Gold started the week badly, dropping to a low in nearly a month below $1,730 on Monday. The yellow metal managed to climb above $1,760 on Thursday but struggled to gather bullish momentum. It then declined below $1,740 ahead of the weekend. Fed policymakers reiterate the importance of August inflation and employment data ahead of its September meeting. Gold prices may struggle to recover ahead of Friday’s Nonfarm Payrolls (NFP) report, according to market analyst Eren Sengezer.

Tuesday: Gold prices benefit from selling pressure surrounding dollar

cryptocoin.com As you follow on , the dollar rally triggered by the Fed’s hawkish comments the previous week continued on Monday as well. Thus, the US Dollar Index (DXY) climbed above the 109.00 level. Meanwhile, the People’s Bank of China (PBoC) lowered the one-year loan prime rate (LPR) and the five-year LPR by 5 basis points and 15 percentage points, respectively. This reminded investors that China’s economic outlook is worsening. This development put additional weight on the shoulders of gold.

Data released by S&P Global on Tuesday showed that business activity in the US manufacturing sector continued to contract in early August. The data revealed that the Composite PMI fell to 45 from 47.7 in July. This data came in worse than the market expectation of 47.5. This caused the dollar to lose its appeal. S&P Global Market Intelligence Senior Economist Sian Jones interprets the survey’s findings as follows:

One area of delay for firms has come in the form of further softening of inflationary pressures. Input prices and output fees rose at the slowest rates in a year and a half amid reports that some core component costs were falling. Gold prices took advantage of the selling pressure surrounding the dollar. Thus, bullion gained more than 0.5% on Tuesday.

Thursday: Gold prices close in positive territory for the third consecutive day

In the second half of the week, the US Bureau of Economic Analysis (BEA) announced that the US economy contracted at an annualized rate of 0.6% in the second quarter. This data came in higher than the latest estimate of -0.9%. It also exceeded the market expectation of 0.8% contraction.

Meanwhile, Philadelphia Fed President Patrick Harker made a statement on Thursday. Harker said he would like to see the next inflation data before deciding on the size of the September rate hike. However, he added that an increase of 50 basis points (bps) would still be a significant move. The dollar struggled to maintain its strength after these comments. Gold prices, on the other hand, closed in positive territory for the third day in a row. Also, the benchmark 10-year US Treasury yield lost more than 2% on Thursday, giving gold an additional boost.

Friday: After all the dust has settled, gold has turned south

The monthly report released by the BEA on Friday revealed that inflation in the US, as measured by the Personal Consumption Expenditure (PCE) Price Index, fell to 6.3% in July from 6.8% in June. Combined with this soft inflation data, Atlanta Fed President Raphael Bostic’s dove-like comments triggered the dollar sell-off. Bostic said he was heading for a 50 basis point rate hike in September after seeing the latest PCE inflation figures.

But FOMC Chairman Jerome Powell said restoring price stability would likely require maintaining a restrictive policy stance ‘for a while’. Powell reiterated his hawkish stance, helping the dollar rise strongly. Regarding the policy move in September, Powell said the decision would be based on the aggregate of data obtained since the July meeting. After all the dust had subsided, the gold turned south. The yellow metal slumped below $1,740, erasing all weekly gains in the process.

“Gold is likely to gain momentum in this scenario”

