With Bitcoin August being the worst month of 2023, it starts the new week struggling with $26,000. The strength of BTC price remains questionable after the sudden crash 10 days ago and the bulls were unable to take back control of the market to provide a comforting bounce. So, what are the main discussion points of BTC price performance for the week ahead? Here are the details…

Bitcoin price drops as it nears monthly close

No reward for guessing how Bitcoin ended its latest weekly candle. Because historical data already hints at this. According to the data, although BTC/USD held $26,000 at the close, it went downhill right after that and dropped to $25,880 before surging a little higher. That said, in part of his analysis of X, popular trader Skew said, “Shorts continue to pile up towards the weekend. Some sort of action is expected at the US Futures opening and the EU session on Monday,” it said. Skew also described BTC behavior over the weekend as “maximum bitter price action.” The monthly close was a key issue for market participants and the cards were fluctuating after August led to 11% losses. Keith Alan, co-founder of monitoring resource Material Indicators, predicted a trip to several-month lows.

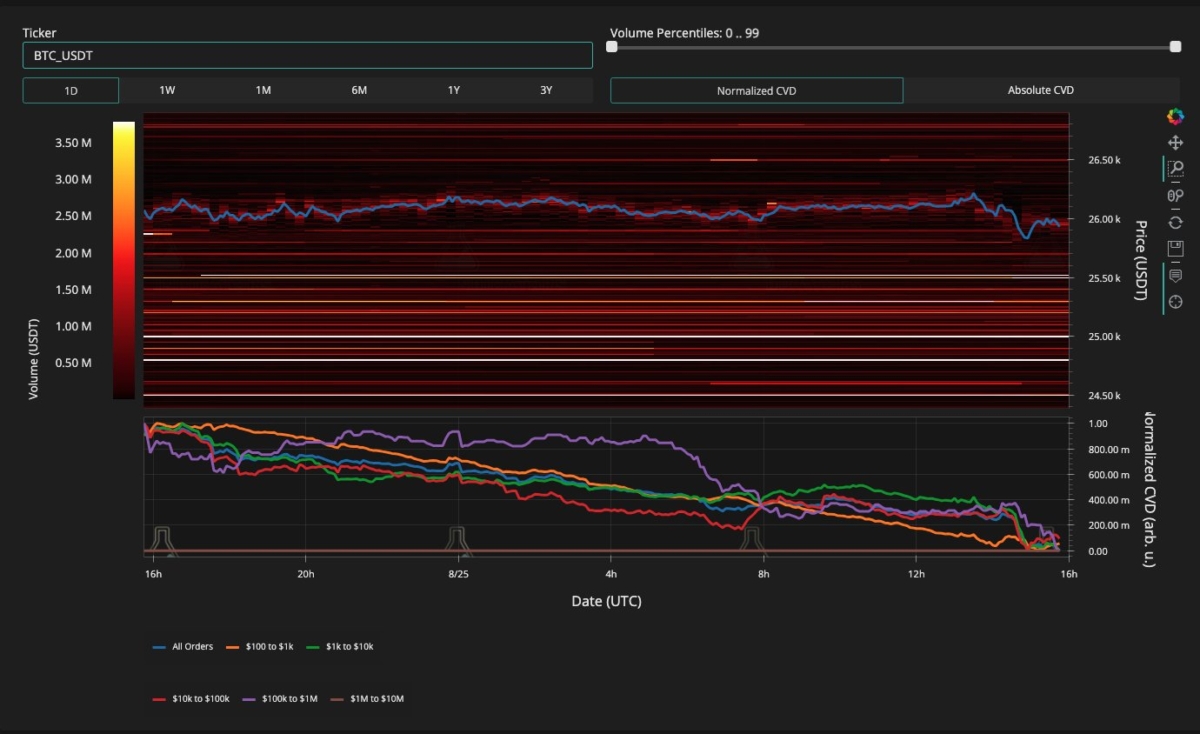

Along with a chart of the Binance BTC/USD order book, “Whales are not buying yet, neither am I. I expect the volatility to continue until the monthly candle close. I am patiently waiting to test the local low,” he said. In addition to the low whale order volume, the accompanying order book chart showed that bid liquidity was generally lacking, with $25,500 receiving only modest interest. “I’m looking for a catalyst to get into where we fell, retraced and pumped below $25,000,” said popular trader Crypto Tony. “Or if we turn $26,700 into support,” he said. Beyond the downside, Rekt Capital warned that moving averages, which previously acted as support before the crash, could now have the opposite effect.

