Bitcoin stays above $25,000 amid ongoing regulatory uncertainty in the cryptocurrency industry. Meanwhile, some investors are concerned about the impact of regulatory changes on the market. On the other hand, others are seeing signs of a new bull run on the horizon.

Critical level for BTC: $ 26 thousand

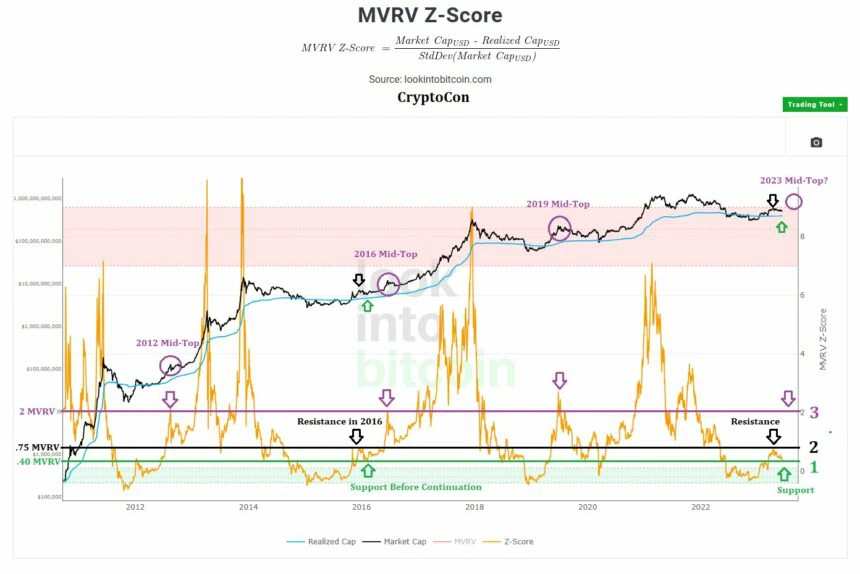

According to crypto analyst Crypto Con, Bitcoin’s Market Cap to Real Value (MVRV) resistance on Line 2 at $31,000 followed by support at the same level reflects a pattern in 2016. This pattern likely indicates that BTC is on the verge of a new bull run that will surpass previous highs.

Historical patterns of BTC in the MVRV indicator / Source: CryptoCon

Historical patterns of BTC in the MVRV indicator / Source: CryptoConCrypto Con recently commented on the importance of these trends. “Reaching the middle top line is inevitable, just like any cycle that has come before. Bitcoin has proven its resilience time and again. Also, I believe we are about to witness a new phase of growth in the cryptocurrency market,” he said.

Levels to watch for Bitcoin

However, Crypto Con’s analysis is based on historical trends and patterns that suggest Bitcoin may be in a favorable position for growth. On the same note, cryptocurrency trader CJ recently shared his analysis of Bitcoin’s price movements on Twitter. In this context, he explained the key levels to watch.

On the weekly chart, CJ notes that BTC has closed below its 200 Moving Average (MA) for the first time in 12 weeks. The price has dropped to an old range. However, a close above this level would be a positive sign. If Bitcoin retraces its $27,000 opening in June, CJ sees the potential for the price to reach $33,000.

On the daily chart, CJ points out that the previous week’s highs and lows and the daily demand level just below the high range are not used. The analyst sees a potential ‘long’ opportunity if the previous week’s low is pulled back to the daily demand level and then recovered, and a ‘short’ opportunity if the previous week’s high is pulled to the June open and then closed below.

Also, on an intraday/1 hour basis, CJ suggests considering the midpoint of the weekly range currently limiting the price to the upside. Another potential trading opportunity for BTC will emerge if the low of the local range is swept away and then recovered by targeting the high of the local range.

Fed keeps interest rates steady, Bitcoin remains stable!

cryptocoin.com As you follow, the Federal Reserve announced that it is not raising interest rates this month. On the other hand, it seems unlikely that the Fed will cut any interest rates in 2023. The Fed’s target remains the 2% inflation rate. In addition, the Fed has signaled that it may increase interest rates later this year.

The Fed said it expects two rate hikes of 0.25 basis points each by the end of the year. This was generally accepted as a hawkish explanation. Despite these developments, Bitcoin has remained relatively stable. The coin has not moved significantly in either direction. This is likely due to several factors, including ongoing regulatory uncertainty.

BTC’s sideways price action after Fed interrupts rate hike / Source: TradingView

BTC’s sideways price action after Fed interrupts rate hike / Source: TradingView