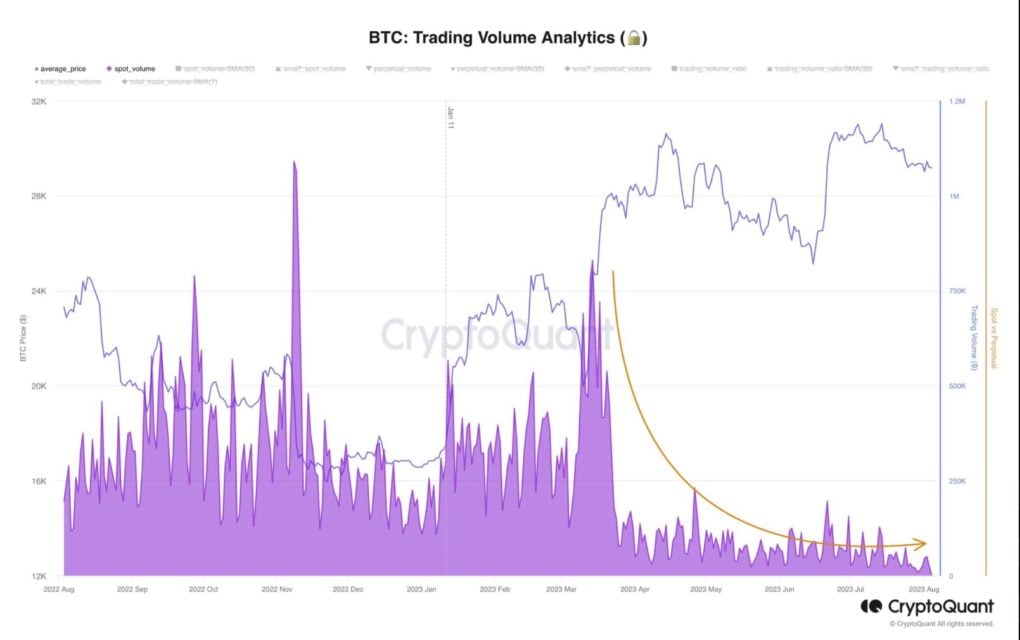

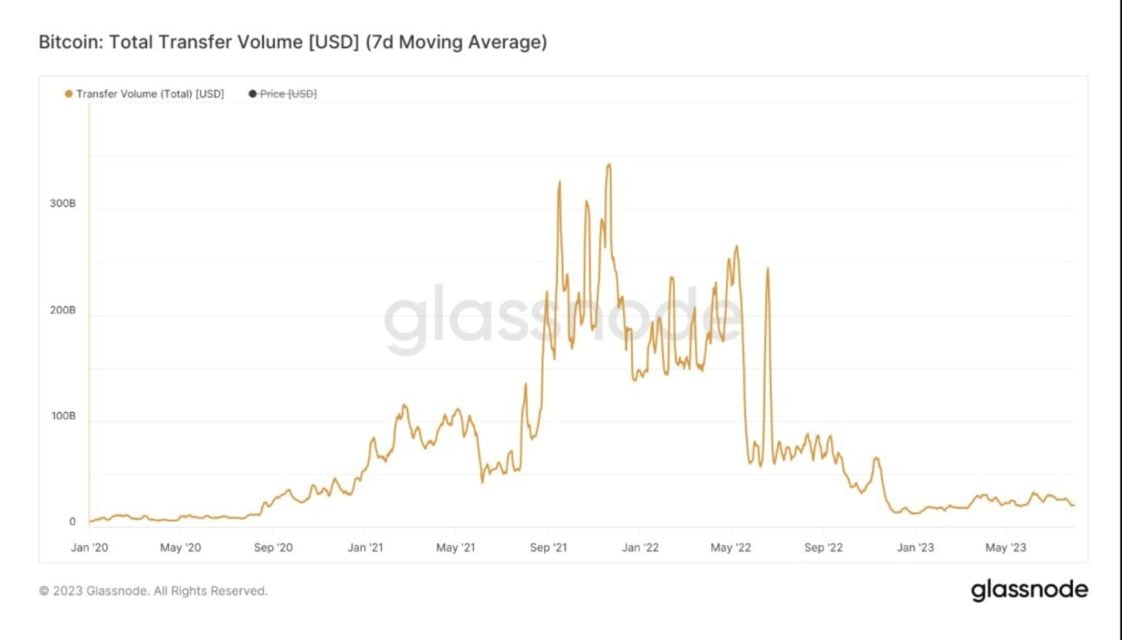

We observe that total transfer volumes have decreased to the lowest levels of the last 3 years. In the first week of August, while the price of Bitcoin was in the range of $ 28,500 – $30,000, we see that spot trade volumes are quite low according to onchain data.