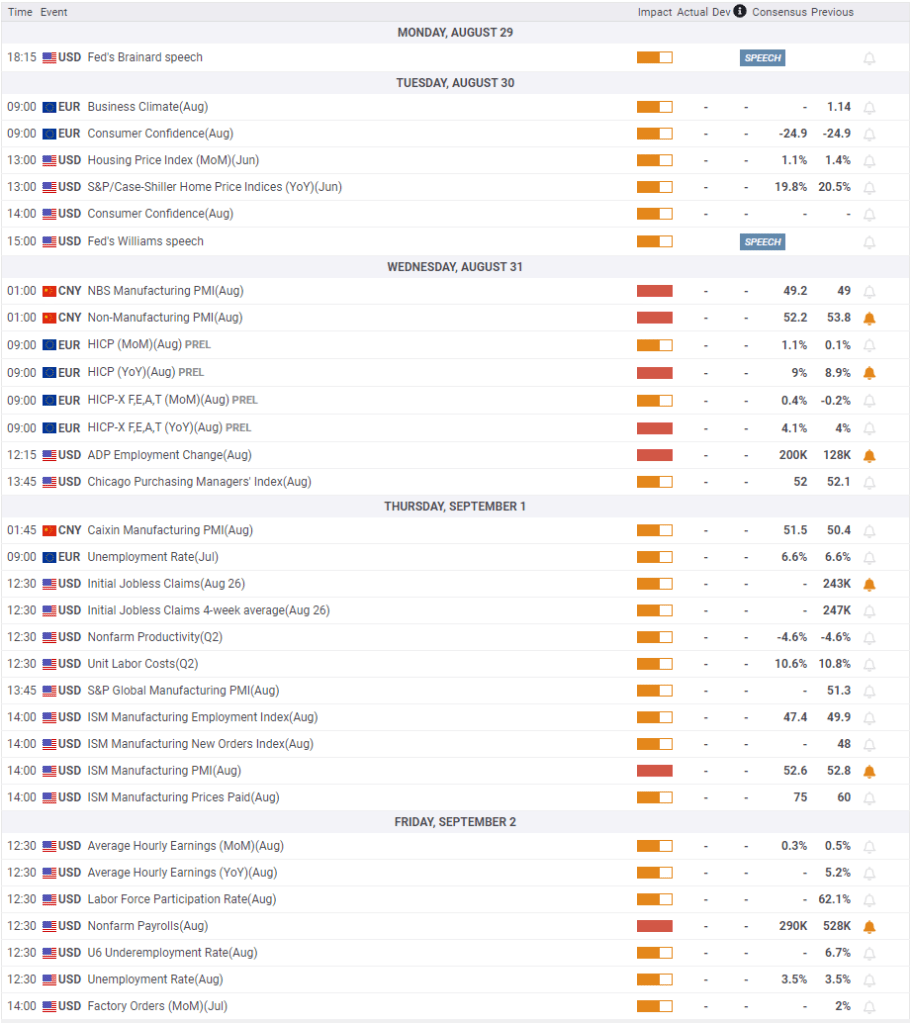

No high-impact data will be released on Monday. The trading action of gold is likely to remain silent. On Tuesday, the Conference Board’s August Consumer Confidence Index will be reviewed for fresh momentum. According to the analyst, inflation that softened in July is likely to help improve consumer confidence in August. The analyst sees such a result as likely to help the dollar outperform its rivals.

The US economic report will release ADP’s new jobs report on Wednesday. According to the analyst, since this will be the first release, it is difficult to understand a possible market reaction. During the European session, Eurostat will publish August Harmonized Consumer Price Index (HICP) data. Markets expect annual HICP to drop to 8.6% in August from 8.9% in July. The analyst says that higher-than-expected data could trigger the euro rally. He also notes that it could cause the dollar to lose altitude. The analyst interprets the effect on gold as follows:

Gold is likely to gain momentum in this scenario. However, if global interest rates rise, it will likely be difficult to climb steadily.

Investors will follow US ISM Manufacturing PMI and NFP data

Markets will look to US ISM Manufacturing PMI on Thursday for fresh momentum. Experts predict the main PMI will remain largely unchanged at 52.6 in August. It also expects the Prices Paid Index to rise from 60 to 75 in July. According to the analyst, if the inflation component confirms that price pressures continue to ease in August, it is possible for gold to turn north. Naturally, the opposite is also true.

Finally, investors will be keeping a close eye on the U.S. Bureau of Labor Statistics’ August employment report. The Fed rejects the idea of a deep recession in the US in tight labor market conditions. The September rate decision is largely dependent on labor market developments. The analyst evaluates the impact of the data on the market as follows:

Disappointing growth in NFP is likely to increase the odds of a 50bps rate hike in September. This is also likely to trigger a deep dollar sell-off. On the other hand, it is possible that another data above 500,000 confirms an additional rate hike. It is possible that this will also support the dollar.

