According to the latest news, the SEC postponed Grayscale’s Ethereum ETF application. Amid these developments, on-chain data shows that the bankrupt Celsius is moving ETH to exchanges. While Bitcoin, the leading crypto in the market, is on the rise, the leading altcoin ETH is stagnating.

SEC postponed decision on Grayscale’s Ethereum ETF application!

The U.S. Securities and Exchange Commission announced Wednesday that it will “establish a longer timeframe for taking action on the proposed rule change” for Grayscale’s Ethereum Futures Trust. Accordingly, the SEC extended the deadline until January 1, 2024.

“The Commission will approve or disapprove the proposed rule change, or will initiate proceedings to determine whether it will be approved,” the SEC said in the filing. Essentially, the regulator has another window to delay a decision. Bloomberg analyst James Seyffart said it was “not too surprising” that the SEC delayed the filing.

UPDATE: @Grayscale Ethereum futures 19b-4 filing was delayed. Nothing remotely surprising about this. They've also filed separately to convert $ETHE into an ETF. pic.twitter.com/bBNOBiFN3U

— James Seyffart (@JSeyff) November 15, 2023

Celsius is piling Ethereum into the exchange

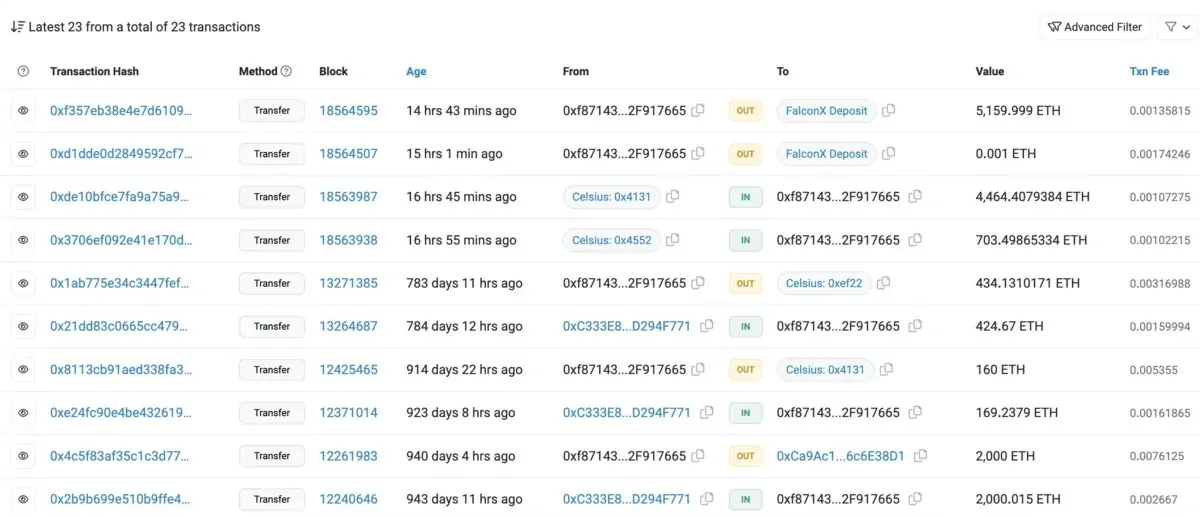

According to on-chain data, an address associated with bankrupt crypto lending platform Celsius is moving ETH to FalconX. The amount Celsius carries is worth millions of dollars. Ethereum (ETH)On-chain data tracker Lookonchain, citing data from blockchain researcher Etherscan, says Celsius moved 5,160 ETH, worth approximately $10.49 million, to institutional crypto trading platform FalconX. According to Lookonchain, Celsius is likely “looking to sell some of its assets with rising prices.”

Meanwhile, Ethereum is trading at $2,028 at the time of writing. The altcoin is up 0.8% on a daily basis and is up nearly 80% year-to-date.

The ETH whale, which made a huge profit, started selling!

On the other hand, Lookonchain is drawing attention to the transactions of an Ethereum whale. It states that this whale earned approximately $14.3 million from its ETH investment. The analytics platform, which goes into detail about the transactions of the whale that is up for sale, reveals interesting points. Accordingly, this whale sold 6,099 ETH at $1,964 for 12 million USDC during the day. Lookonchain, “Is this whale copy trading worth it?” he asks and makes the following statements:

This whale escaped the FTX/Alameda crash and withdrew ETH from FTX in time. Whale began buying and selling ETH for profit in December 2022, making 22 trades in total. Whale does not always buy low and sell high. Even when the price fluctuates greatly, this whale will buy and sell all at once and hesitate. Fortunately, the whale bought ETH before the price spike in January, bought ETH during the USDC de-pegging in March, and recently bought ETH before the price spike. Whale earned approximately $8.3 million from ETH. Additionally, he currently holds 20k ETH with approximately $6 million in unrealized profits.

1/ A whale who made ~$14.3M on $ETH sold 6,099 $ETH for 12M $USDC at $1,964 4 hrs ago.

Is this whale worth copy-trading?

Let's take a look at how he trades.👇 pic.twitter.com/JngtszbIDf

— Lookonchain (@lookonchain) November 15, 2023