Gold prices closed the first four days of the week in negative territory. On Friday, it touched its weakest level since the end of January below $1,790. However, it later climbed above $1,800. In the risk aversion environment, the strength of the dollar was renewed. This weighed on gold and caused it to close in negative territory for the third week in a row.

Speeches of central bank governors followed

cryptocoin.com As you follow on Monday, four members of the G7 decided to ban the import of Russian gold. Gold prices, on the other hand, did not receive support despite the news about it. According to the World Gold Council, Russia is the second largest gold producer in the world, with 330.9 tons in 2021. Meanwhile, macro data from the US showed that Durable Goods Orders rose 0.7% in May compared to the same period last year. The market expectation was an increase of 0.1%.

On Tuesday, gold fluctuated in a relatively tight range near $1,820. But in the end he suffered small daily losses. The Conference Board reported Tuesday that the US Consumer Confidence Index fell to 98.7 in June from 103.2 in May. The publication also revealed that the one-year consumer inflation rate expectation has increased to 8% from May’s revised 7.5% print. Gold continued to decline as the US Dollar Index (DXY) turned north after this report.

FOMC Chairman Jerome Powell spoke at the ECB’s annual Central Banking Forum on Wednesday. Powell reiterated that the US economy can rely on policy moves. He also noted that the strength of the dollar is ‘disinflationary on the margins’. Wall Street’s main indexes suffered heavy losses with Powell’s hawkish statements. Meanwhile, the dollar continued to find demand as a safe haven.

The PCE, which the Fed took into account, came in relatively soft

On Thursday, the US Bureau of Economic Analysis announced that its Personal Consumption Spending (PCE) Price Index remained unchanged at 6.3% year-on-year in May. The annual Core PCE Price Index, which the Fed uses as its preferred inflation indicator, fell to 4.7% from 4.9% in the same period as expected. Market analyst Eren Sengezer comments:

The PCE inflation report was relatively soft. However, end-of-month flows did not allow gold to benefit from falling US Treasury yields.

Gold prices saw below $ 1,800

On Friday, the dollar continued to outperform its rivals in the risk-averse market environment. Gold prices fell below the key $1,800 level during the European session. Therefore, technical bearish pressure has increased.

The latest data of the week showed that business activity in the US manufacturing sector grew at a much softer pace in June than in May. ISM Manufacturing PMI fell from 56.1 to 53. The benchmark 10-year US T-bond yield lost more than 7% after the disappointing PMI survey. This, in turn, helped gold limit its losses.

FOMC to release meeting minutes

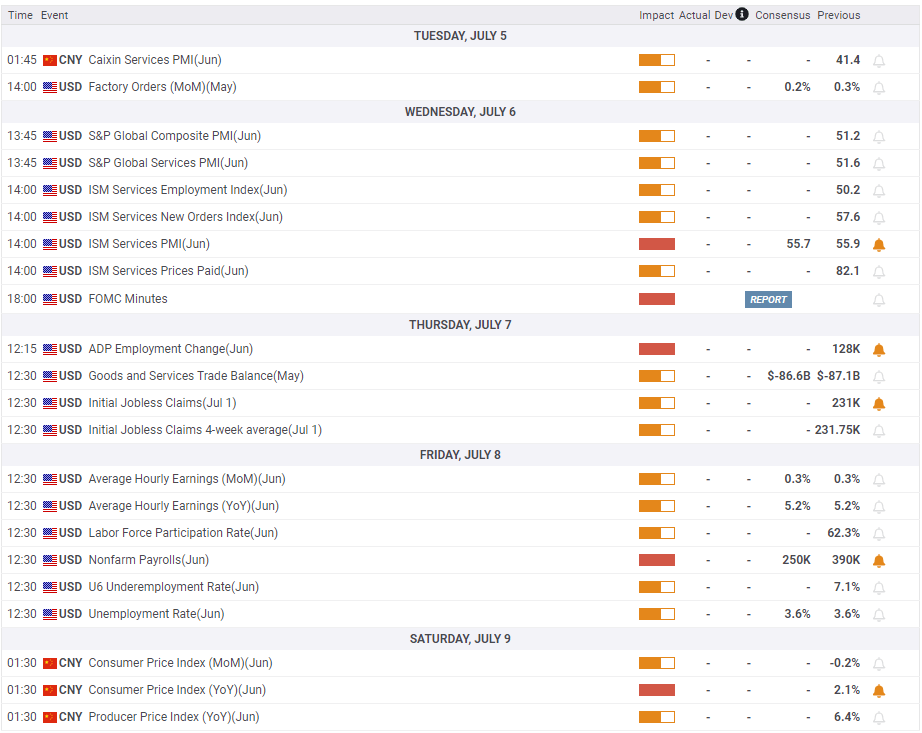

Investors will examine Caixin Services PMI data from China on Tuesday for fresh momentum. Earlier in the week, the upbeat China Manufacturing PMI failed to help gold find demand. Therefore, according to the analyst, this report will not have a serious impact on gold.

On Wednesday, the ISM Services PMI will feature in the US economic program. Later in the day, the FOMC will release the minutes of its June policy meeting. Markets are currently pricing in a 66.5% probability of a 75 basis point (bps) rate hike by the Fed in July, compared to 84% a week ago, according to the CME Group FedWatch Tool. The analyst makes the following prediction:

Gold is likely to face additional bearish pressure if the FOMC’s publication raises the possibility of a 75 basis point gain. On the other hand, the dove tone is likely to put pressure on the dollar and open the door for a recovery.