The #BTC bullish momentum moving averages may act as resistance$BTC #Crypto #Bitcoin pic.twitter.com/2OGAFJwroI

— Rekt Capital (@rektcapital) August 27, 2023

August risks becoming worst in eight years

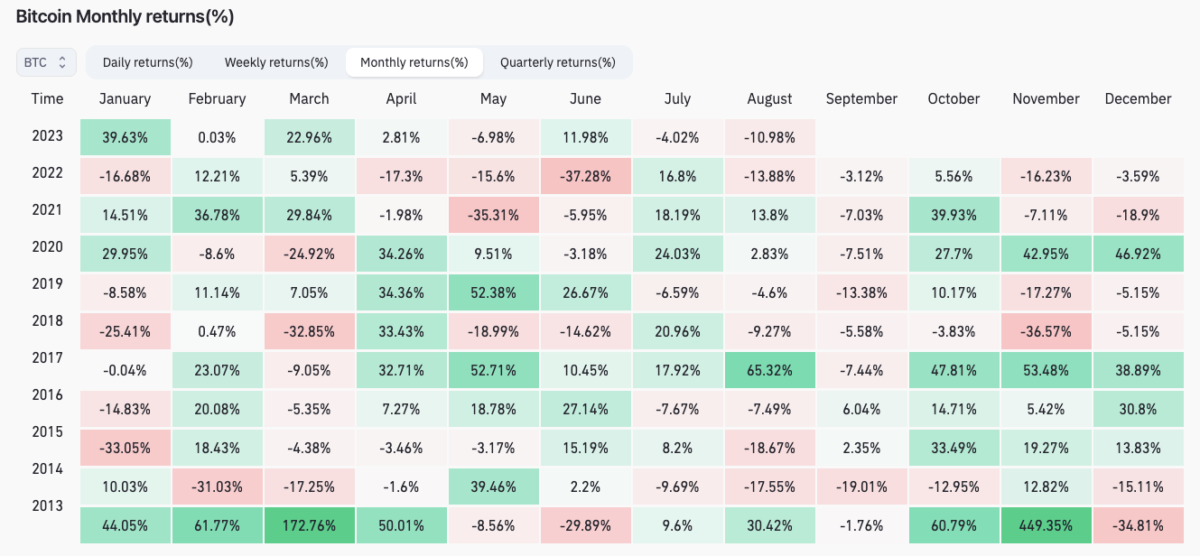

It’s no secret that Bitcoin has underperformed this month, even by August standards. BTC/USD is down 11% this month, raising anticipation among market watchers. Looking at the benchmark data from tracking resource CoinGlass, it seems that August 2023 is already competing with last year to be Bitcoin’s worst August since 2015. The BTC price lost 13.9% in August 2022, and this move was the beginning of half a year of pain. However, some believe that September could easily end just as badly, based on historical precedents. Rekt Capital wrote in part of an X post last week, “Can Bitcoin Drop to $22,000 in September?” he asked. Rekt said the following:

To answer this question, we must first focus on August. What was the worst BTC August drop in history? -17% in 2014 and -18% in 2015. Currently in 2023, BTC is down -16%. If BTC drops -18% this August, BTC will drop to $24,700. But this may not be the end of the retreat. So if BTC suffers another -10% pullback in September… that means the price will drop to ~$22200. This would match the Measured Move target for a double top breakout of approximately ~$22000.

The “longest bear market” in Bitcoin history

Meanwhile, analyzing the year-over-year (YoY) percentage returns for BTC/USD reveals the true extent of the last bear market. Michaël van de Poppe, founder and CEO of trading firm Eight, concluded that this is actually Bitcoin’s “longest bear market in history”. An accompanying chart compares the current 490-day negative annual returns with previous periods. The year 2015 lasted 386 days. Van de Poppe added that even positive news such as the US greenlighting the first Bitcoin spot-priced exchange-traded fund (ETF) has not yet entered the market consciousness. “The thing is that in the current period these events are not reflected in the price at all,” he wrote.

The longest bear market in history for #Bitcoin

It might feel like a ghost town in crypto. It might feel like there's not even going to be a bull cycle anymore and I understand why these thoughts are there.

But why?

