FXStreet analysts shared bearish expectations for the 3 high-volume altcoins on the Binance list. Detailed technical analysis is based on macro factors arising from the gas crisis in Europe.

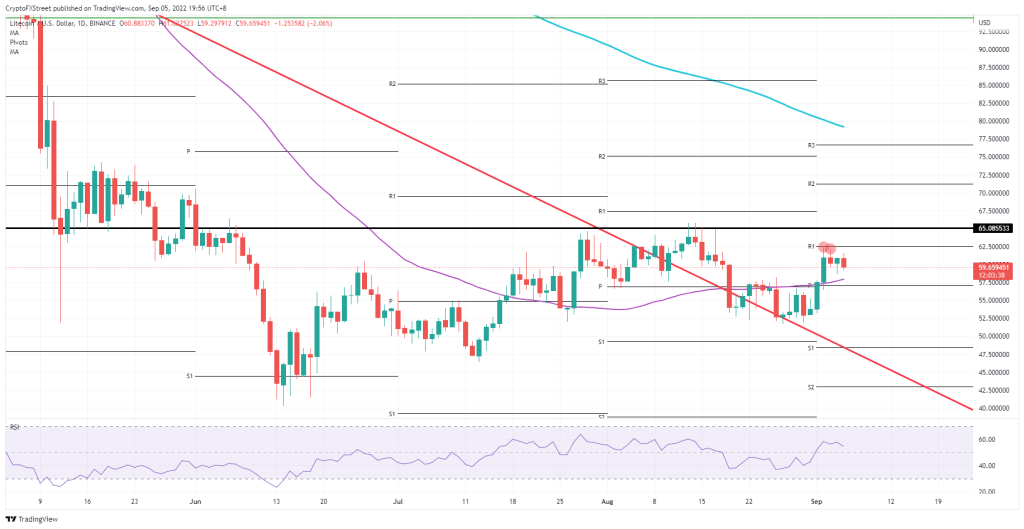

LTC price under leverage pressure

LTC price is having a rough time as investors withdraw their cash from cryptocurrencies. The dollar is putting pressure on the dollar as it continues to rally after Friday’s positive US jobs report. According to analyst Filip L., LTC price is likely to decline to support the pivot around $57.50 initially. We can expect these pressures to continue tomorrow and Wednesday. If the price breaks this level, the bears’ next target will be $48.60.

As we’ve seen so often over the past few weeks, negative Mondays mean positive weekly closes. Therefore, it will be among the cards for the markets to repeat this. In addition, it is possible to successfully address and resolve the problem with many countries creating bailouts and bailing out energy companies. According to the analyst, this scenario will lead to a reversal as $65.08 is tested for a breakout. If this breakout occurs, we can expect to see a weekly close above $70 by Friday.