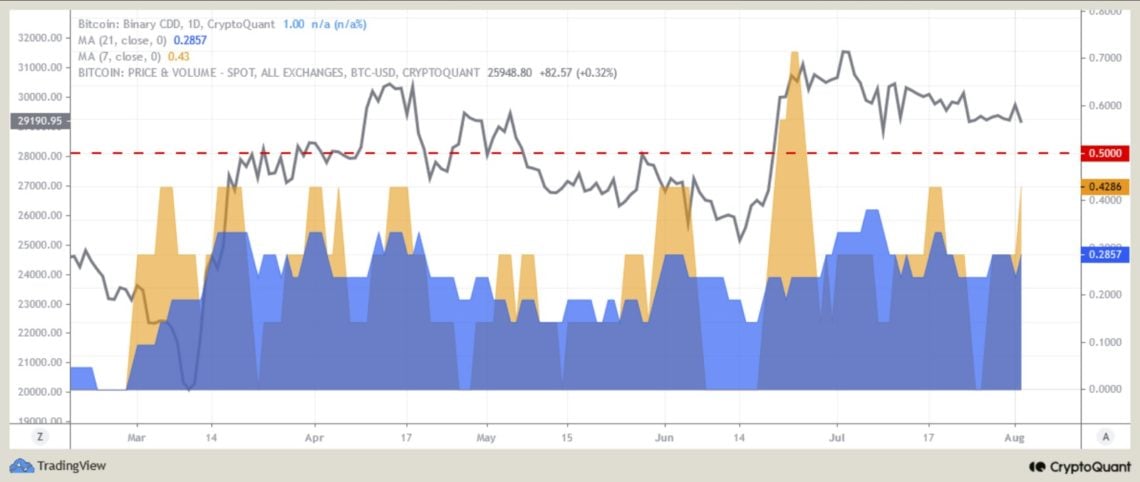

Looking at the Binary CDD data of long-term investors, it is seen that their expenditures and mobility are quite low.

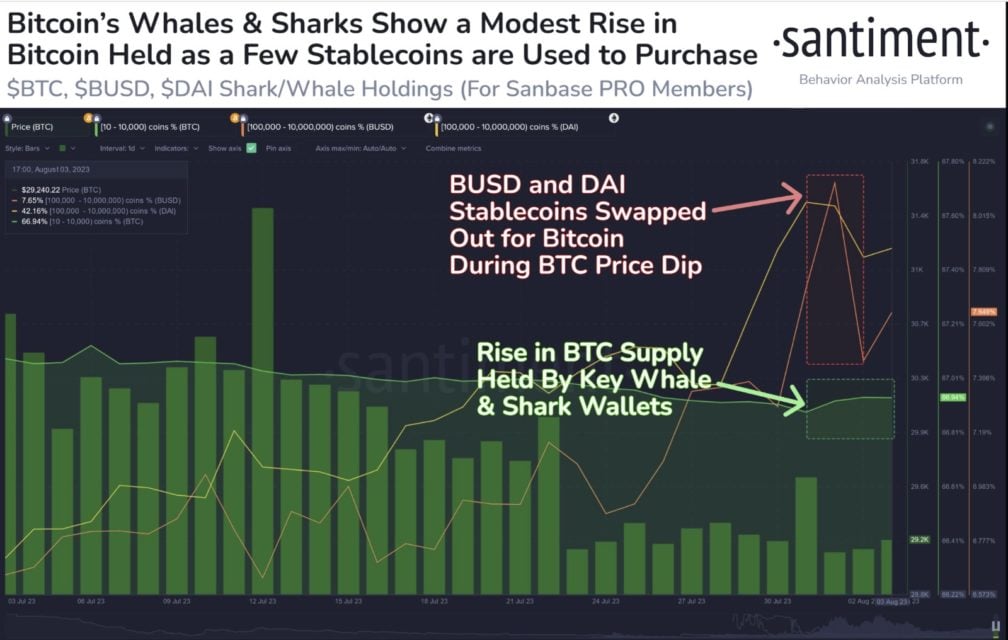

While it is noteworthy that 55% of the circulating Bitcoin supply has not moved for 2 years, it is observed that Bitcoin whales lightened their bags in July, but they started to replace their stablecoins with Bitcoin at the beginning of August. If this trend continues, it seems possible for the price to rise above $30,000 in the coming days.

When we take a look at the stock market entries of stablecoins, we observe that the buying interest has increased.

