After a consolidation phase above $1,700 at the beginning of the week, gold prices gained momentum. The yellow metal hit its highest level since early July above $1,760. The precious metal lost its bullish momentum on Friday. However, it managed to close in positive territory for the second week in a row. Market analyst Eren Sengezer says the short-term technical outlook points to a bullish trend.

“Inflation and interest rate hikes will continue to create strong winds”

Data from the US increased recession fears at the beginning of the week. However, investors stayed away from taking large positions before the Fed’s policy announcements. The main Overall Business Activity Index of the Federal Reserve Bank of Dallas’ Texas Manufacturing Outlook Survey fell to -22.6 in July from -17.7 in June.

On Tuesday, the Conference Board (CB) reported that the Consumer Confidence Index fell to 95.7 from 98.4 in June. “Inflation and additional rate hikes are likely to continue creating strong headwinds for consumer spending and economic growth over the next six months,” the CB said in its publication.

The US Census Bureau announced on Wednesday that Durable Goods Orders rose 1.9% month-on-month in June. The data came in much better than the market’s expectation for a 0.4% decline. Pending Home Sales fell 8.6% in the same period, compared to analysts’ forecasts of 1.5% decline. This, too, took its place as a negative record.

Gold prices found support as Falcon Fed bets decreased

cryptocoin.com As you follow, the Fed increased the policy rate by 75 basis points (bps). At the press conference, FOMC Chairman Jerome Powell said they will no longer make any interest rate guidance. “Our thinking is to reach a moderately restrictive level by the end of this year,” Powell said. That means 3% to 3.5%,” he said. These comments triggered the dollar sale. In addition, it supported gold in the middle of the week, weighing on the US Treasury bond yields.

After the Fed, the probability of a 75 basis point hike in September dropped to 20% from around 50% in the previous week. Additionally, the advanced forecast of the US Bureau of Economic Analysis (BEA) showed that the US economy contracted by 0.9% year-on-year in the second quarter. Hence, it revealed that it missed the market forecast for a 0.5% expansion by a wide margin. After these developments, investors continued to lower their hawkish Fed bets. Therefore, the 10-year US bond yield fell by about 5% in the second half of the day.

Fed’s preferred inflation data came in better than expected

BEA’s monthly publication showed on Friday that inflation in the US, as measured by the Personal Consumption Spending (PCE) Price Index, rose to 6.8% year-on-year in June from 6.3% in May. The Core PCE Price Index, the Fed’s preferred inflation indicator, rose from 4.7% to 4.8% in the same period. The dollar rebounded on warm inflation data and capped gold’s gains ahead of the weekend.

