Bitcoin (BTC) miners have been surrendering for almost two months. However, it is possible that the end of the current congestion has already come. That was the conclusion of Blockchain infrastructure and cryptocurrency mining firm Blockware in its latest Intelligence report on July 29.

Inefficient Bitcoin miners exit the market

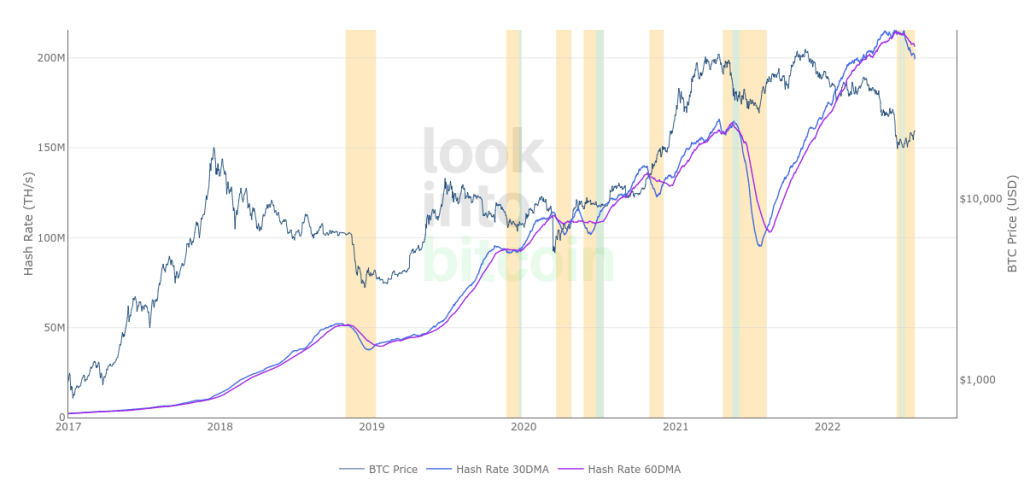

The latest edition of the market research series talks about changes in the mining ecosystem. Accordingly, changes in Bitcoin mining have created a trend change since the beginning of June. Mining firm Blockware evaluated the market based on the hash strip metric. The firm says miners “retire for an extended period.” The hash stripes metric signals a total of 55 days of surrender as of August 1. Blockware points out that the miner surrender started on June 7 and is still ongoing. It is quite important to note that miner capitulations are specifically linked to this. This is because it turns out that a large number of machines are no longer hashing. Blockware said:

“As of June 7, the next generation of mining rigs have likely been fitted by public and private mining companies. However, old enough generation machines or inefficient over-leveraged miners have shut down. As a result, Bitcoin hash rate and miner difficulty started to decrease in size.”

Miner capitulation will end in September at the latest

The turmoil began in June when it reached $17,600. The profitability barriers created by the Bitcoin price drop were the main reason for this. BTC price action at that time sent the market back to late 2020. Now, signs are emerging that the price strength is returning. Therefore, the chances of better conditions for miners increase. According to Blockware, capitulation defined by hash strips should end before the end of summer. The firm’s report expects capitulation to end in August or September if BTC doesn’t make a new low.

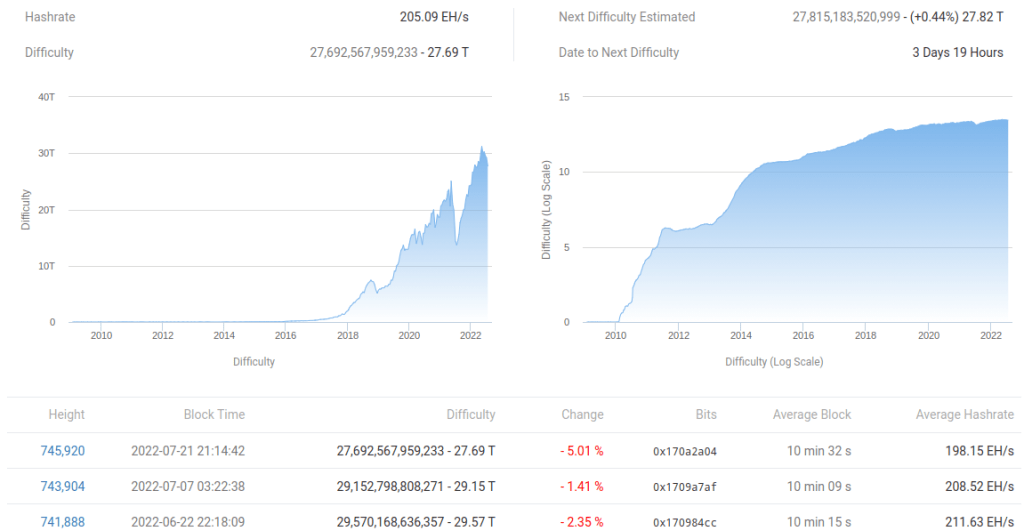

Miner difficulty stems from multi-month decline

It is possible for miners to return to form. For this, automatic adjustments to Bitcoin’s network fundamentals are creating early signals. It is possible that these signals can already be seen on-chain. Specifically, the mining difficulty adjusted three straight down in a row. After that, on August 4, it experienced its first increase after 2 months. According to Blockware, the increase will be a modest increase of around 0.5% if current spot price levels continue. For comparison, the previous difficulty reduction was 5% overall.

How is the Bitcoin price?

Bitcoin price is down almost 50% from its $47,000 price in early 2022. The multi-month bearish movement brought altcoin prices with it. As a result, we witnessed months when many companies went bankrupt and projects disappeared. Now, the leading cryptocurrency has risen from $20,000 and tested $24,000. cryptocoin.comAs we reported, BTC is trading at $ 23,105 at the time of writing and is preparing for a new move.