that they will do what is necessary regarding inflation. This shows that the Fed is determined to control inflation. On the other hand, rumors of recession are spreading in the markets due to rising interest rates.

ANZ Bank economists expect the yellow metal to find support at current levels and move towards $1,900. Economists say stock market weakness and ongoing geopolitical uncertainty will support investor demand. In this context, economists make the following assessment:

Rising expectations of aggressive rate hikes and a stronger dollar are headwinds for gold. Still, it’s possible that equity market weakness and continued geopolitical uncertainty are supporting investor demand. We expect gold to find bottom near current levels and a potential upside target of $1,900.

Pablo Piovano: No more upside possible

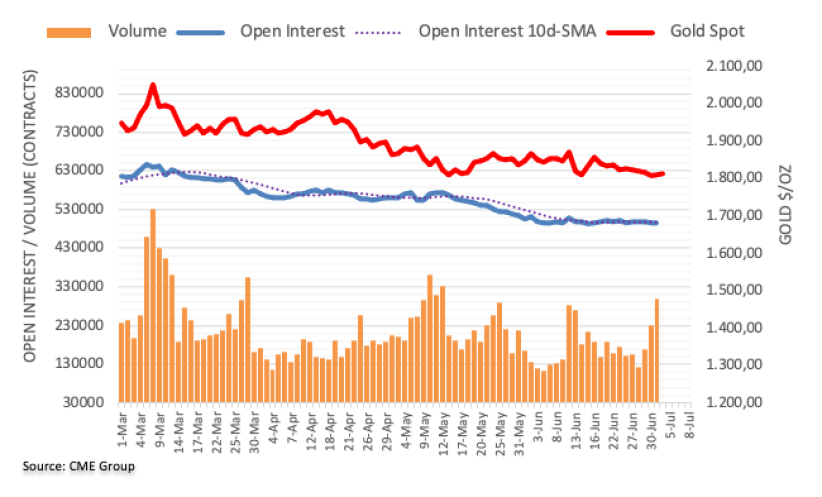

Open interest in gold futures markets fell for the second consecutive day on Friday, now with just 330 contracts, according to preliminary data from CME Group. Instead, volume increased by about 68.4k contracts this time in the third consecutive session.

Gold dropped to a 2022 low of $1,780 on Friday. According to market analyst Pablo Piovano, the decline of gold and the subsequent recovery were behind a small decrease in open interest. However, the analyst expects the all-time low of $1,780 (January 28) YTD to remain bearish for the time being, with a more serious bounce not preferred for now.