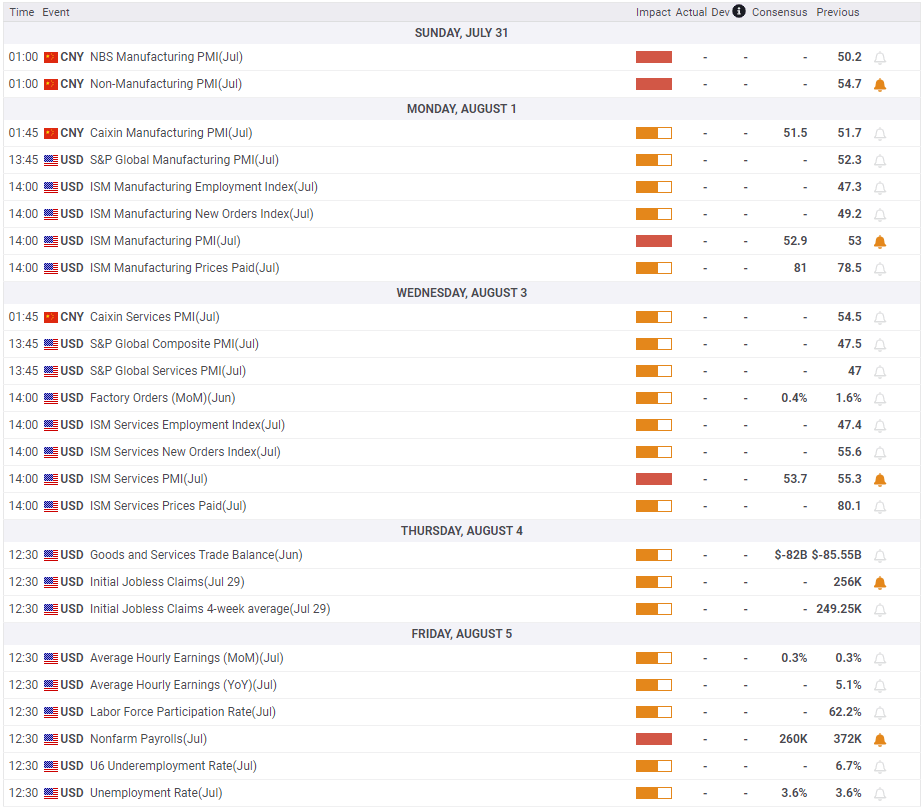

Market will closely follow US ISM Manufacturing PMI and NFP data

On Monday, US ISM Manufacturing PMI data will be watched closely by market participants. According to the analyst, if this data falls below 50, the USD is likely to have difficulty finding demand. On the other hand, optimistic data alone may not be enough for investors to reevaluate the Fed’s rate outlook. ISM will also release its Services PMI report on Wednesday. Meanwhile, S&P Global’s Services PMI fell from 52.7 in June to a flash forecast of 47 in July. This indicated a contraction in the commercial activity of the service sector. After this data, the dollar weakened against its major rivals. According to the analyst, a similar market reaction is likely if ISM’s PMI for Services falls into contraction territory.

Finally, the U.S. Bureau of Labor Statistics will release its July employment report on Friday. Non-Farm Payrolls (NFP) are expected to increase by 260,000 after a better-than-projected 372,000 increase in June. Unemployment Rate is expected to remain stable at 3.6%.

“Gold prices may maintain bullish momentum in this scenario”

Commenting on the labor market, Powell said it was extremely tight and job growth was still strong. “The overall labor market shows that the underlying aggregate demand is sound,” the chairman added. While the US central bank has acknowledged the slowdown in economic activity, it remains committed to tackling inflation as long as the job market remains healthy. Therefore, the analyst considers it reasonable to have a market reaction. The analyst makes the following assessment:

Investors will also closely monitor Fed officials’ comments throughout the week. There is still a 20 percent chance of a 75 basis point increase. Therefore, if the markets are fully priced in September with a 50 basis point increase, it indicates that the dollar has more share on the downside. In this scenario, it is possible for gold to maintain its bullish momentum.

Gold should have a tough time prolonging its recovery if Fed officials leave the door open for a 75 basis point gain in September amid a strong jobs report. It’s also worth noting that the 10-year US T-bill yield remains near the key 2.7% level. If that level turns into resistance, the analyst says, another lower-yielding leg could help push the bottom higher.

