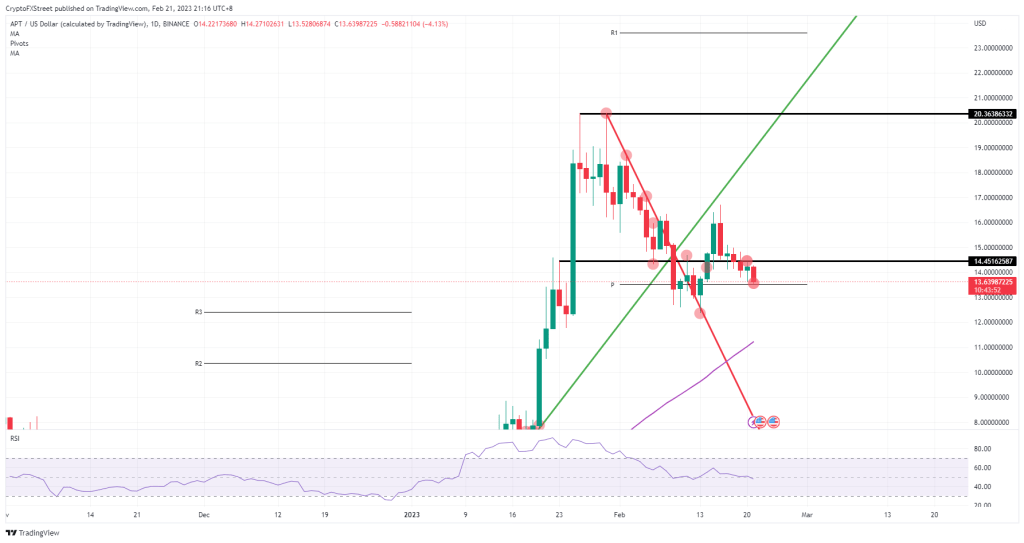

Aptos price slumped below the line after a definitive rejection on Monday. Also, a bullish wave is expected as tail risks decrease.

Aptos is showing fluctuation

cryptocoin.com The price of Aptos fell by about 4% on European stock markets this Tuesday, according to data. The reason is that the bullish boom, which is expected to take place this week, has not emerged so far. This downward impression should not mislead traders, as a large surge in purchasing activity could start to pick up after President Putin’s speech in Russia.

Only the START (Strategic Arms Reduction Treaty) program will be suspended in retaliation for the surrender of tanks and further funding from the West, while many analysts fear that a large number of additional actions and counter-actions will be triggered.

APT finds support near $13.52 and it can be seen rising again to $14.50 to break Monday’s rejection. Once that happens, a bullish turn has been established and Aptos is poised to continue its bullish momentum as geopolitical tail risks become less severe than the markets originally anticipated. Even if it takes weeks, if geopolitical and macro tail risks continue to decrease at this rate, $20 may be possible.

A drastic move is expected at APT should Russia mislead its markets by speaking too softly and suddenly turn to unconventional weapons without warning. A break of the monthly pivot below $13.52 is inevitable and from there, the risk of freefall is quite large. The best estimate is $11 with the 55-day Simple Moving Average as a counterweight.

Dogecoin price against the market

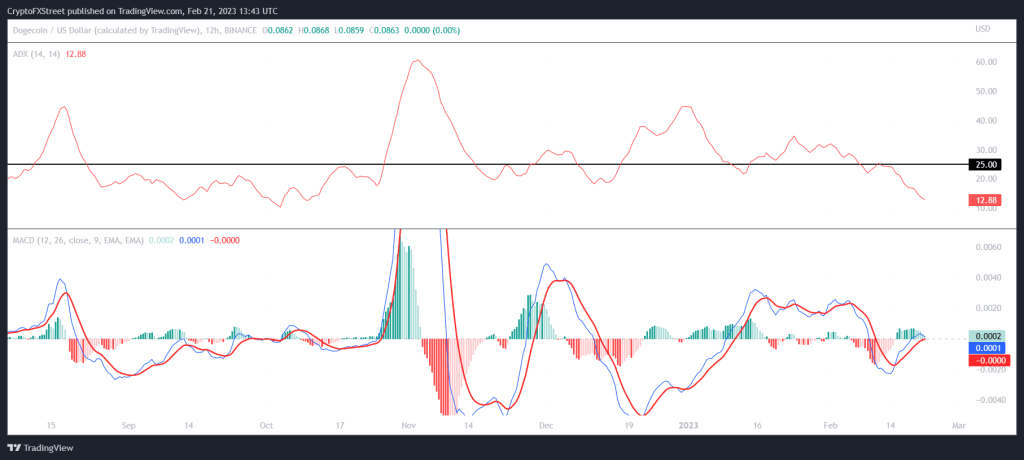

While Bitcoin and most of the large market cap altcoins are showing bullish signs, the Dogecoin price is on the decline. This is because the lack of growth recorded in the first few weeks of the year has kept DOGE below the critical resistance of $0.108.

The Parabolic Stop and Reverse (SAR) trend indicator is currently suggesting an active downtrend as its blue dots are above the current candlesticks. Price indicators are also pointing to possible corrections in the next few trading sessions. The Moving Average Convergence Divergence indicator (MACD) is on the verge of recording a bearish divergence. The signal line (red) is about to move above the MACD line (blue), which shows the same. Decreasing green bars on the histogram also indicate bearish momentum.

However, the Average Directional Index (ADX) records only 12.88 and thus does not show any strength for the downtrend. The indicator needs to be above the 25.0 threshold to expect DOGE to experience a significant loss in price. According to analysts, if Dogecoin price loses the critical support at $0.084, it will likely drop almost 14% to trade at $0.074.