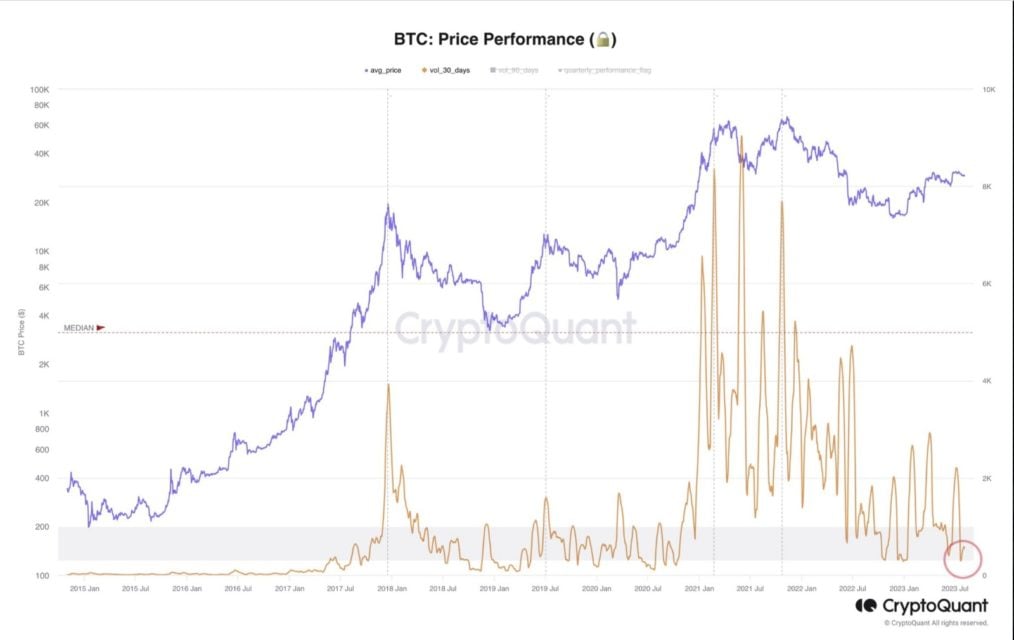

When we take a look at the effects of the 30-day average price-volume performance on the price, we can predict that the price activity is close.

It is also observed that the SOPR value of SMA-7-day BTC Short-Term Traders is currently in the negative territory and a correction is also likely when looking at the past corrections. In this fix, we will observe in the coming days whether the stablecoins entering the aforementioned exchanges will be used to buy Bitcoin.

As a result, at the beginning of August, we see that the Bitcoin price is in a certain range, with stagnation and low volumes prevailing in onchain data.

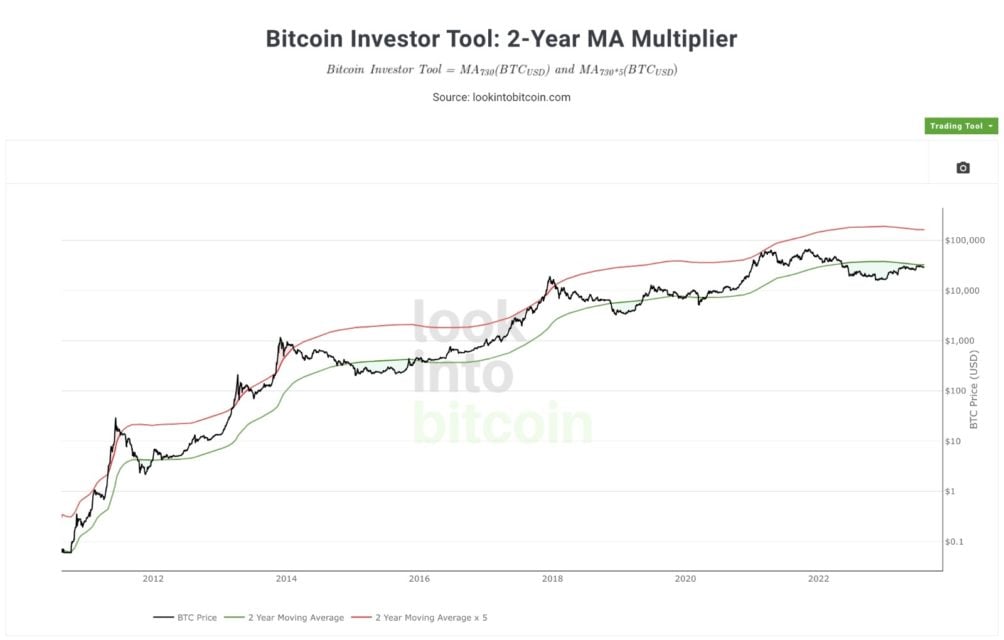

Let’s take a look at the support and resistance levels of 2-year investors for the continuation of the rise in the medium term. Once we surpass the $32,500 resistance and can stay above it, we can expect the uptrend to continue.

References:

https://cryptoquant.com/

https://www.lookintobitcoin.com/charts/bitcoin-investor-tool/

https://santiment.net/

https://glassnode.com/