Bitcoin miners seem to rebalance every time prices rise above $30,000. Bitcoin prices have dropped below the lower range of the Bollinger Bands. Bitcoin (BTC) price reversed last week’s rally. Thus, it is back to the lower end of its last range around $29,700 with low volume. Here are the details…

What do Bitcoin miners’ movements indicate for BTC?

Recent market movements have been notable for rapid price swings as Bitcoin looks poised for a sustained break above the $31,000 level. One explanation could be that Bitcoin miners are selling on price rallies, a possible sign that they need capital, a short-term bearish trend in BTC, or a combination of the two. There are also two technical indicators to explore.

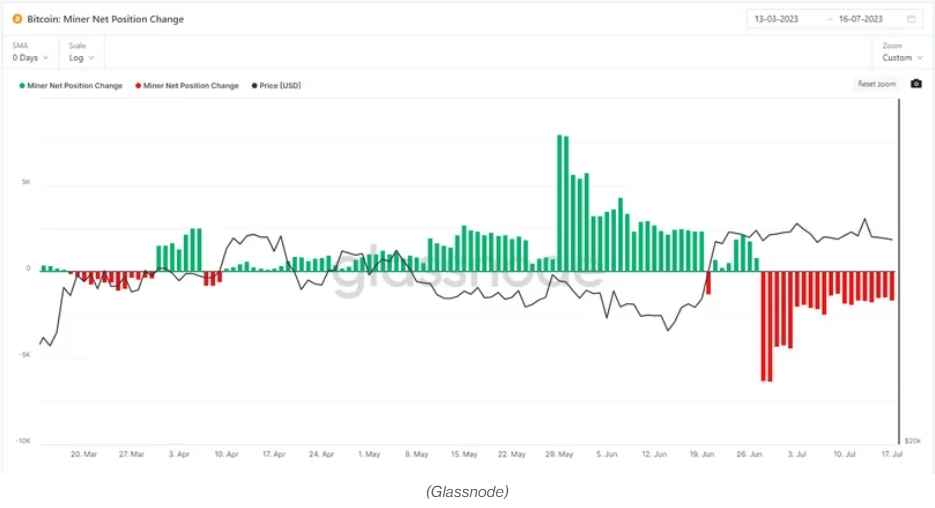

Bitcoin prices exceed $30,000 for most of this month. Meanwhile, Bitcoin miners are reducing their overall net position. According to on-chain analytics firm Glassnode, the 30-day supply change in miner addresses has been negative for 20 consecutive days. This marks a difference from the time frame between April 10 and June 27, where the net position of the sector was positive for all but one day. Does this change signal a shift in sentiment, or the need for cash-strapped miners to make strong sales to finance their operations? According to experts, the answer is probably a combination of the two.

Miners take profit

Given BTC’s 80 percent gain to date, it’s not unreasonable to expect BTC miners to be inclined to take some profits off the table. With this, cryptocoin.com As we have also reported, the overall trading volume has not been strong enough to indicate their massive exit from the asset. In addition, miners’ total Bitcoin balances are currently 1.83 million coins, compared to 1.82 million on January 1. This implies that recent activities may be a rebalancing of their overall position rather than a comment on the price level.

Bollinger Bands are a technical indicator that tracks an asset’s 20-day moving average against price levels two standard deviations above and below that average. Breakouts above or below this value are statistically significant events, as prices are expected to stay within two standard deviations of the mean 95 percent of the time. A recent example of bullishness occurred on June 14. According to experts, prices rose sharply immediately after an upside breach. Today’s move is potentially bearish as the current $29,750 price is a minor downside break above the lower limit of the Bollinger Band range at $29,800.

Significant price is at the level of $30,000

As there are no new catalysts, BTC prices are poised to continue holding near the $30,000 level. The volume in Bitcoin’s price profile shows significant activity at $30,500 since May. Based on the price point, these high activity levels are often referred to as “high volume nodes”. This indicates an important price agreement between traders. Therefore, it usually refers to areas where prices are stabilizing.