Bitcoin (BTC) and U.S. stocks have entered one of their strongest seasonal period of the year.

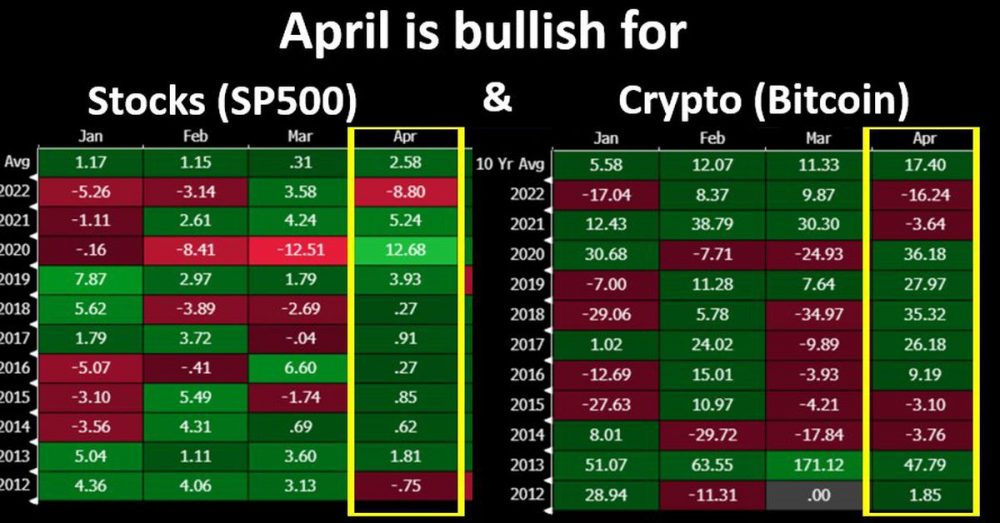

The top cryptocurrency by market value has chalked up gains in April in six out of the past ten years, averaging a return of more than 17%, according to data tracked by crypto services provider Matrixport. Over the past ten years, April has been the best month in the year’s first half and the third-best month for the full year for Bitcoin.

Wall street’s benchmark equity index S&P 500, has averaged a return of 2.6% in April in the past ten years, gaining eight out of ten times.

“The recent bull rally in U.S. stocks should have positive spillover effects for crypto as well – especially since we are now entering the month of April, which has been strong for U.S. stocks (SP500 +2.6%, Nasdaq +2.9%), Bitcoin +17%, and Ethereum +46%,” Markus Thielen, head of research and strategy at Matrixport, said.

“Our big thesis for 2023 that inflation will decline is playing out. All risk assets should rally,” Thielen added.

Recommended for you:

- Usuario de Uniswap pierde $8M en ether por ataque de phishing

- How Ethereum Will Be Transformed in 2022

- It’s Time to End Maximalism in Crypto

- Join the Most Important Conversation in Crypto and Web3 in Austin, Texas April 26-28

Bitcoin rose 23% in March, taking the year-to-date gain to 67%. The S&P 500 has gained 7% this year. Data released on Friday showed the Federal Reserve’s preferred inflation gauge cooled back down in February, boosting hopes that policymakers will be able to dial back their aggressive monetary tightening.