“Inverse correlation between gold prices and US interest rates continued to weaken”

Finally, the U.S. Bureau of Labor Statistics will release June Nonfarm Payrolls (NFP) data on Friday. The labor market is expected to show an increase of 250,000 NFP after a 390,000 increase in May. This means a loss of growth momentum in June.

Investors will also closely monitor wage inflation data. Forecasts are for Average Hourly Earnings to increase by 5.2% year-on-year, as in May. According to the analyst, a higher-than-anticipated wage inflation increase is likely to boost the dollar unless there is a negative surprise in the NFP data. Of course, the opposite is also true. In general, the analyst makes the following assessment:

Gold’s inverse correlation with the 10-year US T-bond rate continued to weaken this week. In addition, markets are reevaluating the inflation outlook. He is likely to be more optimistic that inflation has already peaked. That explains how gold as a traditional inflation hedge and US interest rates fell together this week.

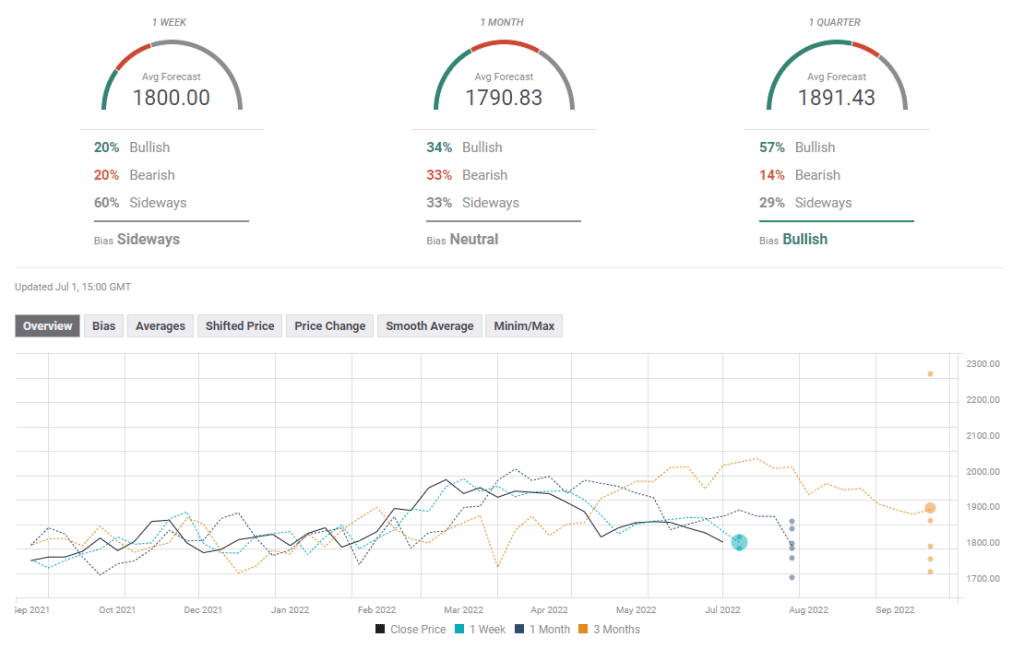

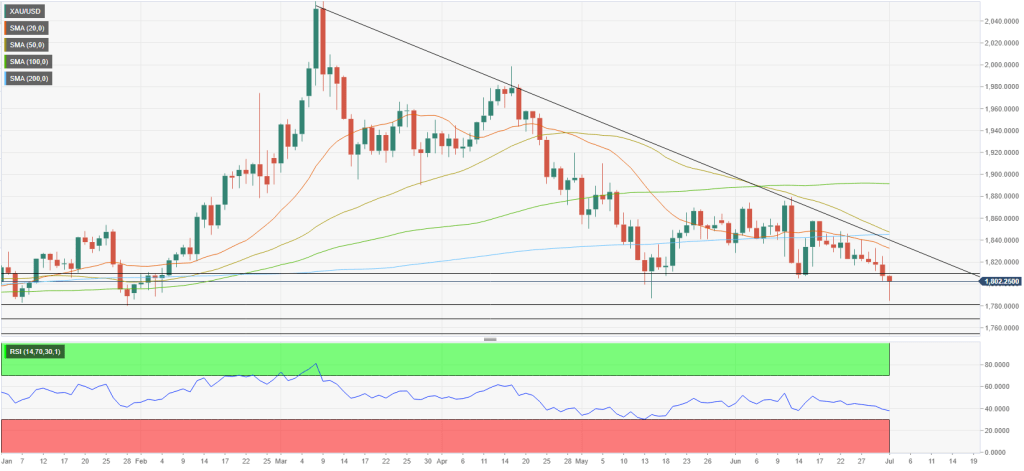

Gold prices technical view and six sentiment surveys

Market analyst Eren Sengezer analyzes the technical outlook of gold as follows. The Relative Strength Index (RSI) indicator on the daily chart stays near 40. This indicates that gold is in a downtrend. It also shows that it has more room to the downside before it technically goes oversold. However, sellers are likely to stay on the sidelines until gold closes below $1,800 daily (psychological level). In this scenario, $1,780 (static level) stands as the next bearish target ahead of $1,767 (static level).

On the upside, $1,810 (static level, former support) stands as the first technical hurdle before $1,832 (20-day SMA). Also, the descending trend line from the beginning of March remains intact. Additionally, there is stiff resistance at $1,840, where the 200-day SMA is located.

Most experts surveyed by FXStreet expect gold to enter the consolidation phase next week. The one-month outlook paints a mixed picture, with the average target of $1,790.