If the downtrend strengthens, DOGE may even lose the $0.070 support and rally to $0.100 if the buyers succeed and the dog-themed token bounces off at $0.084 and surpasses the resistance at $0.090. Turning this level into a support base would give DOGE the support it needs to test the critical resistance at $0.108. Finally, a daily candlestick above this level invalidates the bearish thesis and marks a three-month high for the altcoin.

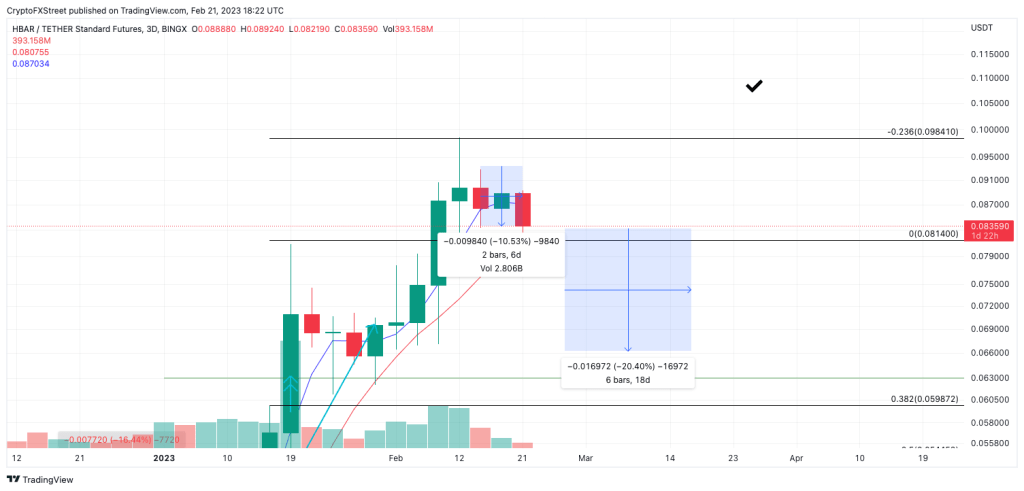

Hedera is on the decline

Hedera Hashgraph price shows short-term bearish techniques that could change the bullish rhetoric in the coming days. Traders should remain neutral during the consolidation phases and continue to apply risk management while seeking profitable opportunities.

Hedera Hashgraph price declined near the upper boundary of the recently established uptrend. The HBAR price is an important move to consider when trading as the coin has been trading in a limited range for the past nine days.

The Hedera Hashgraph price is currently up for auction at $0.083. The bears toppled the 8-day exponential moving average, which provided support during the 1.5-fold rally that started on Jan. The breach can be seen as a confirmation signal for the bears to establish their positions on smaller timeframes.

Classical technical analysis suggests multiplying the average trading range percentage by the total amount of candlesticks held within the range to extract a possible target. The 3-day chart shows the previous two days of range-bound trading with a 10% spread between $0.082 and $0.091. Therefore, a 20% price drop targeting $0.066 could be the next market move for traders to join.

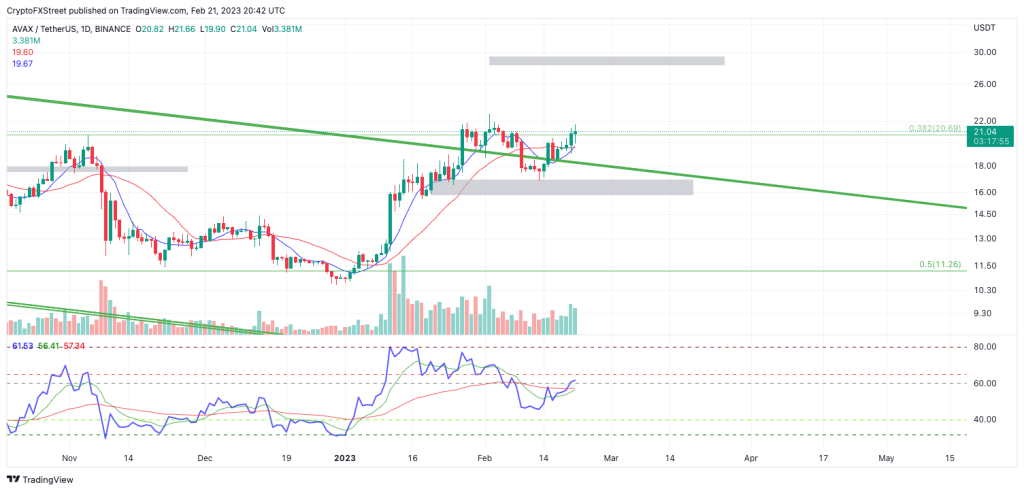

AVAX’s uptrend still intact

Avalanche prices are currently on sale at $21.03. AVAX witnessed the bullish trend of the 8-day exponential and 21-day simple moving average on February 21. This is a signal that many day traders look for to start entering smaller timeframes while predicting that the trend will continue.

The volume indicator also shows confusing evidence that the 1X uptrend that started in mid-winter will continue. According to Binance Exchange API, the consolidation near the $21 region saw significantly less volume compared to the previous uptrend surge that pushed AVAX price to the $17 region. For example, the highest volume day occurred on January 13, with a transaction flow of 20 million near the $17 region. The bears have only averaged 4 million trades on any given red day since the initial volume increase.

It’s worth noting that the bulls retested the $17 zone about a month later on February 12 and has since climbed 17%. While a second retest is always possible, currently the first retest seems balanced enough to lead to an additional uptrend spike.

Considering these factors, the Avalanche price may start to rise in the coming days. The most important level to target will be the $29 region, a liquidity level set during the July 2022 sales. The bearish scenario would create the potential for an increase of 35% from Avalanche’s current market value.