Well, people base their decisions on history. 👇… pic.twitter.com/Ljtv9wmw12

— Michaël van de Poppe (@CryptoMichNL) August 27, 2023

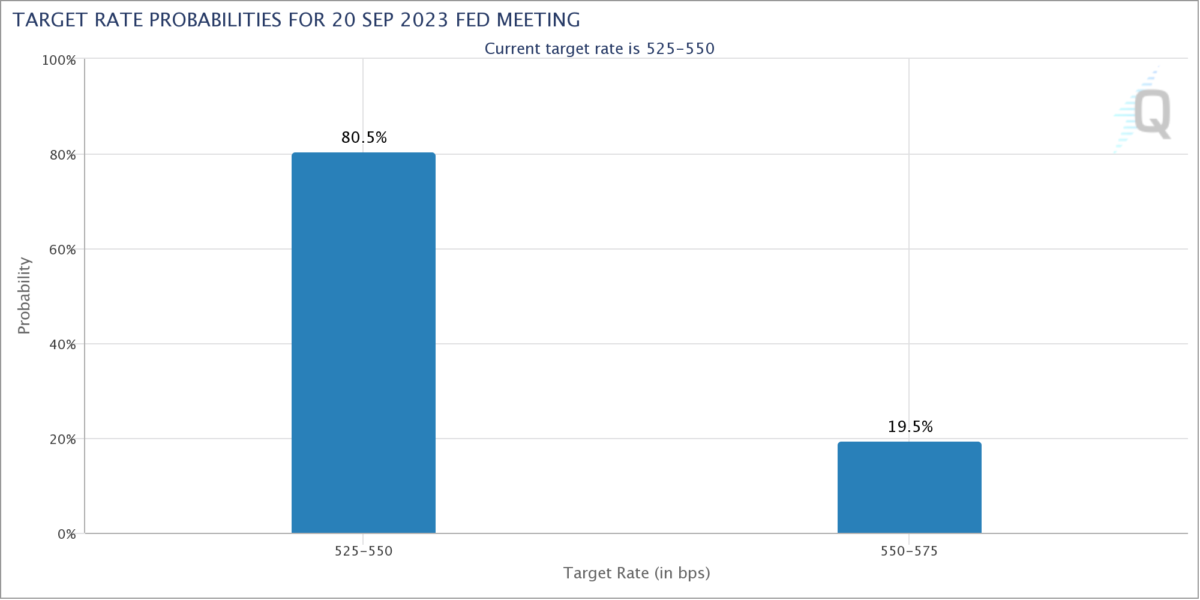

PCE data tracks Jackson Hole response

Bitcoin and altcoins have paid little attention to macroeconomic developments in recent weeks. Even data releases such as the Fed’s rate changes and the Consumer Price Index (CPI) have had a barely perceptible impact on the markets. Comments from Fed Chairman Jerome Powell last week at the annual Jackson Hole Economics Symposium continued this trend, even as CME Group’s FedWatch Tool showed bets to pause in rate hikes from next month by over 80%. This week may not turn out differently, even though it includes the Fed’s preferred gauge of inflation, PCE.

PCE data will be released on August 31, hours before Bitcoin monthly close. On September 1, data on non-farm employment and unemployment will be released. But for macro markets, financial commentator The Kobeissi Letter promised an “action-packed week.” “A big week for EVERYTHING with economic data, volatility is back,” he summed up in part of his latest X analysis.

Record hash rate reflects ‘miner bull run’

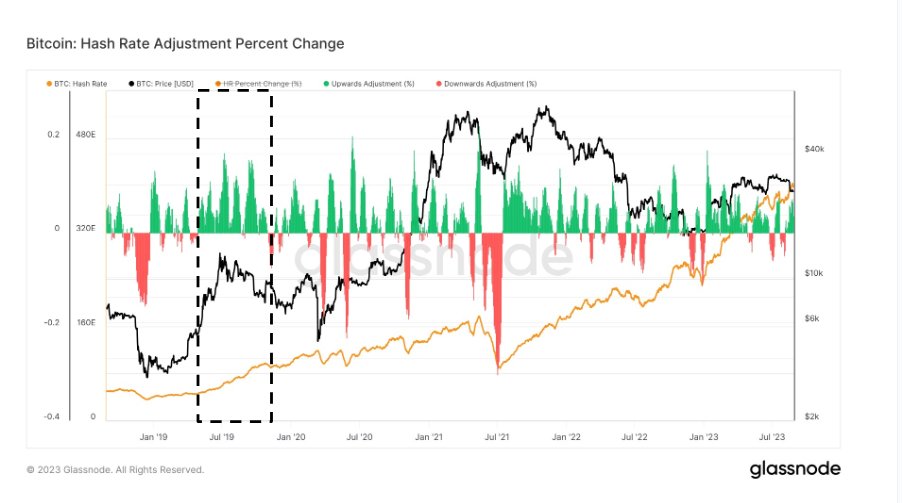

Meanwhile, one theory is that in Q4, miners will bid Bitcoin higher in preparation for the halving, which will reduce their rewards per block by 50% in April 2024. In doing so, they must engage in “smart money” and create their own buzz around the halving narrative, even as the broader market tends to only react to post-factual emissions changes. Continuing the debate, research and data analyst at crypto analysis firm CryptoSlate, James Straten, stated that the Bitcoin hash rate is already heading into uncharted territory. “Bitcoin hash rate has reached 400 th/s for the first time ever. “Given the energy problems in Texas and the rising cost of electricity worldwide, this is mind-blowing.”

cryptocoin.com As we reported, the hash rate is an estimate of the processing power dedicated to mining, and while it is impossible to measure precisely, figures from on-chain analytics firm Glassnode not only show new all-time highs, but also contrast with flat or bearish BTC price performance. also shows upward adjustments. Last week, Bitcoin also saw one of the biggest upward difficulty adjustments in 2023. That, in turn, pushed the benchmark to all-time highs on its own.