Gold prices technical outlook and gold sentiment survey

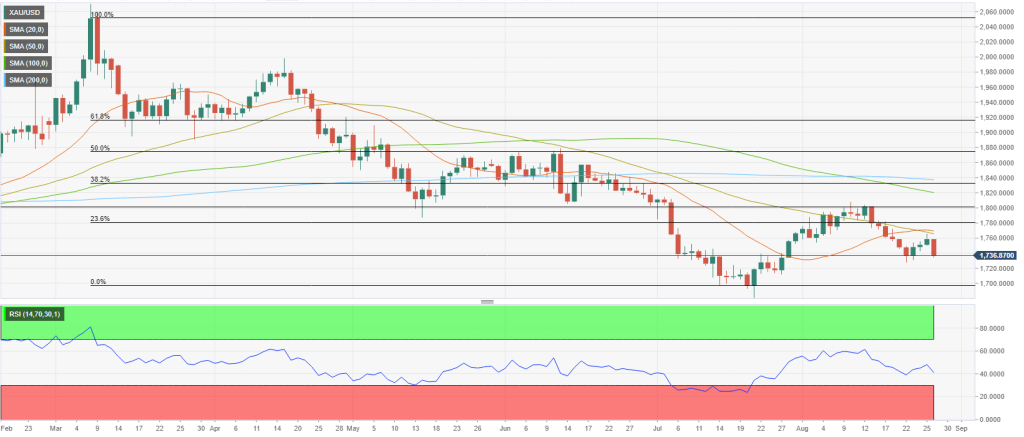

Market analyst Eren Sengezer draws the technical picture of gold as follows. After Friday’s move, the Relative Strength Index (RSI) indicator on the daily chart has dropped below 50. This indicates a bearish trend in the short-term technical outlook. Additionally, gold failed to rise above the 20-day SMA after testing the level on Thursday.

On the downside, $1,720 (static level) stands as initial support ahead of $1,700 (psychological level, end point of recent downtrend). A daily close below the second level is likely to open the door for a long decline towards $1,680 (July 21 low). It forms initial resistance ahead of $1,760 (20-day SMA, 50-day SMA), $1,780 (Fibonacci 23.6% retracement of recent downtrend) and $1,800 (psychological level, static level).

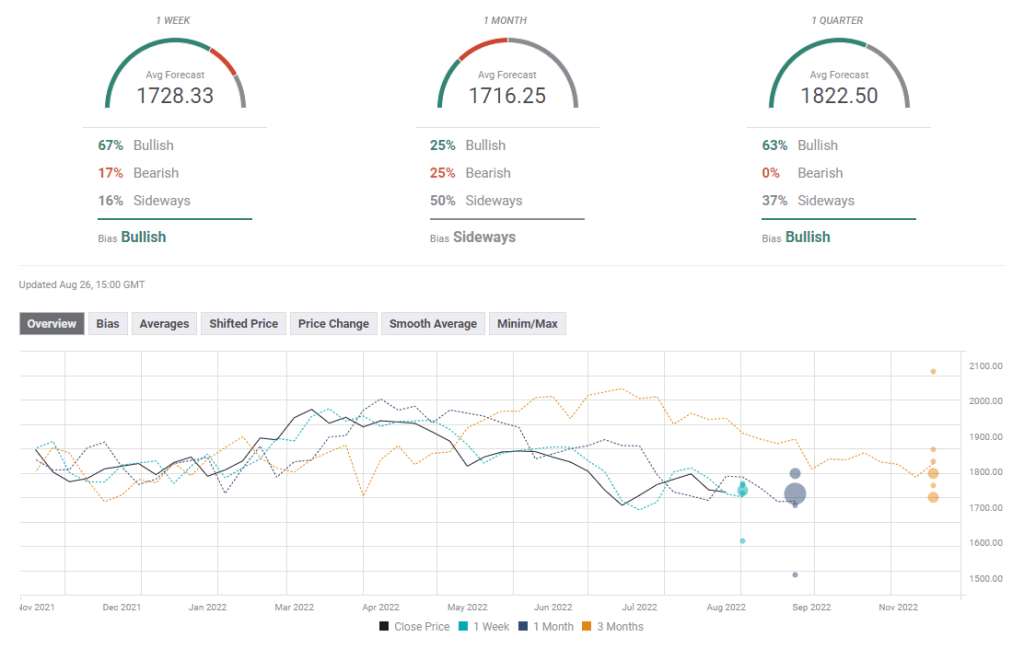

The FXStreet Forecast Survey shows that the majority of experts surveyed expect gold to recover next week. However, half of the experts predict the price to be around $1,730-1,735. So the one-month outlook paints a mixed picture.