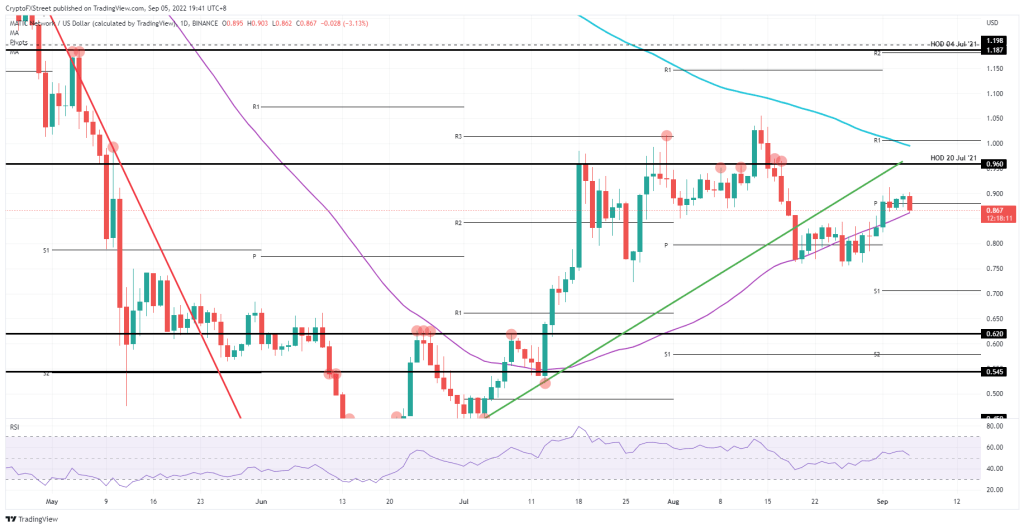

This altcoin is facing the 2008 crisis

He had to bail out several energy companies of Finland and Sweden that were about to go into default on Sunday evening. After his news, MATIC price climbed over 3% during European trading hours. The risk of default on an energy supplier in the European region will be reminiscent of Lehman Brothers’ collapse in 2008. There is even the possibility of triggering a big domino effect to achieve this. Meanwhile, investors are also avoiding risky assets. Once again, they are looking for safe havens where the dollar is strong. This, in turn, suffocates cryptocurrencies.

MATIC price is currently hanging on a tightrope behind the 55-day SMA at around $0.862. As long as this continues, the uptrend is still safe. Although the 55-day SMA has given way to bears, analyst Filip expects a drop of 15% to $0.750.

With the support of the 55-day SMA, an alternative scenario could suggest a reversal as the initial market reaction from the negative euro news begins to subside. We can expect price action to return to $0.900 with a profit target of $0.960 by forecast. This will mean a solid 9% gain for the bulls to split.

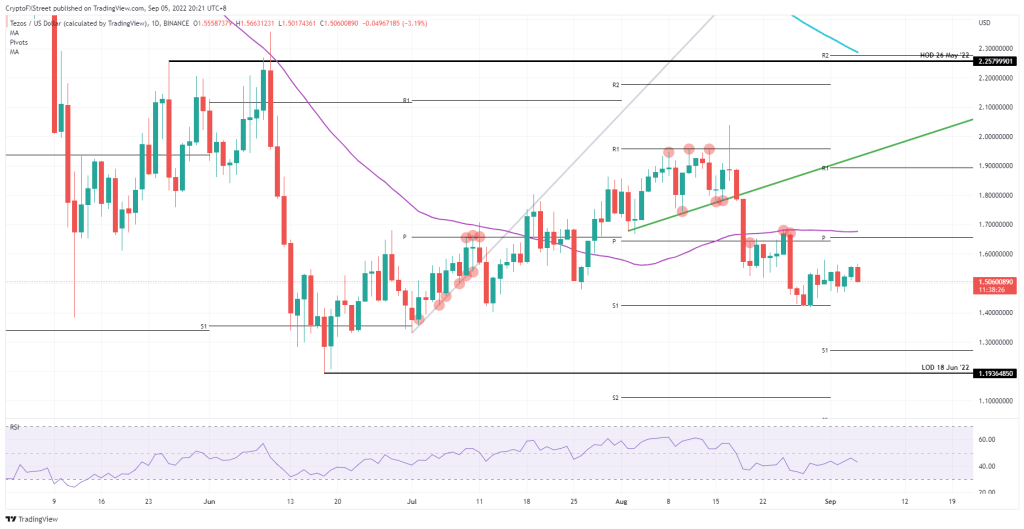

XTZ price risks falling to $1.40

XTZ price is facing downward pressure towards $1.40, two weeks ago low. If this level doesn’t hold, a 9% drop towards $1.30, the religion of September, will be at the door. However, the RSI will have reached the oversold mark and should be ready to be picked up by the bulls.

It doesn’t look like a huge sale is happening yet, as several floors have been set. The energy crisis is far from cryptocurrencies as an asset class, so the negative spillover effect is likely to be quite limited and possibly see a reversal in price action on Tuesday. Expect to see a slightly higher rise towards $1.60, from this the double cap comes into play. This resistance band includes the 55-day SMA and the monthly pivot just below $1.70. cryptocoin.comAs you follow, XTZ is currently spending time in the $1.50 region.