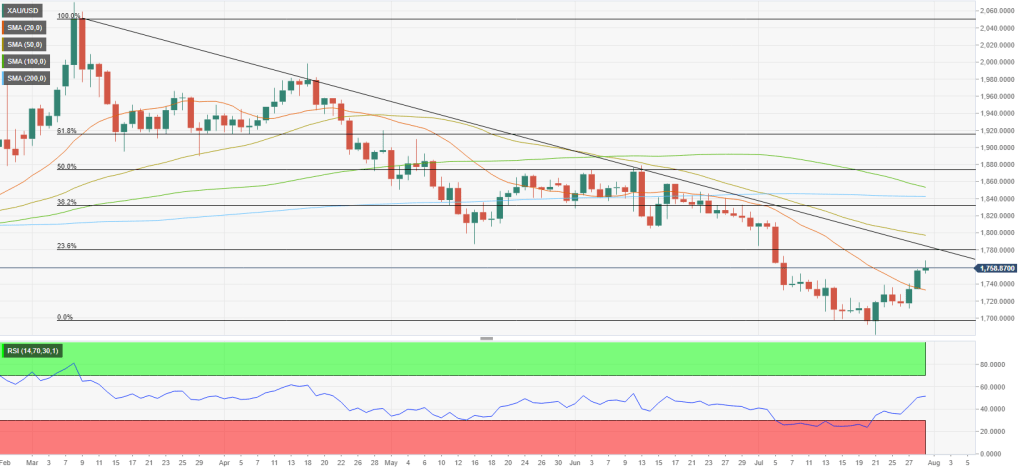

Gold prices technical outlook and gold sentiment survey

Market analyst Eren Sengezer analyzes the technical outlook of gold as follows. The Relative Strength Index (RSI) indicator on the daily chart has crossed above 50. Gold prices closed the last two trading days above the 20-day SMA. Thus, it pointed to a bullish trend in the short-term technical outlook.

On the upside, $1,780 stands as initial resistance. If buyers manage to turn this level to support, $1,800 and $1,830 are likely to be seen as the next bullish targets. On the downside, $1,740, $1,700, and $1,680 are forming initial support.

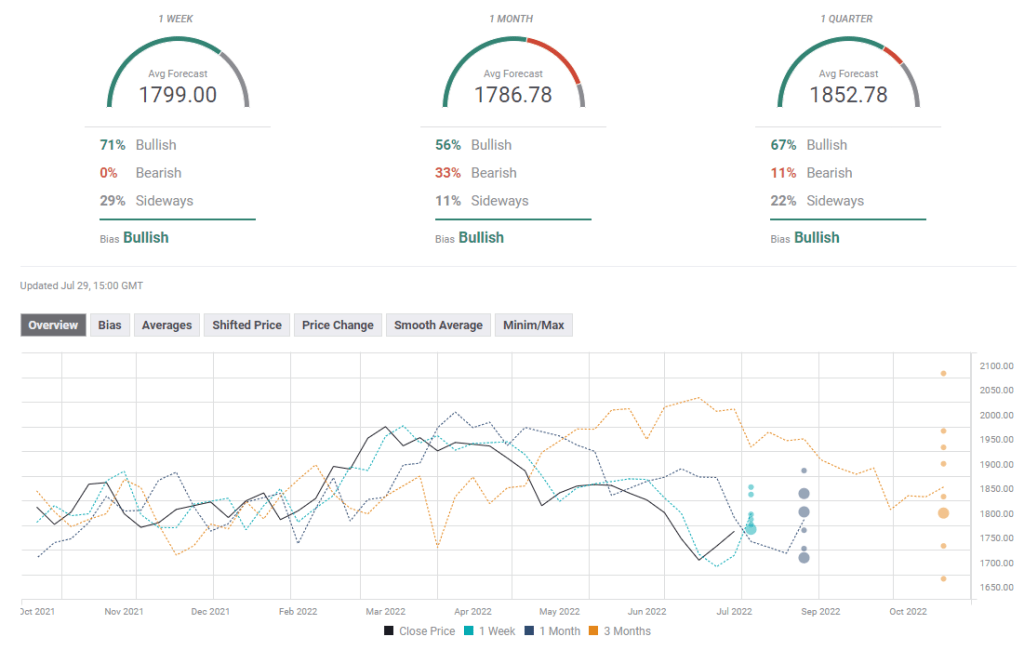

The majority of experts surveyed predict that the price of gold will continue to rise next week. In this context, there is a clear bullish trend in the short-term outlook of gold. The average target in a one-week view is $1,799. The one-month outlook paints a mixed picture, with a third of analysts trending bearish on gold.