Another new stablecoin’s peg has broken after Terra’s (LUNA) algorithmic stablecoin UST lost its dollar peg and was reset. After the LUNA crisis, Kava Network’s stablecoin USDX lost its dollar peg and fell to almost $0.55 on Wednesday. Kava Labs said in a statement that it is offering UST as one of its collateral assets to print USDX.

Another stablecoin problem after LUNA and Waves!

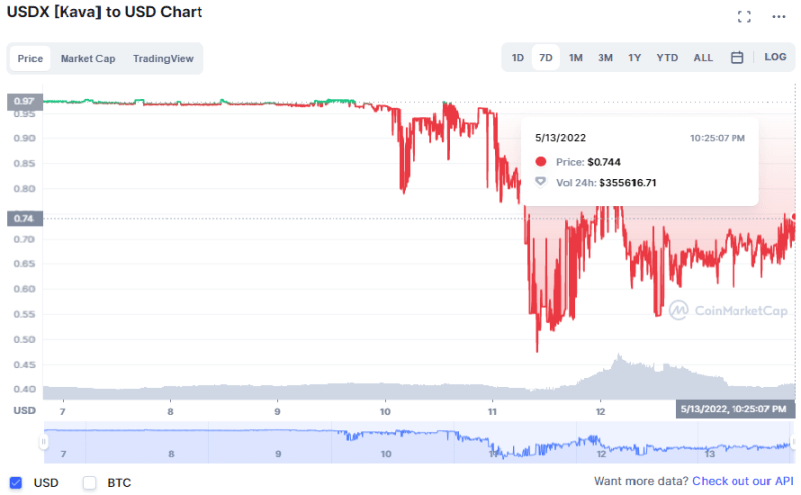

Kava Network’s native decentralized stablecoin USDX has lost par with the US dollar. According to CoinGecko, this stablecoin has a market cap of more than $115 million. USDX has dropped to almost 0.55 on Wednesday and has recovered slightly to $0.74 at time of writing, but is still around 26% off $1

USDX’s dollar It is not clear what caused it to lose parity. Unlike algorithmic stablecoins such as those provided by Terra, Kava Network’s USDX can be minted as a loan backed by collateral reserves.

One possible explanation via Twitter from Kava Labs, the development team behind the stablecoin, is that USDX has lost the stable due to its link to Terra USD (UST), an algorithmic stablecoin that recently crashed. UST was backed by some collateral backing USDX, as well as other assets such as Kava, Cosmos, Wrapped Bitcoin and Ethereum.

Co-founder and CEO of Kava Labs says that the problem will be resolved

As you can follow from cryptokoin.com news, UST is 10% of its value in a week. It lost more than 99 to fall 0.1787, resulting in collateral liquidations that dragged USDX. According to Scott Stuart, co-founder and CEO of development team Kava Labs working on stablecoin, the liquidations likely caused USDX to exit the one-dollar stable. Scott Stuart claims that USDX will return stable as it is not an algorithmic token like UST:

USDX is not UST. When UST exits the system, USDX is expected to return to its stable price.

Scott Stuart adds that the risk of UST in Kava is isolated and can be tolerated, adding that “UST has (clearly) been significantly de-pegged and has led to some risk for downstream protocols using it.”